Russians Buy 1 Million Ounces of Gold Bars In August

Commodities / Gold and Silver 2015 Sep 21, 2015 - 05:01 PM GMTBy: GoldCore

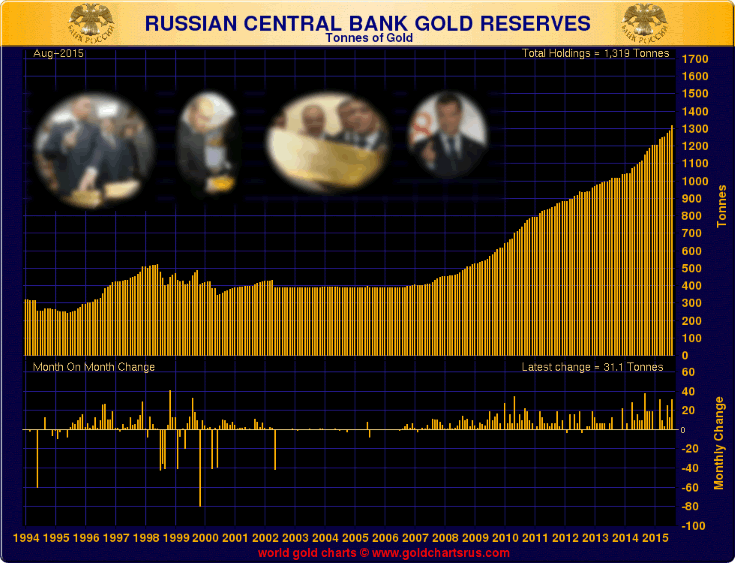

Russia’s gold reserves rose to 42.4 million troy ounces as of September 1 compared with 41.4 million troy ounces a month earlier, the Russian central bank announced on Friday.

Russia’s gold reserves rose to 42.4 million troy ounces as of September 1 compared with 41.4 million troy ounces a month earlier, the Russian central bank announced on Friday.

The monthly accumulation of 1 million ounces in just one month was one of the more sizeable monthly purchases by Russia and equates to 31.1 metric tonnes in August alone.

The value of the bank’s holdings rose to $47.68 billion from $44.96 billion a month earlier, Russia said in a statement on its website.

The amount bought was more than the 30.5 metric tons that Russia purchased in March, then the highest amount in six months.

Russia is now the seventh biggest holder of gold reserves after the U.S, Germany, the IMF, Italy and France and the rising gold power China. Russia has more than tripled its reserves since 2005 and holds the most gold bars since at least 1993, International Monetary Fund data shows.

Nations globally have been increasing their gold holdings in recent years, a reversal from two decades of selling. China, Kazakhstan, Ukraine and Belarus are among other nations that have been accumulating gold.

Gold remains a large part of many central banks’ reserves, decades after they stopped using it to back paper and the electronic currency of today.

Russia has been steadily buying bullion since 2007 and the advent of the global financial crisis. Russia was accumulating gold even prior to tensions with the West and international sanctions over the Ukrainian conflict.

Gold has protected the Russian reserves and acted as a hedge as gold priced in rubles has surged over 60 percent in the last 12 months. The plunge in oil prices contributed to sharp falls in the ruble.

Russia added about 13 tons in July and 24 tons the month before that. As tensions escalate with the U.S., the UK and the EU, Russia appears to be intensifying efforts to diversify out of their large dollar holdings and into physical gold.

DAILY PRICES

Today’s Gold Prices: USD 1136.85, EUR 1007.27 and GBP 732.86 per ounce.

Friday’s Gold Prices: USD 1136.00, EUR 992.31 and GBP 726.25 per ounce.

(LBMA AM)

Gold had a 3 percent weekly gain and silver had a 3.5% weekly gain. Gold ended with a gain of 0.73% on Friday while silver rose to as high as $15.43 before ending with a gain of 0.26%.

Gold in USD – 5 Days

In Singapore, gold dipped lower initially prior to recouping losses. In European trade gold is flat, hovering just below the $1,140 per ounce level. Silver bullion is 0.1% higher to $15.30 today. Platinum and palladium are mixed but essentially flat today.

Download Essential Guide To Storing Gold Offshore

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.