Stock Market Topped Thursday, Now What?

Stock-Markets / Stock Markets 2015 Sep 20, 2015 - 08:15 AM GMTBy: Brad_Gudgeon

Last week, I predicted an important top for September 17 based on astrology. While I thought it would be a lower top, nonetheless, it was an important top caused by the FED: and as predicted, I said that they would not raise rates, but they did place something in the FED-speak that would cause the market to sell-off dramatically. That something was "no more QE". From late Thursday to late Friday, the SPX fell over 4%.

Last week, I predicted an important top for September 17 based on astrology. While I thought it would be a lower top, nonetheless, it was an important top caused by the FED: and as predicted, I said that they would not raise rates, but they did place something in the FED-speak that would cause the market to sell-off dramatically. That something was "no more QE". From late Thursday to late Friday, the SPX fell over 4%.

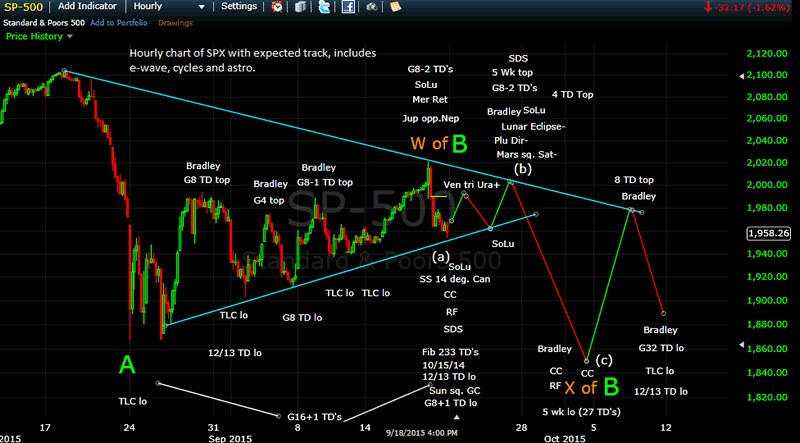

Friday left the stock market fairly oversold on a short term basis: the TRIN ended at 2.81, the Gann cycles bottomed and there were signs of minor momentum divergences that should launch us into an a-b-c type up-down-up week ahead. The astro-cycles look fairly negative for the week after next, but not ominous. The expected move to take out the lows of August 24/25 lows is coming. I have Sept. 30th and Oct 2nd being important dates for lows. I expect that SPX 1850 will be tested. Once 1850 is tested, I believe we see a strong rally throughout much of October that should take out Thursday's high. This is where it gets interesting.

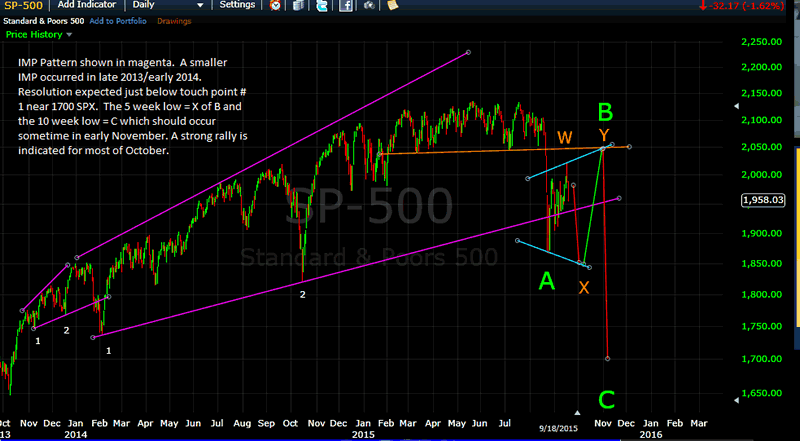

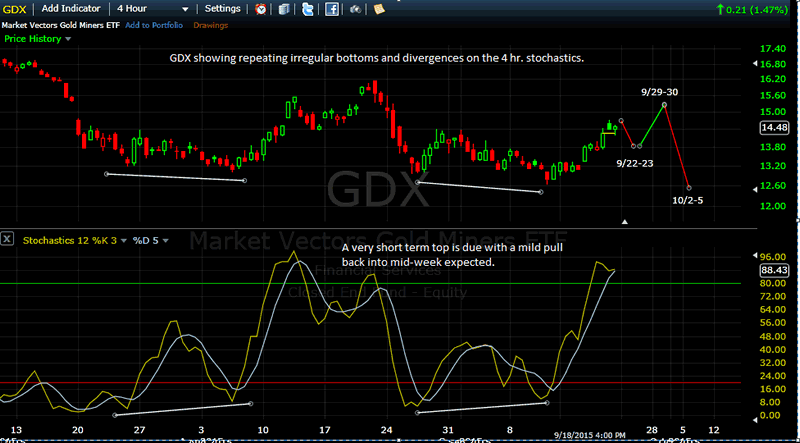

In the past few months, I shared what I call the coming IMP pattern (which we are now in). The charts below show what I believe is ahead into early October and beyond into early November. The biggest portion of the down move is still dead ahead! Also below, I have included a chart of GDX, which I expected to rally through this period we are in now. I have amended it further suggesting after a period of softness early next week, that gold and GDX should continue to rise into late September before succumbing to weakness caused by the expected drop in the stock market.

S&P500 Hourly Chart

S&P500 Daily Chart

GDX Divergences 4-Hour Chart Chart

I keep saying that this is not a buy and hold market, but a trading market! This has been my mantra all year. Our BluStar3X C 2 verified trading is +76% since April 15, 2015. Our new BluStar3XGold, which trades NUGT and DUST is +47% in just one month!

Brad Gudgeon

Editor of The BluStar Market Timer

The BluStar Market Timer was rated #1 in the world by Timer Trac in 2014, competing with over 1600 market timers. This occurred despite what the author considered a very difficult year for him. Brad Gudgeon, editor and author of the BluStar Market Timer, is a market veteran of over 30 years. The website is www.blustarmarkettimer.info To view the details more clearly, you may visit our free chart look at www.blustarcharts.weebly.com Copyright 2015. All Rights Reserved

Copyright 2015, BluStar Market Timer. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

Brad Gudgeon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.