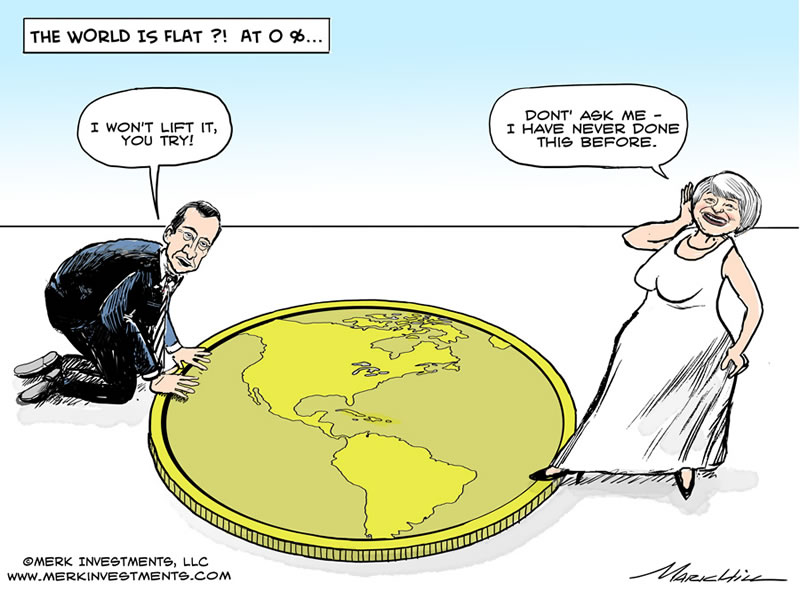

Interest Rates All Bad at 0%?

Interest-Rates / US Interest Rates Sep 29, 2015 - 12:01 PM GMTBy: Axel_Merk

We call on central banks to abolish their zero interest rate policy (ZIRP) framework before more harm is done. In our assessment, ZIRP is bad for all stakeholders and may even lead to war.

We call on central banks to abolish their zero interest rate policy (ZIRP) framework before more harm is done. In our assessment, ZIRP is bad for all stakeholders and may even lead to war.

ZIRP: Bad for Business?

At first blush, it may appear great for business to have access to cheap financing. But what may be good for any one business is not necessarily good for the economy. When interest rates are artificially depressed, it can subsidize struggling enterprises that might otherwise be driven out of business. As a result, productive capital can be locked into zombie enterprises. If ailing businesses were allowed to fail, those laid off would need to look for new jobs at firms that have a better chance of succeeding. As such, the core tenant of capitalism: creative destruction, may be undermined through ZIRP. In our assessment, the result is that an economy grows at substantially below its potential.

ZIRP: Bad for Investors?

Investors may have enjoyed the rush of rising asset prices as a result of ZIRP. However, this may well have been a Faustian bargain as the Federal Reserve (Fed) and other central banks have masked, but not eliminated, the risks that come with investing. Complacency has been rampant, as asset prices rose on the backdrop of low volatility. When volatility is low (more broadly speaking, we refer to "compressed risk premia"), rational investors tend to allocate more money to historically risky assets. While that may be exactly what central banks want - at least for the real economy - investors may bail out when volatility spikes, as they realize they didn't sign up for this ("I didn't know the markets were risky!").

We believe that until early August this year, investors generally "bought the dips" out of concern of missing out on rallies. Now, they may be "selling the rallies" as they scramble to preserve their paper gains. This process is driven by the Fed's desire to pursue an "exit." For more details on this, please see our recent Merk Insight "Lowdown on Rate Hikes."

But it's not just bad because asset prices might crumble again after their meteoric rise; it's bad because, in our analysis, ZIRP has driven fundamental analysts to the sideline. For anecdotal evidence, look no further than the decision by Barron's Magazine to kick Fred Hickey (who may well be one of the best analysts of our era) out of the Barron's Roundtable. Instead, money looks to be flocking towards investment strategies based on momentum investing, a strategy that works until it doesn't. Again, ZIRP gives capitalism a bad name because we feel it disrupts efficient capital allocation.

ZIRP: Bad for Main Street?

Excessively low interest rates are also bad for Main Street. In our analysis, excessively low interest rates are a key driver of the growing wealth gap in the U.S. and abroad. Hedge funds and sophisticated investors seemed to thrive as they engaged in highly levered bets; at the other end of the spectrum are everyday people that may not get any interest on their savings, but are lured into taking out loans they may not be able to afford. We believe ever more people are vulnerable to "fall through the cracks" as they encounter financial shocks, such as the loss of a job or medical expenses; hardship may be exacerbated because people had been incentivized to load up on debt even before they encountered a financial emergency. Again, we believe ZIRP gives capitalism a bad name, although ZIRP has nothing to do with capitalism.

