Financial Markets Hit by Credit Market Stresses and Deteriorating Corporate Earnings

Stock-Markets / Financial Markets Jun 29, 2008 - 10:46 AM GMT T.S. Eliot might have been out by a few months – it looks as though June might turn out to be the cruelest month of the year rather than April.

T.S. Eliot might have been out by a few months – it looks as though June might turn out to be the cruelest month of the year rather than April.

Renewed fears of inflation and slower growth caused by record energy costs played havoc with global stock markets last week, resulting in the Dow Jones Industrial Average being on track to record its worst June since the Great Depression. As stocks suffered, gold bullion surged and government bond yields dropped due to safe-haven buying.

Sentiment soured as investors became more concerned that the credit crisis still had a long way to run and that the fallout was increasingly contaminating the real economy.

Credit market stress deteriorated markedly as shown by the widening credit default spreads in both the US and Europe. The CDX (North American, investment grade) Index rose by 17 basis points to 143, and the Markit iTraxx Europe Crossover Index by 41 basis points to 541.

“When sorrows come, they come not single spies, but in battalions,” said Claudius in Shakespeare's Hamlet. The pictures below, courtesy of Barry Ritholtz ( The Big Picture ), could have been taken from the play's brochure.

Besides surging oil prices and financial sector woes, the focal point for the week was the FOMC's interest rate announcement on Wednesday. As expected, the Fed left the Fed funds rate unchanged at 2.0%, and its wording in the accompanying statement largely reiterated the hawkish comments leading up to the meeting.

The Fed said overall economic activity continued to expand, partially due to “firming” in household spending, but it expected economic growth would face the burdens of tight credit conditions, housing contraction and the rise in energy prices.

The directive also said uncertainty over the inflation outlook remained high, although the Fed expected inflation to “moderate later this year and next year”, stating that downside economic risks had diminished somewhat, while inflation risks had increased.

“We're in a nasty environment,” said Tim Bond, Barclays Capital's chief equity strategist. “There is an inflation shock under way. This is going to be very negative for financial assets. We are going into tortoise mood and are retreating into our shell. Investors will do well if they can preserve their wealth. There is going to be a deep global recession over the next three years as policymakers try to get inflation back in the box.”

These sentiments were echoed by Jim Cramer ( New York Magazine ) who said: “In 25 years on Wall Street, I have never seen things this bad. We've had some tough times: the 1987 stock market crash, the collapse of the once-all-powerful Drexel Burnham Lambert, the immolation of Long Term Capital, the post-9/11 calamity, and the dot-com implosion. Every one of these events rocked the Street, causing pay cuts and layoffs and creating a sense of doom. But this time is different; it's doom itself.

“Sell everything. Nothing's working. Revisit when the prices are adjusted for a big recession, soaring inflation and a crushed consumer. Sell at 12,000 and come back at 10,000. Even better: short it,” said Cramer .

Difficult as it may be, you should guard against letting your emotions get the better of you. “Be prepared to hear a litany of dire predictions now as people jump on the ‘sell everything' bandwagon by the very same people who were pounding on the table to buy stocks just a few short weeks ago. Ignore the noise and scare tactics and focus on what matters most – making good decisions and finding opportunities that do exist …,” remarked Charles Kirk ( The Kirk Report ).

Although I did not intend compiling a “Words from the Wise” report this week, I actually managed to do a shortened version in midair from Cape Town to Europe. As I could not access the Internet for some of the usual statistics and was constrained by the laptop's limited battery capacity, the end result is significantly less comprehensive than usual. Blogging will remain slow for the next ten days as family time stakes its claim.

Although I did not intend compiling a “Words from the Wise” report this week, I actually managed to do a shortened version in midair from Cape Town to Europe. As I could not access the Internet for some of the usual statistics and was constrained by the laptop's limited battery capacity, the end result is significantly less comprehensive than usual. Blogging will remain slow for the next ten days as family time stakes its claim.

Before highlighting some thought-provoking news items and quotes from market commentators, let's briefly review the financial markets' movements on the basis of economic statistics and a performance round-up.

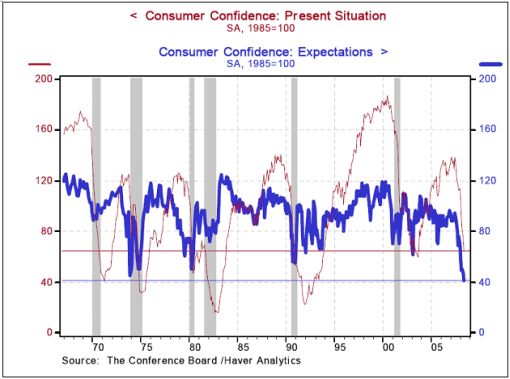

• The Conference Board Consumer Confidence Index fell further in June to 50.4 from May's 58.1. This puts the Index at a 16-year low, and this is the fourth-lowest reading in the history of the survey, which dates back to 1969.

• New Home Sales declined in May as housing markets continued on a downward trend. Sales of new single-family homes came in at 512,000 after seasonal adjustment, a decrease of 2.5% below the revised April total of 525,000 sales, and 40.3% below the total of 857,000 for May 2007. The supply of new single-family homes remained high at 10.9 months.

• Personal Income soared 1.9% in May, following April's 0.3% growth. Income growth was inflated by the effects of the tax rebates. Excluding those, personal income rose by 0.4% in May, up from 0.2% in April. Spending growth jumped to 0.8% from 0.4% the previous month. Real spending rose by half as much. The core PCE deflator rose by 0.1% again, while the top-line deflator rose by 0.4%.

Economy

“Global business sentiment softened last week and remains fragile, but it is well off its late April bottom,” reported the Survey of Business Confidence of the World conducted by Moody's Economy.com . “There has been a worrisome increase in pricing pressures during the past month. Confidence remains weakest in the US where it suggests the economy is still contracting, and it is strongest in Asia where it is consistent with an economy growing near its potential.”

The past week's economic reports in the US included the following notable releases:

The market is still pricing in two rate increases by year end. However, according to the Financial Times , Pimco's Bill Gross said he thought the Fed was just “jawboning” to keep inflation expectations under control. “By this time in December the Federal funds level is still going to be 2.0%,” he said.”

