Bundesbank “Reassures” Re. Gold Bullion Reserves as Deutsche Bank Shocks With €6 Billion Loss Warning

Commodities / Gold and Silver 2015 Oct 08, 2015 - 04:43 PM GMTBy: GoldCore

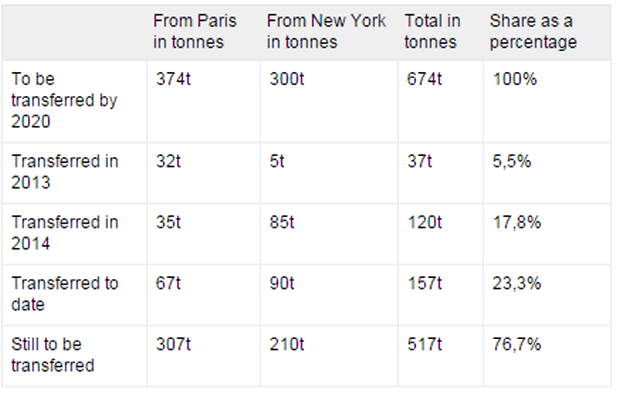

The German Bundesbank released an inventory of its gold reserves yesterday in order to quell ongoing public concerns about the true amount of actual unencumbered reserves and the location of the reserves stored in vaults in Frankfurt, London, Paris and particularly in the New York Federal Reserve.

The German Bundesbank released an inventory of its gold reserves yesterday in order to quell ongoing public concerns about the true amount of actual unencumbered reserves and the location of the reserves stored in vaults in Frankfurt, London, Paris and particularly in the New York Federal Reserve.

The central bank said its gold reserves amount to 3,384 tonnes of gold worth just €107 billion at today’s prices.

The move is the latest by the central bank, which is in the process of trying to move its gold reserves back to Germany after the eurozone sovereign debt crisis broke out in 2012 and led to public concerns and questions about the safety of Germany’s gold reserves.

Germany’s gold reserves are the second biggest in the world after those of the U.S. but Germany has been struggling to repatriate its gold reserves from the U.S. Federal Reserve in recent years. This has created wider concerns about the U.S. own gold reserves.

See Bundesbank Announces Repatriation of 120 Tonnes of Gold from Paris and New York Federal Reserve

The Bundesbank also helpfully provided a massive 2,302 page report, presumably in an attempt to create further transparency and understanding of the issue which remains an important one to large sections of the German political and financial class and the public who are concerned about a new Eurozone debt crisis and the ongoing debasement of the euro.

During the Cold War the West German Bundesbank was happy to keep its gold in the U.S. in case of nuclear war or an invasion from East Germany and the Soviet Union. Today there are public concerns about the Federal Reserve’s gold reserves and the indeed the precarious U.S. fiscal situation.

Hence, the desire to have clarity re the exact nature of the amount and legal ownership of the gold (possible gold lending, swaps etc) and having the gold reserves on German soil again in case of another U.S, Eurozone and global financial crisis or indeed a likely global monetary crisis.

Deutsche Bank Shocks With €6 Billion Loss Warning

Coincidentally, on the same day Deutsche Bank has warned it will lose a whopping €6.2 billion ($7 billion) in the third quarter, its biggest quarterly loss in at least a decade and potentially ever.

Many of those voicing concerns about the gold reserves are also concerned about the still unreformed, out of control and very fragile banking system.

In a peculiar late night announcement that shocked analysts globally, Germany’s biggest bank blamed huge “impairment charges” of €5.8 billion for the unexpected losses. Forecasts had been for profits of around €1 billion.

The charges are related to “higher capital requirements” for Deutsche’s investment bank and the reduced value of its Postbank division, which is up for sale.

On top of this, the bank is setting aside €1.2 billion to cover litigation costs. Like other banks, Deutsche has been caught up in the Libor-rigging scandal and faces another investigation in Switzerland for suspected price-fixing in the precious metal market.

Gillian Tett, ourselves and many others have warned that Deutsche and its massive derivative book has the potential to be a ”European Lehman Brothers”. Is Deutsche Bank, the largest holder of Warren Buffett’s “financial weapons of mass destruction” derivatives in trouble?

DAILY PRICES

Today’s Gold Prices: USD 1143.30, EUR 1011.59 and GBP 745.31 per ounce.

Yesterday’s Gold Prices: USD 1147.90, EUR 1021.45 and GBP 750.43 per ounce.

(LBMA AM)

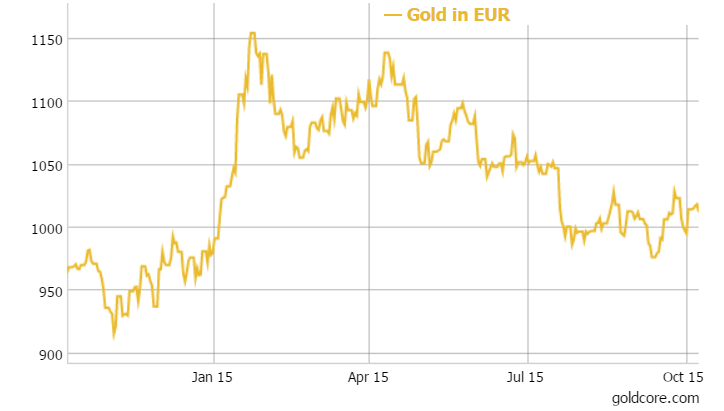

Gold in Euro – 1 Year

Gold was flat yesterday and finished just $1.20 lower, closing at $1145.80. Silver closed at $16.02, up another $0.22 for the day, a 1.4% gain. Euro gold rose to about €1019, platinum gained $11 to $943.

Download Essential Guide To Storing Gold Offshore

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.