Low interest rates may not even be good for home buyers: it may sound attractive to have low financing cost, but the public appears to slowly wake up to the fact that when rates are low, prices are higher: be that the prices of college tuition or homes. It's all great to have high home prices when you are a home owner, but it's not so great when you are trying to buy your first home.

ZIRP: Bad for Price Stability?

While we believe inflation may ultimately be a problem if interest rates are kept too low for too long, ZIRP may temporarily suppress inflation. While this may sound counter-intuitive, it is precisely because of the aforementioned capital misallocation ZIRP may be fostering: when inefficient businesses are being subsidized, as we believe ZIRP does, inflation dynamics may not follow classical rulebooks. That's because an economy with inefficient capital resource allocation experiences shifts in supply of goods and services that may not match demand leading to what may appear to be erratic price shifts. The most notable example may be commodity prices, where the extreme price moves in recent years are a symptom that not all is right.

ZIRP: Bad for Politics?

In our assessment, Congress has increasingly outsourced its duties to the Fed (the same applies to politicians and central bankers to many other parts of the world). The Fed now ought to look after inflation, employment, and financial stability. The Fed, in our humble opinion, is not only ill suited to tackle most of these, but invites political backlash as they step on fiscal turf. Let me explain: monetary policy focuses on the amount of credit available in the economy; in contrast, fiscal policy - through tax and regulatory policy - focuses on how this credit gets allocated. If the Fed now allocates money to a specific sector of the economy, say, the mortgage market by buying Mortgage Backed Securities (MBS), they meddle in politics. Calls to "audit the Fed" are likely a direct result of the Fed having overstepped their authority, increasingly blurring the lines between the Fed and Congress.

More importantly, the U.S., just like Europe and Japan, face important challenges that in our opinion can neither be outsourced, nor solved by central banks in general or ZIRP in particular.

ZIRP: Bad for Peace?

In 2008 and subsequent years, you likely heard the phrase, "Central banks can provide liquidity, but not solvency." In essence, it means central banks can buy time. But what happens when central banks buy a lot of time and underlying problems are not fixed? In our assessment, it means that the public gets antsy, gets upset. When problems persist for many years the public demands new solutions. But because monetary policy is too abstract of an issue for most, they look for solutions elsewhere, providing fertile ground for populist politicians. Here are just a few prominent political figures that have thrived due to public frustration with the status quo: Presidential candidate Donald Trump; Senator and Presidential candidate Bernie Sanders; Greek Prime Minister Tsipras; Ukrainian Prime Minister Yatsenyuk; Japanese Prime Minister Abe; and most recently the new leader of UK's Labor Party Jeremy Corbyn.

And what do just about all politicians - not just the ones mentioned above - have in common? They rarely ever blame themselves; instead, they seem to blame the wealthy, minorities or foreigners for any problems.

We believe the key problem many countries have is debt. I allege that if countries had their fiscal house in order, they would rarely see the rise of populist politicians. While there are exceptions to this simplified view, Ukraine may not be one of them: would Ukraine be in the situation it is in today if the country were able to balance its books?

Central banks are clearly not appointing populist politicians, but we allege ZIRP provides a key ingredient that allows such politicians to rise and thrive. ZIRP has allowed governments to carry what we believe are excessive debt burdens though ZIRPs cousin quantitative easing ("QE"). QE is essentially government debt monetization in our view. Take the Fed's U.S. treasury buying QE program. Those Treasuries (or new Treasuries that the Fed rolls into) might be held indefinitely by the Fed (despite claims of balance sheet normalization) - meaning that US Government will never pay the principle, and the U.S. Government effectively pays zero interest on that debt because the profits of the Fed flow back to the US Treasury. ZIRP allows governments to engage on spending sprees, such as a boost of military spending Prime Minister Abe might pursue.

The Great Depression ultimately ended in World War II. I'm not suggesting that the policies of any one politician currently in office or running for office will lead to World War III. However, I am rather concerned that the longer we continue on the current path, the more political instability will be fostered that could ultimately lead to a major international conflict.

How to get out of this mess

It's about time we embrace what we have been lobbying for since the onset of the financial crisis: the best short-term policy is a good long-term policy. We have to realize that when faced with a credit bust, there will be losers, and that printing money cannot change that. In that spirit, we must not be afraid of normalizing policy in fear of causing an economic setback. When rates rise, businesses that should have failed long ago, are likely to fail. Rather than merely rising rates, though, policy makers must provide a long-term vision of the principles that guides their long-term policy. In our humble opinion, "data dependency" is an inadequate principle, if it is one at all.

The Fed needs to have the guts to tell Congress that it is not their role to fix their problems. It requires guts because they must be willing to accept a recession in making their point.

To continue this discussion, please register to join us for our upcoming quarterly Webinar. If you haven't already done so, ensure you don't miss it by signing up to receive Merk Insights. If you believe this analysis might be of value to your friends, please share it with them.

Axel Merk

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Rick Reece is a Financial Analyst at Merk Investments and a member of the portfolio management

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.