“My bet is that the FOMC remains on hold for the rest of the year as consumer spending softens again and headline inflation moderates in the third quarter,” said Paul Kasriel, chief economist of Northern Trust .

Elsewhere in the world, Jean-Claude Trichet, the president of the European Central Bank, expressed fresh concern about inflation and wage growth, strengthening expectations that the ECB would raise its main rate by 0.25 percentage points next week to 4.25%.

WEEK'S ECONOMIC REPORTS

| Date | Time (ET) | Statistic | For | Actual | Briefing Forecast | Market Expects | Prior |

| Jun 24 | 10:00 AM | Consumer Confidence | Jun | 50.4 | 56.0 | 56.0 | 58.1 |

| Jun 25 | 8:30 AM | Durable Orders | May | 0.0% | 0.3% | 0.0% | -1.0% |

| Jun 25 | 10:00 AM | New Home Sales | May | 512K | 520K | 510K | 525K |

| Jun 25 | 10:30 AM | Crude Inventories | 06/21 | 830K | NA | NA | -1242K |

| Jun 25 | 2:15 PM | FOMC Policy Statement | - | - | - | - | - |

| Jun 26 | 8:30 AM | Chain Deflator-Final | Q1 | 2.7% | 2.6% | 2.6% | 2.6% |

| Jun 26 | 8:30 AM | GDP -Final | Q1 | 1.0% | 1.0% | 1.0% | 0.9% |

| Jun 26 | 8:30 AM | Initial Claims | 06/21 | 384K | 370K | 375K | 384K |

| Jun 26 | 10:00 AM | Existing Home Sales | May | 4.99M | 5.05M | 4.95M | 4.89M |

| Jun 27 | 8:30 AM | Personal Income | May | 1.9% | 0.4% | 0.4% | 0.3% |

| Jun 27 | 8:30 AM | Personal Spending | May | 0.8% | 0.7% | 0.7% | 0.4% |

| Jun 27 | 8:30 AM | PCE Core Inflation | May | 0.1% | 0.2% | 0.2% | 0.1% |

| Jun 27 | 10:00 AM | Mich Sentiment-Rev. | Jun | 56.4 | 56.7 | 56.7 | 56.7 |

Source: Yahoo Finance , June 27, 2008.

In addition to the European Central Bank's interest rate decision on Thursday, July 3, next week's economic highlights include the following: Chicago PMI on Monday, Construction Spending and the ISM Index on Tuesday, ADP Employment and Factory Orders on Wednesday, and Initial Jobless Claims, ISM Services, and June's jobs data on Thursday. Markets will be closed on Friday in observance of Independence Day.

Markets

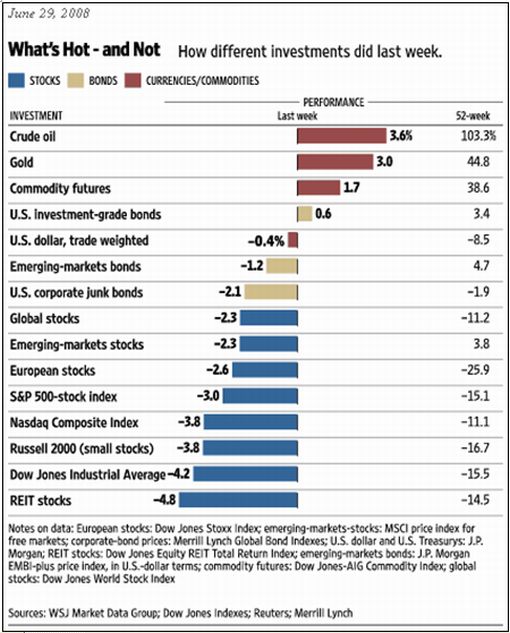

The performance chart obtained from the Wall Street Journal Online shows how different global markets performed during the past week.

Source: Wall Street Journal Online , June 29, 2008.

Equities

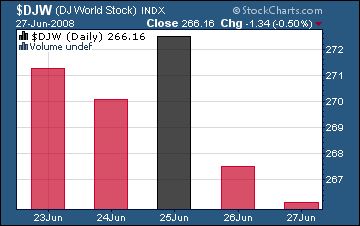

The MSCI World Index experienced four down-days and plunged by 2.3% (on top of the previous week's -1.9%) during the past week as concerns about surging inflation, further credit-related trouble and deteriorating corporate earnings intensified. The MSCI has dropped by 11.7% since the beginning of 2008 – its worst first-half performance since a decline of 13.8% during the first six months of 1982.

The MSCI World Index experienced four down-days and plunged by 2.3% (on top of the previous week's -1.9%) during the past week as concerns about surging inflation, further credit-related trouble and deteriorating corporate earnings intensified. The MSCI has dropped by 11.7% since the beginning of 2008 – its worst first-half performance since a decline of 13.8% during the first six months of 1982.

The performance of emerging markets (-2.3%) varied from the Brazilian Bovespa Index (-0.5%) that fared relatively well, to the less fortunate Indian BSE 30 Sensex Index (-5.3%) and the Taiwan Taiex Index (-4.5%). The Chinese Shanghai Composite Index (-2.9%) is at risk of losing its entire gain of 141% recorded during last year's eight-month rally.

The US stock markets got hammered on high volume and closed trading on Friday on a weak note. The index movements tell the story: Dow Jones Industrial Index -4.2% (YTD -14.5%), S&P 500 Index -3.0% (YTD -12.9%), Nasdaq Composite Index -3.8% (YTD 12.7%) and Russell 2000 Index -3.8% (YTD -8.9%).

Nine of the ten US stock market sectors recorded a decline for the week, with energy (+1.4%) the only one to end in positive territory. Of the subsectors, gold & silver stocks shone with a gain of 8.9%.

As far as specific companies were concerned, General Motors (GM) plummeted 16% after Goldman cut its earnings estimates and said the company may be forced to raise capital. Citigroup (C) and Merrill Lynch (MER) were both down about 10% on expectations that further write-downs were imminent.

The Dow Jones Industrial Index declined for eight of the last ten trading days, leaving it at its lowest level since September 2006 and down close on 20% (i.e. bear market definition) since its October 2007 high. Although the Dow has fallen below its March 2008 lows, all the other major US indices are still holding out above the year's lows.

Fixed-interest instruments

Government bonds around the globe benefited from renewed concerns about the economic outlook and commensurate safe-haven buying.

