Pictures for the Pope Francis and Progressives

Politics / Social Issues Oct 23, 2015 - 09:45 PM GMTBy: Steve_H_Hanke

In September, Pope Francis visited the United States, where he addressed the U.S. Congress. His address, while nuanced, hit on social justice themes. The Pope’s remarks were well received by left-of-center politicians who embrace progressive policies.

In September, Pope Francis visited the United States, where he addressed the U.S. Congress. His address, while nuanced, hit on social justice themes. The Pope’s remarks were well received by left-of-center politicians who embrace progressive policies.

When the Pope left the U.S., he traveled to Latin America, where he spoke in his native Spanish and was more direct. While in Bolivia, Pope Francis had this to say: "Let us not be afraid to say it: we want change, real change, structural change," the Pope said, decrying a system that "has imposed the mentality of profit at any price, with no concern for social exclusion or the destruction of nature."

Pope Francis’ rhetoric inspired the anti-free market forces in Bolivia, and elsewhere. They believe that the goals of social justice and poverty reduction can best be achieved by collective efforts, not by free markets.

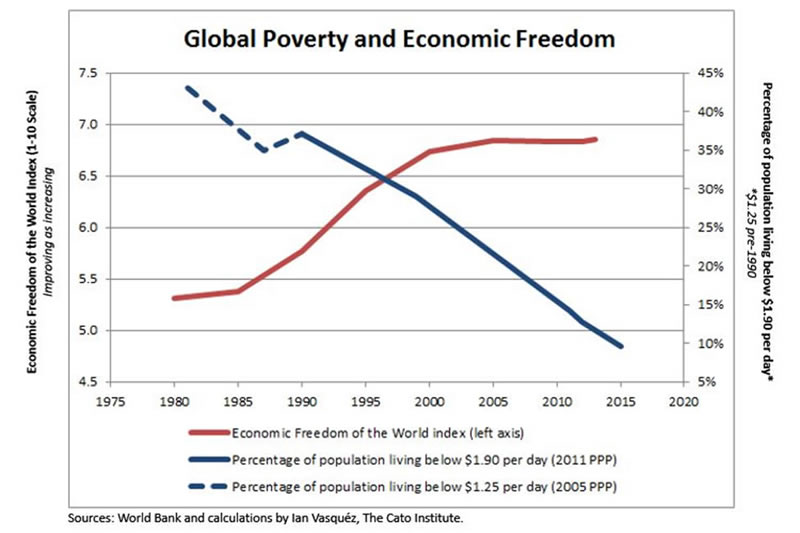

Pope Francis raises an important question. Has the spread of free markets improved people’s lives?

Interestingly, the recipient of the 2015 Nobel Prize in economics, Angus Deaton, answers that question. Indeed, Deaton’s 2013 book, The Great Escape: Health, Wealth, and the Origins of Inequality, opens with: “Life is better now than at almost any time in history.”

Deaton’s conclusion was echoed in an edifying essay, “The Age of Milton Friedman,” penned by Harvard economist Andrei Shleifer in 2009. In that essay, Shleifer observed that, from about 1980, the world had embraced the free markets that Nobelist Friedman had championed. Shleifer also indicated that living standards had risen sharply, poverty had declined dramatically, while life expectancy had increased. Shleifer asked whether the spread of free markets accounted for the improvements, and he answered with a resounding, “Yes.” With a series of charts, Shleifer let the data talk. In what follows, I do the same.

The best elixir to address the concerns of Pope Francis and other progressives is more free markets, not fewer. Just look at the pictures. As the saying goes, they are worth a thousand words.

By Steve H. Hanke

www.cato.org/people/hanke.html

Twitter: @Steve_Hanke

Steve H. Hanke is a Professor of Applied Economics and Co-Director of the Institute for Applied Economics, Global Health, and the Study of Business Enterprise at The Johns Hopkins University in Baltimore. Prof. Hanke is also a Senior Fellow at the Cato Institute in Washington, D.C.; a Distinguished Professor at the Universitas Pelita Harapan in Jakarta, Indonesia; a Senior Advisor at the Renmin University of China’s International Monetary Research Institute in Beijing; a Special Counselor to the Center for Financial Stability in New York; a member of the National Bank of Kuwait’s International Advisory Board (chaired by Sir John Major); a member of the Financial Advisory Council of the United Arab Emirates; and a contributing editor at Globe Asia Magazine.

Copyright © 2015 Steve H. Hanke - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Steve H. Hanke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.