Macrocosm Revisited

Stock-Markets / Financial Markets 2015 Oct 05, 2015 - 06:05 PM GMTBy: Gary_Tanashian

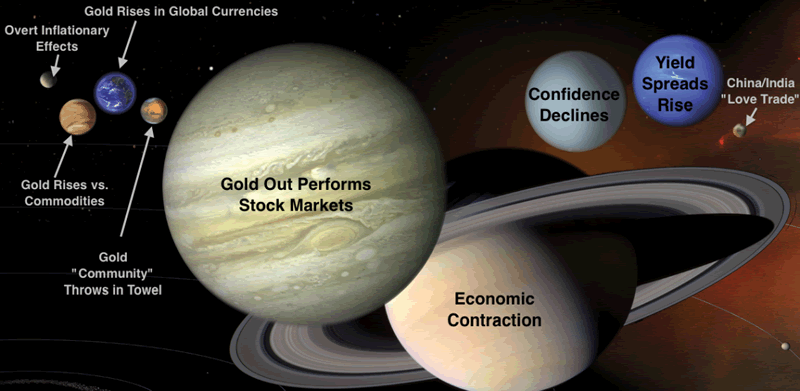

Here again is our representation of what a positive macro environment would look like for a bullish gold and gold mining stance. We created this theme in July for NFTRH 353.

Here again is our representation of what a positive macro environment would look like for a bullish gold and gold mining stance. We created this theme in July for NFTRH 353.

This view comes off as repugnant to much of the gold “community”, but I cannot stress strongly enough how important it is to tune out the fairy stories about missing COMEX gold (and silver), love-inspired demand from China and India, ‘rising US employment drives interest rates, incentivizes banks to lend and creates inflation, driving people into gold and gold stocks’ or any other angle out there that does not focus on declining confidence in policy making and its ability to control economies and financial markets. Every single one of these supposed fundamentals have already been proven wrong.

Later in the report we will check up on the macro and sector fundamentals in light of Friday’s big up day (as the sector acted as it ‘should’, in line with our fundamental views) and we will see how the technicals – a completely different animal from the improving fundamentals – are lining up. But first I want to use as a talking point a blog post by Martin Armstrong, who could be described as being anti-gold ‘promoter’. Not anti-gold, but anti the promotional aspects of the sector’s most notable figures.

In an October 2 post titled Gold & Money Supply, Martin Armstrong answers an email from a reader…

“Sir; Will the Fed start to print money again if the economy turns down and does this not cause gold to rise?”

Below is Armstrong’s response. I want to go through it piece by piece because there are things I agree with but, per the Macrocosmic view noted above, his view seems incomplete. Again, I realize Marty is a mythical figure and since I do not know enough about him to be critical (unlike certain cookie cutter gold sector analysts in the “community”) I want to try to flesh out what he is saying and insert my own views.

“No. The gold promoters constantly tout inflation, stating that the rise in money supply must lead to higher gold prices. If you simply correlate gold prices to the money supply, you will discover that this is total propaganda. Just look at the last few years alone: gold peaked in 2011 and the money supply continued to rise. There is zero truth to the propaganda and those who believe it will end up losing everything. It should be criminal. If you are going to sell medicine, you cannot claim something will grow hair when it will not or reverse the aging process when it will not. You would go to prison for consumer fraud, but this is not the case when it comes to precious metals. One day, a lot of these people will end up in jail for consumer fraud.”

Phew, that is a mouthful. But anyway, I too was under the propagandist impression that an impulsively rising money supply would be bullish for gold. So let’s get that straight right off the bat. The thing is, not being a Guru, Swami or Crystal Ball gazer I also have the imperative to myself and to NFTRH subscribers to either be right, or when proven wrong, get right ASAP. The ‘rising money supply is bullish for gold’ assumption was proven wrong years ago, so we adjusted to this reality years ago. So right on, Marty.