The ten-year US Treasury Note dropped by 15 basis points during the week to close at 3.99%. Similarly, the UK ten-year Gilt yield declined by 11 basis points to 5.04% and the German ten-year Bund yield by 10 basis points to 4.53%.

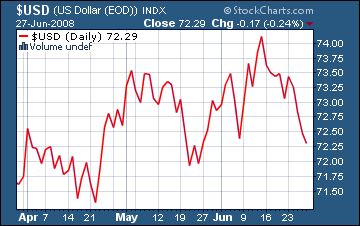

Currencies

A realization that an imminent rise in US interest rates was not on the cards, resulted in dollar weakness, causing the greenback to decline by 0.9% over the week against the euro, 0.6% against the British pound and 0.7% against the Japanese yen.

Commodities

US dollar weakness and supply concerns pushed the Reuters/Jeffries CRB Index 2.0% higher for the week, on track for its largest gain in 35 years. The Index has risen by 30.1% since January, the largest increase since the 30.2% gain in the first half of 1973.

At centre stage during the past week, the price of West Texas Intermediate crude recorded an all-time high of $142.26 a barrel, before pulling back to close at $140.50 – a weekly gain of 3.8%. In addition to the lower dollar, supply concerns and unrest in Nigeria prompted the advance, as traders shrugged off an increase in inventory levels and word that Saudi Arabia was increasing output in July.

Crude oil prices could rise to as high as $170 per barrel in the coming months but are unlikely to hit $200 and should ease towards the end of the year, OPEC President Chakib Khelil said on Thursday, according to Reuters .

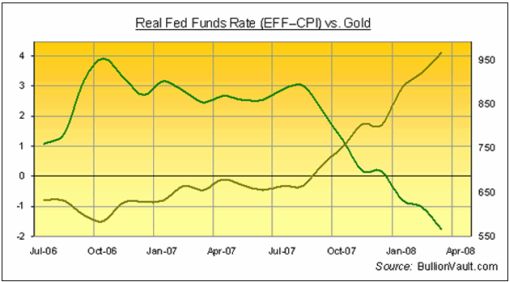

The declining dollar, together with rising price pressures and expectations that US interest rates might remain negative in real terms for quite a while, positively impacted on gold (+3.1%) and silver (+1.8%). Friday's surge of $32 was the biggest one-day gain in gold in 27 years.

As far as agricultural commodities were concerned, corn (+6.1%) and soyabean (+3.9%) prices traded at record levels ahead of an update from the US Department of Agriculture on Monday.

Now for a few news items and some words and charts from the investment wise that will hopefully assist in keeping head above (the very murky) water. It's best to remain cool and collected about these markets, and not take unnecessary risks.

Source: Unknown

CNBC: Analyzing inflation with Bill Gross

“The Fed is walking a tightrope between inflation and a recession, hoping to find its way to neutral. Bill Gross of Pimco shares his insight.”

Source: CNBC , June 25, 2008.

Telegraph: Barclays's Tim Bond warns of a financial storm

“Barclays Capital has advised clients to batten down the hatches for a worldwide financial storm, warning that the US Federal Reserve has allowed the inflation genie out of the bottle and let its credibility fall ‘below zero'.

“‘We're in a nasty environment,' said Tim Bond, the bank's chief equity strategist. ‘There is an inflation shock underway. This is going to be very negative for financial assets. We are going into tortoise mood and are retreating into our shell. Investors will do well if they can preserve their wealth.'

“Barclays Capital said in its closely-watched Global Outlook that US headline inflation would hit 5.5% by August and the Fed will have to raise interest rates six times by the end of next year to prevent a wage-spiral. If it hesitates, the bond markets will take matters into their own hands. ‘This is the first test for central banks in 30 years and they have fluffed it. They have zero credibility, and the Fed is negative if that's possible.'

“The Fed's stimulus is being transmitted to the 45-odd countries linked to the dollar around world. The result is surging commodity prices. Global inflation has jumped from 3.2% to 5% over the last year.

“Mr Bond said the emerging world is now on the cusp of a serious crisis. ‘Inflation is out of control in Asia. Vietnam has already blown up. The policy response is to shoot the messenger, like the developed central banks in the late 1960s and 1970s,' he said.

“‘They will have to slam on the brakes. There is going to be a deep global recession over the next three years as policy-makers try to get inflation back in the box.'

“Barclays Capital recommends outright ‘short' positions on Asian bonds, warning that yields could jump 200 to 300 basis points. The currencies of trade-deficit states like India should be sold. The US yield curve is likely to ‘steepen' with a vengeance, causing a bloodbath for bond holders.

“The bank said the full damage from the global banking crisis would take another year to unfold.”

Source: Telegraph , June 27, 2008.

Financial Times: Spectre of inflation over global economy

“The spectre of inflation returned to haunt the global economy on Tuesday as companies ranging from Dow Chemical of the US to South Korea's Posco unveiled sharp price rises to combat the soaring cost of energy and raw materials.

“The moves by Dow, the biggest chemical group in the US, and Posco, the world's fourth largest steelmaker, came as Charles Holliday, chief executive of the chemical giant DuPont, warned of rising inflationary pressures in the corporate sector.

“‘Inflation is here big time,' Mr Holliday told the Financial Times, adding that companies such as DuPont faced ‘tremendous cost pressures' and had the ‘obligation' to raise their prices to offset higher costs.

“The general price pressure was exacerbated when BHP Billiton, the mining company, said the 96.5% record increase in iron ore cost announced by Rio Tinto on Monday was not enough, signalling it could ask for a rise above 100% with its steelmaker customers.

“The sustained rise in the price of oil and commodities has hammered industries such as airlines and carmakers, and deepened fears of a global inflationary spiral – which has already provoked riots across Asia – as producers pass on higher costs to manufacturers and consumers.”

Source: Francesco Guerrera, Krishna Guha and Javier Blas, Financial Times , June 25, 2008.

Financial Times: Fed sits tight as ECB chief signals rate rise

“The Federal Reserve indicated growing fears about inflation relative to growth on Wednesday, but stopped short of saying that it saw inflation as the dominant risk.

“The central bank kept open the option of raising interest rates soon, without signalling an intention at this stage to do so. Rates remained at 2.0%.

“The Fed said: ‘Although downside risks to growth remain, they appear to have diminished somewhat, and the upside risks to inflation and inflation expectations have increased.'

