Can You Imagine The Fed Raising Rates In This World? Everything Going Wrong At Once Edition

Interest-Rates / US Interest Rates Oct 02, 2015 - 12:16 PM GMTBy: John_Rubino

After the markets failed to embrace its most recent interest rate dither, the Fed dispatched pretty much its entire PR team to make sure we understood that rates would rise Next Month For Sure.

After the markets failed to embrace its most recent interest rate dither, the Fed dispatched pretty much its entire PR team to make sure we understood that rates would rise Next Month For Sure.

Then everything kind of fell apart. Emerging market capital flight accelerated…

Is this the mother of all warnings on EMs?

(CNBC) – The last time emerging markets had it nearly this bad, Ronald Reagan was the U.S. President, KKR purchased RJR Nabisco, and a future popstar named Rihanna was born.Net capital flows for global emerging markets will be negative in 2015, the first time that has happened since 1988, the Institute of International Finance (IIF) said in its latest report. Net outflows for the year are projected at $541 billion, driven by a sustained slowdown in EM growth and uncertainty about China, it added.

In other words, investors will pull out more money out of emerging markets than they will pump in.

The data come on the heels of a separate IIF report this week that showed portfolio capital outflows in EMs amounted to $40 billion during the third quarter, the worst performance since 2008.

Indeed, relief from the Federal Reserve’s decision to delay its first interest rate hike in a decade has proved to be short-lived for EMs amid fresh evidence of a slowing Chinese economy, precipitous currency declines, a sustained slide in commodity prices, and political uncertainty in countries such as Brazil and Turkey.

The US trade balance deteriorated, causing projected GDP to plunge…

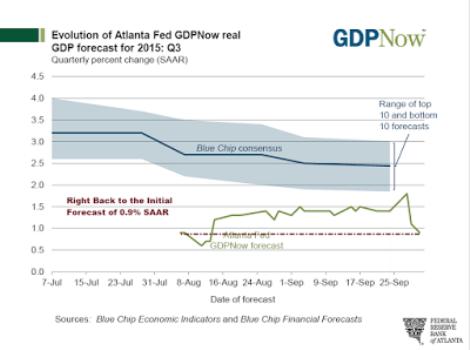

GDPNow Forecast Plunges to 0.9% Following Advance Report on US Balance of Goods

(Mike Shedlock) – The past few days have seen significant swings in the Atlanta Fed GDPNow Forecast. We are right back to the initial forecast in August.

What Happened?

1. On September 28 following the Personal Income and Outlays Report, the forecast rose 0.4 percentage points to 1.8%.

2. On September 29, following the Census Bureau Advance Trade Report the forecast fell 0.7 percentage points to 1.1%.

3. On October 1, following the Manufacturing ISM report, the forecast fell another 0.2 percentage points to 0.9%.

And last but definitely not least, Russia, Iran, Saudi Arabia, China and the US suddenly started bombing each other’s surrogates…

Iran troops to join Syria war, Russia bombs group trained by CIA

(Reuters) – Hundreds of Iranian troops have arrived in Syria to join a major ground offensive in support of President Bashar al-Assad’s government, Lebanese sources said on Thursday, a sign the civil war is turning still more regional and global in scope.Russian warplanes, in a second day of strikes, bombed a camp run by rebels trained by the U.S. Central Intelligence Agency, the group’s commander said, putting Moscow and Washington on opposing sides in a Middle East conflict for the first time since the Cold War.

Senior U.S. and Russian officials spoke for just over an hour by secure video conference on Thursday, focusing on ways to keep air crews safe, the Pentagon said, as the two militaries carry out parallel campaigns with competing objectives.

And that’s just a sampling of the political and economic chaos that broke out in September. Also shaking things up was the sudden resignation of the speaker of the US House of Representatives, the landslide election of a separatist party in Catalonia, and Volkswagen’s emission-gate scandal.

Under normal circumstances the US response would be to paper everything over with newly-created dollars. But these obviously aren’t normal circumstances, which leaves the Fed with a serious case of cognitive dissonance and no idea what to do about it.

By John Rubino

Copyright 2015 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.