Silver Price Green Light

Commodities / Gold and Silver 2015 Oct 16, 2015 - 04:03 PM GMTBy: DeviantInvestor

Silver looks like it has bottomed and will move substantially higher. Why?

Silver looks like it has bottomed and will move substantially higher. Why?

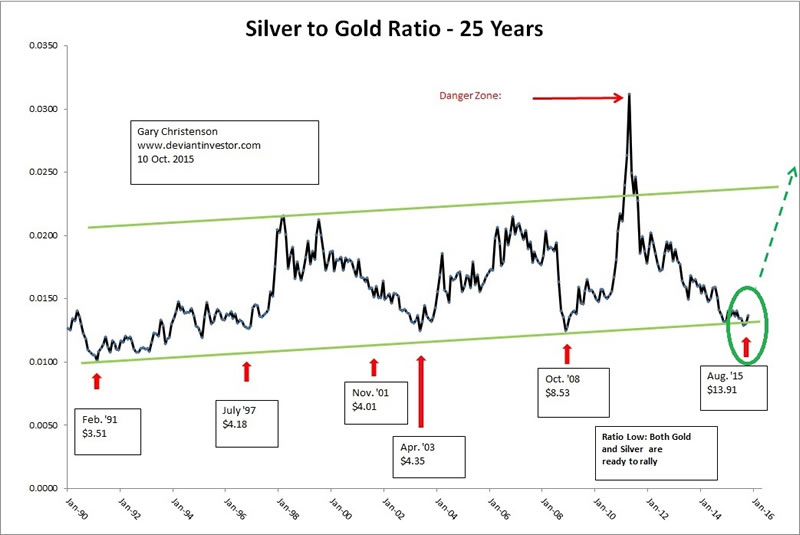

Long Term – 25+ years: Examine the silver to gold ratio since 1990. The ratio is currently low and appears to have bottomed. Silver bottoms when the ratio bottoms. Expect a multi-year rally.

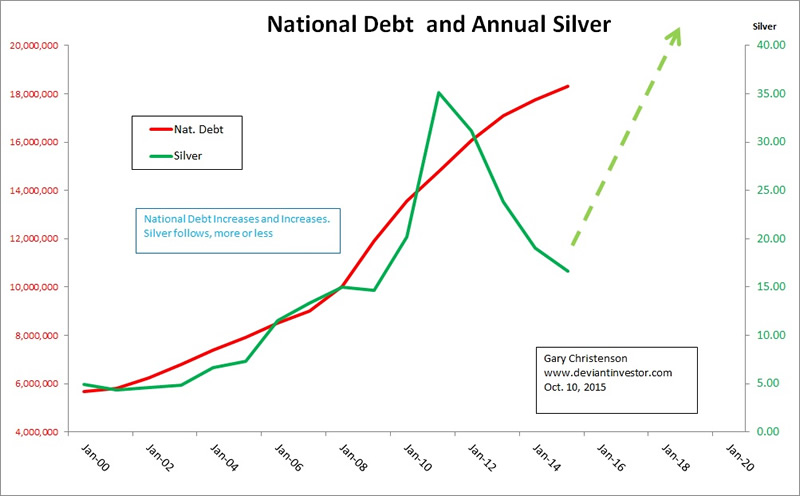

Medium Term – 15+ years. The US national debt is huge, moving higher, and has effectively zero chance of stabilizing or decreasing in the next decade. A poorly built mobile home is more likely to survive a Category 5 Hurricane than the US national debt will decrease. Examine the chart of national debt and silver prices for the past 15 years. Silver prices will “catch up” with the drastic increase in national debt.

Silver prices erratically follow national debt higher. Long term charts of debt versus silver since 1913 and 1971 (not shown) clearly demonstrate the same relationship. Questions:

- Do you expect US national debt, global debt, and other sovereign debt will decrease without a massive debt default? I don’t – debt will increase.

- If the world continues on its current “borrow and spend” path, do you expect silver prices will reverse their 100 year correlation with debt, spending, and currency in circulation? I don’t – silver prices will increase substantially.

- But if the world economy collapses into a deflationary depression and $100 Trillion in global debt defaults, would you rather own physical silver, dodgy fiat currency, or paper debt?

- Or if the world economy collapses into a hyperinflationary disaster, would you rather own physical silver, increasingly worthless paper currency, or paper debt?

Multi-year Term: Examine the graph of weekly silver prices. Silver prices are low and have broken the long term descending resistance line. The next targets are the upper horizontal band at about $19.15 and then about $35.

Short Term: The High Frequency Traders are overly influential in the short term gyrations of COMEX paper silver prices. They will push paper silver prices wherever is best for them, but real silver prices are moving upward.

Note that the premium above spot prices (COMEX paper silver prices) is currently larger than normal. I recently checked an on-line site and they quoted about 44% premium (somewhat less now – Oct. 11) for silver eagles in quantities of 100 or more. I remember a similar high premium at the bottom of the silver market in late 2008, while a premium of 10% to 15% is more typical. When real physical silver falls much less or actually increases in price as the COMEX paper price declines, we are (most likely) at or have passed a bottom in silver prices.

From John Rubino:

“At the risk of sounding like a broken record, the negative interest rate/high debt/rapid money growth world envisioned by the Guardian looks like a precious metals paradise.”

I see a green light for substantial silver price increases in the next several years.

Gary Christenson

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2015 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.