“The Fed upgraded its description of near-term growth, saying the economy ‘continues to expand, partly reflecting some firming in household spending'.

“It also upgraded slightly its description of the housing market, saying a contraction was now ‘ongoing' rather than ‘deepening'. However, it said tight credit conditions, and housing and energy prices would ‘weigh on economic growth over the next few quarters'.

“The Fed reiterated its expectation that inflation will moderate ‘later this year'. But it said continued increases in energy prices and the ‘elevated state' of some inflation expectation measures suggested ‘uncertainty about the inflation outlook remains high'.

“Alan Ruskin, strategist at RBS Greenwich Capital, said the Fed statement ‘tends to play strongly to the view that the next move in rates will be an increase, but the Fed plainly does not wish to tie itself down'.

“The market is still pricing in two rate increases by year end. However, Bill Gross, managing director at Pimco, the bond fund manager, said he thought the Fed was just ‘jawboning' to keep inflation expectations under control. ‘By this time in December the Federal funds level is still going to be 2%,' he said.”

Source: Krishna Guha, Financial Times , June 25, 2008.

Paul Kasriel (Northern Trust): FOMC stays on hold, keeping its options open

“The Fed is less worried about a death spiral in real economic activity and more worried about upside risks on inflation than it was at the end of April. This does not mean that the economic downside risks and inflation upside risks are equal in the eyes of the FOMC.

“In my opinion, the Fed remains more worried about weaker economic activity than it is about a wage-price spiral. Recent data suggest that housing is nowhere near a bottom, capital spending remains weak and the labor markets continue to soften. The next element of aggregate demand to cave in will be state/local government spending. The jury still is out as to whether consumer spending is out of the woods. The motor vehicle producers would say ‘no'.

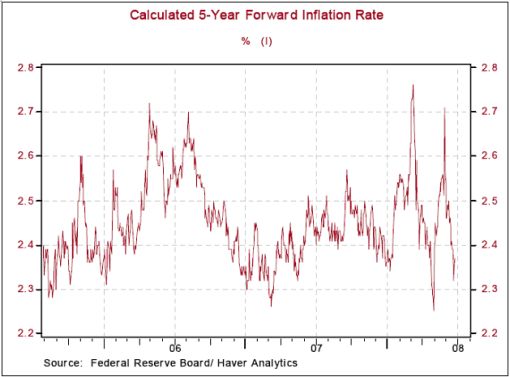

“Meanwhile, industrial metals prices appear to have topped out, crude oil prices have edged lower, and one of the Fed's favorite market-based measures of inflation expectations – the implied 5-year inflations expectations 5 years forward – has fallen back in range. My bet is that the FOMC remains on hold for the rest of the year as consumer spending softens again and headline inflation moderates in the third quarter.”

Source: Paul Kasriel, Northern Trust – Daily Global Commentary , June 25, 2008.

BCA Research: Fed turns a bit more hawkish

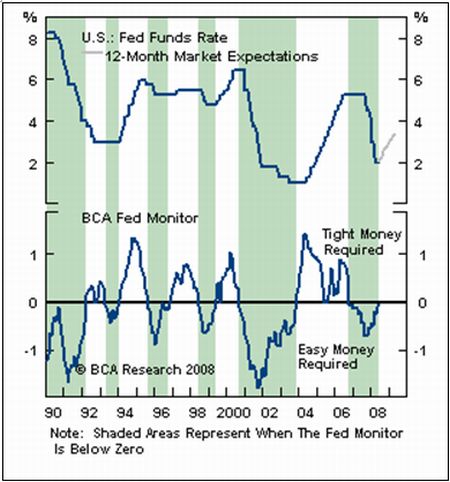

“The FOMC stayed on hold, but adopted a slightly more hawkish tone in its policy statement. Nonetheless, the markets still expects too much in the way of rate hikes in the coming year.

“It was no doubt a lively FOMC meeting this month, with several members probably arguing for either a rate hike, or at least tougher language in the policy statement. The statement made a gesture in that direction, noting that downside economic risks had moderated while upside inflation risks had increased. The case for an early tightening is still weak, in our view.

“The underlying inflation picture is better than the headline data suggest, many market interest rates are still higher than before the Fed started to ease, and the credit system is not yet functioning properly. Market expectations of a 50 basis point rise in rates over the next six months are too aggressive.”

Source: BCA Research , June 26, 2008.

David Fuller (Fullermoney): Not time for Bernanke to turn hawkish

“I maintain that Bernanke turned a bit hawkish with his statements in May because he could, following a 2-month stock market rally. Shades of November 2007.

“The Fed Chairman and his colleagues find themselves in a high-stakes game of poker. Given a strong hand, in terms of the US economy, I am sure that they would choose to raise rates to underpin the dollar and combat inflation. Unfortunately, Bernanke and Co have a decidedly weak hand, although not entirely by chance, as they have contributed to inflationary pressures by allowing money supply to expand rapidly for many years …

“With the Dow approaching its January and March lows, we should ask whether or not Bernanke is bluffing? Probably, provided he is not being influenced by his critics. I would be very surprised if he raised rates anytime soon, despite being considerably more concerned about inflation today than at the January or March stock market lows. Nevertheless most of that inflation is from energy and food prices – global developments which cannot really be controlled by the Fed's monetary policy.

“However if I am wrong and the Fed does raise rates, I think the stock market would certainly fall further, quite probably contributing to additional economic weakness.

“In attempting to navigate between the Scylla of inflation and the Charybdis of a weak economy, I do not think this is the time for Bernanke to turn hawkish in deed as well as word.”

Source: David Fuller, Fullermoney , June 24, 2008.

Bill King (The King Report): Bernanke's Hobson's choice

“The most important fact about the FOMC soiree was the Fed/Bernanke chose not to act on inflation because it believes, or is using as an excuse, that inflation will soon ebb because the economy stinks. But this has been Bernanke's strategy since he took over the Fed – 28 months ago. While Bernanke fiddles, an inflationary fire is consuming the globe and it is intensifying because real interest rates are decisively negative and get more negative each passing day.

“Bernanke has not hiked rates because he fears the US financial system is too fragile. Yet when he did nothing to arrest inflation, commodities surged and the dollar tanked; this will exacerbate inflation. If there was even a hint of a beneficial trade-off for ignoring inflation, Ben's inertia might be justified.