“There is no correlation between gold and inflation any more than there is with most commodities. We have the largest database in the world. If such a relationship existed, we would be shouting it from the rooftop. The commodities business is highly cyclical; boom and bust is par for the course. Yet, these promoters bury people alive by telling them that there is no cycle and it is always up, up, and away.”

Have a look at the Macrocosm picture above. Do you see the tiny little planets called Overt Inflationary Effects and China/India Love Trade? These are the types of promotions that “bury people” as Armstrong notes. I agree sir, they are based on the idea of people buying the inflation story that would be driven by growth in India, China and in US bank lending. Notice also, a significantly larger planet called Gold Rises vs. Commodities (it should be larger, but work with me here).

This is a key macro indicator toward global economic contraction, not inflation-fueled economic growth. As you know, NFTRH, NFTRH.com and Biiwii.com have done their shares of bitching and moaning about ‘inflationist’ assumptions (and promotions) lumping gold with silver, copper (as in “the metals” per lazy analysis), tin, oil, hogs, etc.

“If the Fed increases the money supply, it will NOT drive gold higher. Gold will rise when confidence in government declines. That is the issue.

There is a time to buy and there is always a time to sell. It’s Just Time.”

[to everything… turn turn turn, there is a season… turn turn turn, and a time to every purpose under heaven –The Byrds]

Joking aside, Marty puts my whole outlook in a nutshell. “Gold will rise when confidence in government declines.” The difference is that I am not focused on politics and government (Republican, Democrat, establishment conservative, establishment liberal; in my opinion it’s the same animal as far as the system is concerned). I am focused on monetary policy, which aligns with a given political regime at a given time, but has its own continuum of negative inputs on the economy. Why chase government around when talking about money? Cut off the head of the snake if you want to kill it. Government is transitory, as policy continues.

What Marty seems to leave out is that confidence declines because economies decline and when economies decline and gold out performs items positively correlated to economies (as it usually if not always does), sector fundamentals improve.

I am a little bit uncomfortable talking too much about myself (especially side-by-side to a renowned, even mythical figure in financial markets) and am looking forward to getting on with the report to update the nuts and bolts of what is going on in stock markets and gold, but first a little more. From March 2013, a comment in response to an article of mine as published at Safehaven.com…

“Are you intentionally trying to become the single most hated individual in “Goldbugsville”..??”

No, just trying to be right with the markets. Per a post at Biiwii. In response to the commenter:

“This site is not a ‘hey look at Gary carry the mantle for a particular orthodoxy’ site. It is a ‘get the market right or die trying’ site. Period.

That is because my job is to tell what I see and interpret, not to glad hand people. This crap about pissing off gold bugs is the least favorite part of my job. I remember when Tim Wood used to come with his obligatory gold bearish view on Puplava’s radio show years ago. He always seemed to have an apologetic tone in his voice.”

I don’t know who the most hated individual in Goldbugsville is, but I would guess that Martin Armstrong is the most feared individual in Goldbugsville. I also think that Goldbugsville is a much more educated place now because really, who is actually listening to “the promoters” anymore, anyway? Well, some are. But I would bet the number is much smaller than in spring of 2011 when it was ‘silver to 200!’ and ‘gold to 5,000!’.

Deflation is the thing that has manifested since the last great ‘inflation trade’ blew out in spring of 2011. Later that same year Operation Twist, the most diabolically ingenious policy imaginable, sanitized inflation’s signals in traditional macro indicators by buying long-term bonds to suppress long-term yields, selling short-term bonds to instigate short-term yields (giving the impression of policy tightening and sound stewardship) and painting the opposite picture (of inflation) into the macro.

The deflation story is very mature now, economic contraction is gaining traction and confidence is flagging. Though Armstrong has much lower targets for gold, not having a Socratic computer or a crystal ball, I’ll just continue to state that the macro fundamental situation is improving for the gold sector. Now let’s get on with this week’s work…

And that is exactly what NFTRH 363 then went on to do as we continue to manage a wild, yet highly manageable financial market environment.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2015 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.