11 Days to U.S. Government Shutdown Crisis... What Investors Should Know

Stock-Markets / Financial Markets 2015 Oct 22, 2015 - 06:24 PM GMTBy: Investment_U

Sean Brodrick writes: America is on a collision course with a crippling crisis. One that could start as early as November 3 - just 11 days from now.

Sean Brodrick writes: America is on a collision course with a crippling crisis. One that could start as early as November 3 - just 11 days from now.

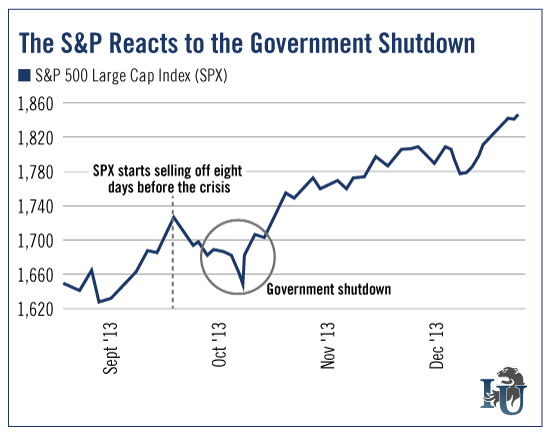

Importantly, the last time this happened, the market started selling off hard eight days before the actual crisis. So I want to make you aware of both the looming risks... and the potential profit opportunities.

The crisis I’m talking about is a government shutdown. We will automatically trigger one if the U.S. hits its debt ceiling and, at the same time, Congress refuses to raise the federal borrowing limit. Once that happens, the Treasury will run out of cash, and non-essential federal services will have to shut down.

Congressmen will still get paid, of course. (For some reason they seem to consider themselves “essential.”)

Treasury Secretary Jack Lew wrote a letter to Congressional leaders, begging them to raise the debt ceiling. He pointed out that, once the existing limit is hit, the remaining cash balance of less than $30 billion would deplete quickly.

Not increasing the debt limit would be "ridiculous," Lew said.

He should be careful what he says to Congress. They might consider his words a challenge.

No Laughing Matter

A debt-ceiling fight in the summer of 2011 resulted in a credit-rating downgrade of the United States by Standard & Poor's. A similar fight in 2013 resulted in the federal government actually shutting down.

In 2013, approximately 800,000 federal employees were furloughed (sent home without pay) while the crisis dragged on. Another 1.3 million “essential” personnel had to come in to work, but weren’t paid until the crisis ended.

And even before that happened, the market panicked, as you can see from this chart.

The market sold off hard as the shutdown loomed. Then, rumors floated that there was a solution. Traders charged in and bought with both hands.

To be sure, there’s no guarantee that history will repeat. But it often rhymes. We may see something similar this time. Will you be one of the unlucky who are shaken out in the plunge? Or will you be one of those who buy the bottom?

That’s assuming there is a solution to the crisis this time. Many observers of Foggy Bottom say Congress has become ungovernable. In the run-up to next year’s presidential election, neither side wants to look weak by compromising.

I think there will be an 11th-hour solution. But it could be a wild ride.

The Crisis Will Spread

If there is a shutdown, the stock market won’t be the only thing affected. Here’s a short list of items that may affect you directly...

- National parks - all 58 of them - and national monuments will be shuttered.

- Loans may be delayed or denied. Banks use government systems to verify Social Security numbers and other personal information for private loans. And loans backed by the federal government are in double trouble.

- Government agencies will shut down. While “essential” personnel report to work, many others stay home. This means many government agencies simply can’t open to the public.

Odds are, this is all the stuff you already knew about. (Perhaps you remember from the last shutdown.) Maybe it doesn’t sound too bad. However, there’s a good reason the market sells off. Several, actually.

See, the market prices in worst-case scenarios, things that happen if the shutdown is not resolved quickly. Scenarios like...

- Economic Drag. If the government isn’t functioning, certain parts of the economy slow to a crawl and even stop. A three-to-four-week shutdown could drop gross domestic product by about 1.2%.

- Potential Recession. Naturally, the longer a shutdown goes on, the more the economy is hurt. Over a long enough timeline, we could see an outright recession.

- U.S. Debt Default. This may seem obvious, but think about it. If the U.S. hits the debt ceiling, debt default looms. Should that happen, we could see “mega-austerity” along the lines of what Greece is experiencing. That could cost America millions of jobs on an annualized basis. And it would also mean higher interest rates as investors dump U.S. Treasurys. Potentially, interest rates wouldn’t come back down to where they were before the crisis, either. Investors may turn to European or Asian debt instead.

- Widespread Poisoning. In the 2013 showdown, a multistate salmonella outbreak spread like wildfire because the Centers for Disease Control and Prevention furloughed much of its staff. Due to the sequester, the CDC was forced to cut $285 million of its fiscal year 2013 budget. And hundreds of people in 18 states suffered as a result.

- A Black Swan Event. Pick one: A natural disaster with no federal disaster relief to deal with it. Maybe Chinese or Russian hackers choose that moment to send our financial system into chaos. Pretty much any nightmare scenario will be made worse by a lack of federal response.

The funny thing is, a government shutdown doesn’t even save money. In the long run, people are paid. There’s just the extra cost of shutting things down and opening them back up again. Overtime must be shelled out so the government agencies can catch up.

In fact, every week of a shutdown adds about $10 billion to the federal debt.

Some Congressional Republicans have asked the Treasury Department to pay its debts selectively to help avoid a shutdown. But the Treasury says no way. For one thing, it means the federal government would pay creditors - including foreign bondholders - ahead of veterans, soldiers, air traffic controllers, law enforcement and more.

Now, if you’re an optimist, you can hang your hat on hopes that the government won’t run out of money on November 3. That’s because some estimates say Uncle Sam’s line of credit would last a little longer. The real shutdown would start sometime between November 10 and 19.

Some reprieve, eh? And where it ends, nobody knows.

Fact is, sooner or later, these budget buzzards are coming home to roost. As for me, I think Washington will tap its resources... its endless supply of self-interest. That should produce a last-minute, skin-of-our-teeth, shut-up-and-sign-it deal.

But, as I said, there could be a big sell-off going into that deal... and a big rally coming out. That offers plenty of opportunities for traders and investors alike.

Traders will probably be playing the sell-off with an inverse fund. One example is the ProShares Short S&P 500 ETF (NYSE: SH). Or, if you have the stomach for speculation, the double-inverse ProShares UltraShort S&P 500 ETF (NYSE: SDS).

And when the bottom comes, both traders and investors will be hunting. Did you miss the bottom in one of your favorite stocks when the S&P 500 bottomed in August... and again in September? Your next buying opportunity may be right around the corner.

Good investing,

Sean

Copyright © 1999 - 2015 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.