“However, stocks collapsed, led by financials, and leading US companies are now face increasing bankruptcy concern. And we know from recent experience that fear of bankruptcy can become a self-fulfilling prophesy.

“Ergo, Bernanke is faced with a choice. He can remain inert and watch the inflationary recession intensify with commensurate financial duress and a dollar collapse or Ben can try to legitimately boost the dollar and arrest inflation, which will worsen economic and financial conditions.

“Ben's choice is to watch conditions worsen and have the dollar collapse or to save the dollar and watch conditions worsen. It's conceivable that a dollar collapse would produce even worse conditions than hiking rates and restricting credit to save the dollar. It seems like a relatively simple choice, especially when one considers the calamity that could develop with a dollar collapse.”

Source: Bill King, The King Report , June 27, 2008.

Bill King (The King Report): Ridiculous GDP number

“We must comment on the ridiculous 1% Q1 GDP. ‘Services' accounted for 1.31% of GDP with ‘Housing' accounting for .23% of ‘Services'. How is this possible?!?!? Of course a big chunk of the 1.31% growth of ‘Services' is unaccounted inflation. ‘Net Exports' accounted for .79% of GDP and ‘Government Consumption' contributed .41 to GDP.

“Without hokey accounting for inflation and trade, GDP would be decidedly negative. More importantly, ‘Profits before tax without adjustments' declined 4.4%. If GDP grew 1%, how did US companies, in the ‘new paradigm' and benefitting from ‘the great US productivity miracle' suffer a 4.4% drop in profits?

“A few days ago, John Williams noted that industrial production for May showed a y/y decline and this occurs only during recessions. Thank God, the BLS can manufacture positive GDP!”

Source: Bill King, The King Report , June 27, 2008.

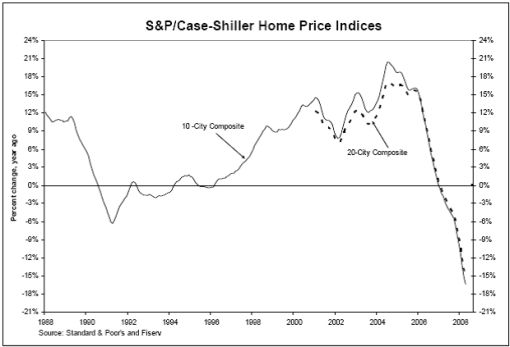

Standard & Poor's: S&P/Case-Shiller – steep declines in home prices

“Data through April 2008, released today by Standard & Poor's for its Price Indices, the leading measure of US home prices, show annual declines in the prices of existing single family homes across the US continued to worsen in April 2008 …

“The chart above depicts the annual returns of the 10-City Composite and the 20-City Composite Indices. Both composite indeces are now reporting annual declines in excess of 15.0%. The 10-City Composite posted a new record low of -16.3%, and the 20-City Composite recorded a record low of -15.3%.

“‘There might be some regional pockets of improvement, but on an annual basis the overall numbers continue to decline,' says David M. Blitzer, Chairman of the Index Committee at Standard & Poor's.”

Source: Standard & Poor's , June 24, 2008.

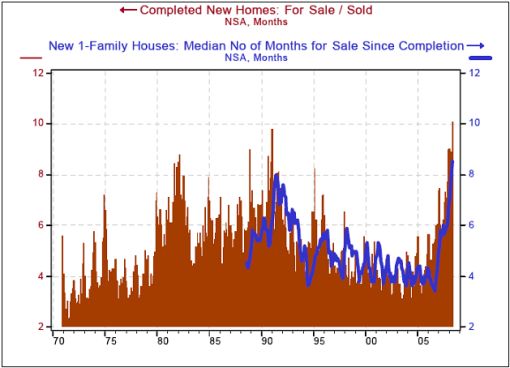

Paul Kasriel (Northern Trust): New homes – taking longer to move the merchandise

“I hope the Census Bureau can count the number of people in the US better than it can count the number of new homes sold. The first estimate of a given month's sales is notoriously off. So, we should take the first estimate of May sales and inventories of new homes with a grain of salt. Be that as it may, May new home sales retreated 2.5% to an annualized pace of 512,000 units. The low sales rate for this cycle to date is 501,000 established in March. The sales region that really put a dent in the total was the wild West, where sales declined 11.63% to a cycle low annual rate.

“But I want to concentrate on the difficulty developers are having in moving their ‘merchandise' and what the supply looks like relative to demand. The chart shows that it took a record high 8.5 months for builders to sell a home after it was completed. The bottom line is that that the bottom in the housing market and house prices is nowhere in sight.”

Source: Paul Kasriel, Northern Trust – Daily Global Commentary , June 25, 2008.

Paul Kasriel (Northern Trust): June conference board data augurs poorly for unemployment rate

“Earlier this month, the Buffalo Fed branch and the Philly Fed reported that manufacturing activity had deteriorated in their regions. Today the Richmond Fed corroborated the message from its regional brethren with a report showing that its composite manufacturing survey index dropped to minus 12 in June from minus 3 in May.

“At the same time that Richmond was reporting, the Conference Board released its June consumer confidence, or lack thereof, report. Wow! Gasoline at 4 bucks a gallon really knocks the wind out of consumers' sails, to mix metaphors. The chart shows that the June reading on the present-conditions component of consumer confidence dropped to its lowest level since September 2003. … the expectations component of consumer confidence fell in June to its lowest level in the history of the series.”

Source: Paul Kasriel, Northern Trust – Daily Global Commentary , June 24, 2008.

Bloomberg: Sector to watch – regional banks

Source: Bloomberg , June 20, 2008.

MarketWatch: Bond insurers trying to unwind contracts

“Bond insurers, including Ambac, MBIA and FGIC, reportedly are trying to unwind $125 billion of guarantees they sold on risky debt securities.

“MBIA, Ambac and FGIC are talking with banks about ‘commuting' these insurance contracts, which were sold in the form of credit-default swaps, a type of derivative that pays out in the event of default, the Financial Times reported on Monday.

The contracts guaranteed payments on collateralized debt obligations – complex debt securities often backed by mortgages that have plunged in value amid a recent wave of foreclosures.”

Source: Alistair Barr, MarketWatch , June 23, 2008.

Richard Russell (Dow Theory Letters): How deep will stock market decline be?

“Russell, you've been saying that following the current vicious stock market ‘correction', you expect a worldwide boom as the massive amounts of currencies on the sidelines finally kick in. Do you still hold to that thesis?

“Answer – That's been my ‘scenario'. But I'm flexible, as you have to be in this business. I want to see how powerful this downturn in the US stock market and world markets become. I want to see whether the Transports hold above their January lows or whether the Transports finally ‘throw it in'. I want to see how deep this decline goes, and how much damage is done.

“With the price of oil over $135, the oil producing nations are choking on petrodollars. Wealth is building up at an enormous rate in the oil producing nations. Depending on how bad the world economy becomes, this massive build-up in wealth is laying the ground for a potential boom. But first we have to get through the pain, and the pain is increasing as stocks head lower.

“It's well to remember that even as $130 oil impoverishes the US, it enriches Saudi Arabia and Abu Dhabi and Venezuela. It's a different world we're living in today as compared with the world of my youth where the US was master of the universe.

“The immediate task for me and my subscribers is to get through this correction (bear market?) with as little loss as possible. To do this again I recommend cash and gold. I also recommend that you get rid of as much debt as possible. As markets head down, debt becomes an increasing burden. Unfortunately, this market mess is coming at a time when US consumers are holding far too much debt.”

Source: Richard Russell, Dow Theory Letters , June 23, 2008.

Eoin Treacy (Fullermoney): Stock market convalescence period to be lengthy

“We have forecast for a number of months that the convalescence of the S&P 500 will be lengthy and so far this has been borne out. The failure to break back into the overhead trading range in mid-May was a further indication that the recovery will take time.

“One of our main concerns is the weakness of the banking sector. The S&P 500 Bank Index led on the downside and remains in an overall downtrend, with a progression of lower highs. The Index has been falling on almost consecutive days since May and the last two days are the first two consecutive days on the upside in that timeframe. Today's weak close will not instil confidence and it needs to rally above 200 to break the short-term downtrend. The general health of the banking sector is a bellwether for the wider market. If the Banks at least stop going down, a headwind to sentiment will have been removed.

“The S&P 500, having failed to break upwards in May, is now testing the January and March lows. The Dow Jones is currently testing its lows and the Nasdaq 100 remains substantially above its lows.

“Is it time to sell? Speaking for myself, I believe it is too late to sell now, Sentiment is deteriorating and we are in region of prior lows, so there is the potential for at least a short-term rally. For our view to be correct, the market needs to hold at or above the January / March lows and remain in the overall ranging pattern. Any downside break needs to be retraced quickly; otherwise another down leg is a possibility. If we are wrong and the current consensus view, that the period from the January lows to now, was a distribution within a developing downtrend, is correct, then you would be justified thinking about selling part of your position and more into a future rally.

“Is it time to wait? I believe it is. Stock markets are volatile and I have no qualms about saying it is difficult to make money in the current environment. A war is going on between supply and demand and at present the bears have temporarily got the upper hand.

“Is it time to buy? Trading opportunities will exist when the market bounces, whenever that occurs. We have seen over the last five-months that at the upper side of the range sentiment is more sanguine and at the lower side it is extremely bearish. As long as the current ranging activity continues, we can expect these sorts of mood swings.”

Source: Eoin Treacy, Fullermoney , June 25, 2008.

David Fuller (Fullermoney): What is sentiment indicator telling us?

“Oversold readings of this magnitude have always coincided with market bottoms of at least near-term significance. Could it be different this time? That is always a possibility, because the fundamental background is never the same, but it is probably not a good bet.

“Given Wall Street's continued weakness, it would take a rally tomorrow and early next week to prevent an even more extreme reading when this important sentiment indicator is next updated.

“Meanwhile, of the many headwinds buffeting stock markets, crude oil is probably the most important. A sustained break above $140 would reaffirm the uptrend for crude and certainly be bearish for most global stock market indices. A close beneath $120 remains necessary to confirm a peak of medium-term significance.”

Source: David Fuller, Fullermoney , June 26, 2008.

Bloomberg: Sam Stovall – S&P 500 earnings to rise 8% in 2008

“Sam Stovall, chief investment strategist at Standard & Poor's, talks with Bloomberg from New York about the outlook for US corporate earnings, the financial industry and his expectations for oil prices.”

Source: Rhonda Schaffler, Bloomberg , June 23, 2008.

Financial Times: Longer-term trends looking positive for Japanese stocks

“… the Nikkei has certainly been displaying remarkable resilience of late. The FTSE Global index ex-Japan has lost 9% since the tentative rally was viciously reversed in mid-May. The Nikkei is down less than 3%.

“The weaker yen has helped. For example, consumer goods, much of which are exported, account for a quarter of the Nikkei's capitalisation.

“Another reason the Nikkei has outperformed is that investors believe Japan's banking system has emerged relatively unscathed from the subprime crisis.

“Whether this was the fortuitous result of a need to sort out their own balance sheets after the 1990s slump or a strategic decision not to dive headlong into the credit party, the upshot is they are now healthy enough to pick up stakes in struggling foreign institutions. The US banking sector is off 21% since mid-May, Japan's 7.5%.

“Longer-term trends look more positive. Agitation to improve corporate governance is gathering pace. Companies are increasing dividends and buybacks, says Dr Seiichiro Iwasawa, chief equity strategist at Nomura, who adds that, although high oil prices have traditionally hurt Japanese stocks, the country is the most energy-efficient in the world.

“But for the Japanese market to maintain a good bull run, it will be necessary for Mrs Watanabe to add more domestic stocks to the family portfolio instead of seeking returns abroad.

“And today's confirmation that, after years of deflation, inflation in Japan continues to rise will remind consumers that shares can go up as well as down.”

Source: Jamie Chisholm, Financial Times , June 26, 2008.

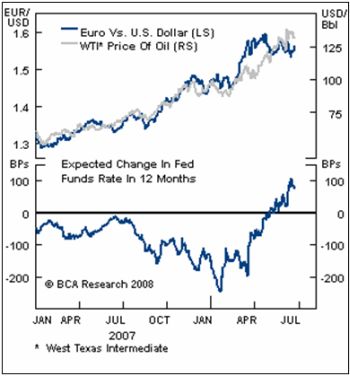

BCA Research: US dollar – going nowhere fast

“Rising crude oil prices are forcing European central bankers to become more hawkish than the Fed, helping to undermine the dollar.

“The euro/dollar exchange rate and the price of oil have moved in lockstep over the past year. While oil has constructive supply and demand fundamentals which have little to do with currencies, the rise in energy prices has undermined the dollar versus the euro in at least three ways. First, the ECB has been more hawkish than the Fed in the face of oil-related stagflation risks. Second, there are concerns that Middle Eastern oil-producing countries will abandon longstanding dollar pegs as their economies overheat and inflation moves into double digits. Third, the US economy is more cyclically fragile than its euro area counterpart, meaning higher oil prices present a greater risk for US growth.

“These factors may explain why the dollar has not risen much in the face of a massive upward shift in US interest rate expectations. Bottom line: The US dollar should remain under pressure, despite increased rhetoric from domestic policymakers. While officials are calling for a strong dollar and threatening intervention, they will settle for a trading range.”

Source: BCA Research , June 23, 2008.

Financial Times: Kohn speech hints at call to drop dollar peg

“Countries with overheating economies are contributing to inflation around the world by pushing up commodity prices, Don Kohn, the vice-chairman of the Federal Reserve, said on Thursday.

“His comments came in a speech in which he appeared to call on fast-growing emerging markets to drop their exchange rate pegs to the dollar and adopt independent monetary policies – so they no longer import Fed monetary policy.”

Source: Krishna Guha, Financial Times , June 26, 2008.

Bloomberg: Yuan near highest since peg on inflation fight; bonds decline

“The yuan traded near the highest level since a dollar peg was scrapped in 2005 on speculation China will seek a stronger currency to slow inflation.

“The yuan has appreciated 2.2% against the dollar this quarter, the best among the 10 most-traded currencies in Asia outside Japan, as Premier Wen Jiabao pledged to tackle inflation. A central bank survey showed that most households expect consumer prices to rise next quarter, according to a statement published on its Web site yesterday.

“‘Steady yuan appreciation, at an annual 10%, will remain an important policy,' along with increases in required reserve ratios to reduce inflation, Ben Simpfendorfer, an economist with Royal Bank of Scotland in Hong Kong, said in a report yesterday.

“Inflation quickened to 8.1% in the first five months of this year, compared with 4.8% for all of 2007. A strengthening currency lowers import costs.”

Source: Judy Chen and Belinda Cao, Bloomberg , June 26, 2008.

Bloomberg: Yen falls to record low against euro

“The yen fell to a record against the euro on speculation the European Central Bank will boost interest rates and as Japanese workers prepare to spend their summer bonuses on overseas assets offering higher yields.

“Japan's currency slid for a third day as ECB President Jean-Claude Trichet said on CNN there may be a ‘small increase' in rates, while the Bank of Japan will likely keep borrowing costs on hold. The dollar traded near the weakest level in more than two weeks against the European common currency as investors raised bets the Federal Reserve will hold off lifting rates.

“‘The yen is going to continue to fall because the Bank of Japan has made it clear it isn't going to raise rates anytime soon,' said Neil Mellor, a currency strategist in London at Bank of New York Mellon Corp.

“The yen may decline to 174 per euro [from 169.46] and 110 to the dollar [from 107.70] in the next three months, Mellor said.”

Source: Lukanyo Mnyanda and Stanley White, Bloomberg , June 26, 2008.

Financial Times: Swiss franc may experience pressure

“Supporters popping into Switzerland for the Euro 2008 soccer tournament over the past few weeks might have got their timing just right.

“If the matches had been played a few months earlier, in March, when the financial world was embroiled in the turmoil emanating from Wall Street, foreign fans would have had to pay more for the trip.

“The brief jump in the Swissie during that period – from about SFr1.62 to the euro to SFr1.55 – confirmed that the franc remains a safe-haven asset.

“It's now back to the former level but where it goes from here may provide a useful tool for gauging investors' appetite for risk and the likely path for global markets.

“For John Hardy at Saxo Bank, the infatuation of central banks with inflation risks will damage global growth, benefiting the franc and the yen as investors from those countries repatriate funds to escape falling markets.

“The Swissie may also garner support from homeowners in eastern and central Europe. Having financed their mortgages in francs, these retail carry traders will face the prospect of house price deflation spreading from the US and UK and their domestic currencies falling, forcing them to buy francs to hedge exchange-rate risk.

“But other factors may reduce the franc's attractiveness.

“The Swiss National Bank last week kept interest rates on hold at 2.75% and analysts are divided on the next move. True, producer price inflation is close to a 20-year high, but gross domestic product grew by just 0.3% in the first quarter so another cut in interest rates may be required.

“Yet perhaps the biggest drag could come from investors' concerns about the Swiss financial sector, which accounts for 13% of national output. Indeed, the total assets of UBS and Credit Suisse are about seven times Swiss GDP.

“Safe havens are not always what they're cracked up to be.”

Source: Jamie Chisholm, Financial Times , June 24, 2008.

Bloomberg: Marc Faber – Commodities will fall in second half

“Commodities face a ‘correction' after a seven-year rally, which will help ease global inflation, investor Marc Faber said.

“‘Commodity prices will come down in the next six months to one year,' Faber, publisher of investment newsletter the Gloom, Boom and Doom Report, said at a briefing in Taipei today. Commodity prices will resume their gains after the correction, he said, with demand for oil doubling in the next 12 years.

“Faber said Taiwan equities will outperform global stocks, while China ‘is not yet a buying opportunity.' Taiwan's Taiex Index has dropped the least among Asian benchmark indexes this year and China's CSI 300 Index has slumped 44%.

“‘Some inflation pressures will abate as commodity prices decline, said Faber. ‘It doesn't mean I am bearish about commodities. I think commodity bull markets will last about 20 years,' he said.

“‘Corporate profits in China will by and large disappoint as well as in India, so overall I am not very optimistic about these markets,' he said.

“US equities could ‘outperform markets like China and India' after underperforming in the past four years, Faber said. Japanese stocks may also beat peers, he said.

“Faber said he's negative about the dollar in the long term, though the US currency may ‘strengthen somewhat' in the short term.

“Faber also said he prefers Taiwanese to US technology companies, although the outlook for the industry is ‘bad'.”

Source: Tim Culpan, Bloomberg , June 26, 2008.

Bloomberg: Kiener sees gold price at $2 500 by 2012

“Juerg Kiener, chief investment officer at Swiss Asia Capital, talks with Bloomberg from Singapore about the outlook for global commodity markets, and his investment strategy.”

Source: Simon Kennedy, Bloomberg , January 25, 2008.

Phil's Stock World: How badly did the Fed blow it?

Source: Phil's Stock World , June 25, 2008.

Reuters: OPEC chief sees oil at $150-170 in coming months

“Crude oil prices could rise to as high as $170 per barrel in the coming months but are unlikely to hit $200 and should ease towards the end of the year, OPEC President Chakib Khelil said in an interview on Thursday.

“The comments came as crude prices neared $135 per barrel, after rising about 40% this year.

“Khelil said he doubted prices would climb as high as $200. ‘I think that the devaluation of the dollar against the euro, if everything goes as I think it will, will be of the order of perhaps 1% to 2% and this will probably generate an $8 rise in the price of oil,' he said.

“The head of the Organisation of Petroleum Exporting Countries, said it had been clearly established that speculation was impacting markets. ‘It's not a question, but a certainty. The problem is the extent of that speculation on the market,' he said, adding that the effect of the subprime crisis in the United States had affected oil markets.

“Asked what the main factor behind the rise in prices had been, he replied: ‘I think it's the devaluation of the dollar. You can see, every time the dollar strengthens, there is a fall in prices,' he said.”

Source: Reuters , June 26, 2008.

Financial Times: Chinese agree 96% jump in ore prices

“Global inflation fears deepened as Chinese steelmakers agreed to a record increase in annual iron ore prices in a move likely to boost the cost of cars, machinery and other products.

“Chinese millers agreed to pay Anglo-Australian miner Rio Tinto up to 96.5% more for their ore supplies this year, the largest ever annual increase and well above the 9.5% increase paid last year.

“The rise suggests that demand for commodities from emerging economies remains strong, in spite of the US slowdown, fuelling fears that global inflation will continue to rise. The rise – an average 85% – surpasses the record increase of 71.5% agreed in 2005, when the commodities boom gathered pace.”

Source: Javier Blas and Rebecca Bream, Financial Times , June 23, 2008.

Financial Times: Stagflation fears in eurozone rise

“The eurozone on Monday slid closer to stagflation – low growth combined with rising inflation – as private sector output contracted this month for the first time in five years.

“Weak economic data indicated soaring oil prices had hit growth in June, but not enough to stop the European Central Bank going ahead next week with a planned quarter percentage point rise to 4.25% in its main interest rate.

“The eurozone purchasing managers' index dropped from 51.1 in May to 49.5 in June, the first contraction in activity since July 2003. The risk of a recession in the 15-country region had increased, analysts said. That contrasted with the robust growth seen at the start of the year.

“But the same survey also showed inflationary pressures mounting – especially in the service sector, where prices rose at the fastest rate for more than seven years. That will alarm the ECB, which saw the annual eurozone inflation rate leap to 3.7% in May, the highest for 16 years, and is braced for a rise as high as 4% in coming months.

“‘The ECB hiking [interest rates] in July would be consistent with a stagflationary feel,' said Michael Hume at Lehman Brothers.”

Source: Ralph Atkins, Financial Times , June 23, 2008.

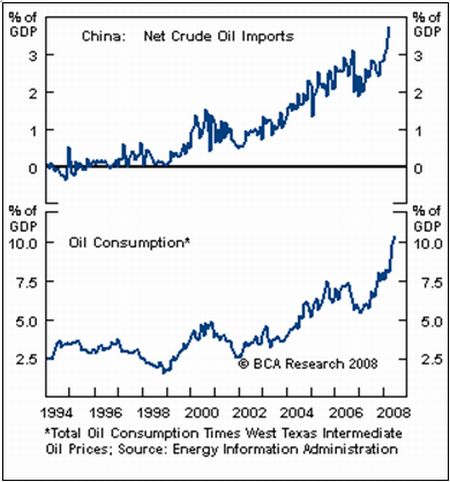

BCA Research: China – what could go wrong?

“China's macro environment is increasingly challenging. There are a number of risk factors, with oil and wage costs currently being the two most important.

“The Chinese economy has been able to handle surging crude oil prices remarkably well, although it is difficult to know at what point energy prices will begin to choke domestic growth. China is one of the largest oil importers in the world and its dependence on external supplies of crude oil is close to 50% of its consumption. The rise in crude prices has become an increasingly heavy economic burden. Total oil consumption has jumped to more than 10% of China's GDP, up from about 5% at the beginning of last year.

“With regards to labor compensation, stronger wage growth (potentially driven by rising food prices) would be a precursor to widespread inflationary pressures in China. As long as earnings growth remains in check, it is unlikely that a wage inflation spiral will develop. So far, wage gains have been largely offset by improvements in productivity (i.e. unit labor costs have not risen much) but this trend is worth monitoring closely.

“Bottom line: Moderating but robust growth and subdued inflation remains our baseline forecast, despite these potential risks. Stay tuned.”

Source: BCA Research , June 25, 2008.

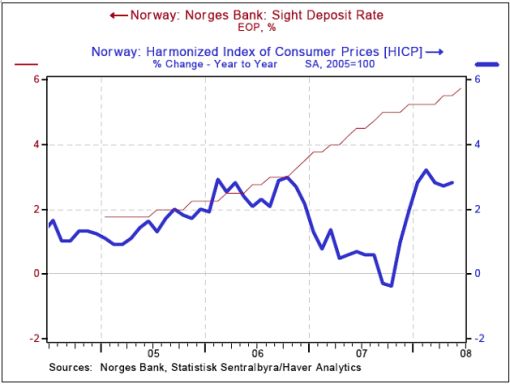

Paul Kasriel (Northern Trust): Norwegian Krone as the next reserve currency?

“Today, the Norges Bank, the Norwegian central bank, raised its policy interest rate 25 basis points to 5.75%. That puts the Norges Bank's policy rate 293 basis points over the May year-over-year CPI inflation rate … Notice that the Norges Bank was raising its policy rate in the first half of 2007 as the inflation rate was falling. The Norges Bank is offering savers an ‘honest' return on their funds. Isn't this what you would look for in a reserve currency's central bank?”

Source: Paul Kasriel, Northern Trust – Daily Global Commentary , June 25, 2008.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.