Stock Market’s Technical Strength Grows

Stock-Markets / Stock Markets 2015 Oct 26, 2015 - 05:55 PM GMT The Continued Hollowing Out Of European Industry.

The Continued Hollowing Out Of European Industry.

“The power of producing wealth is infinitely more important than wealth itself; it insures not only the possession and the increase of what has been gained, but also the replacement of what has been lost.” Freidrich List "The National System of Political Economy"

I always believed the above quote by Freidrich List and I could never understand the modern politician’s obsession with “free trade”.

When Ireland joined the European Union in the early 1970’s it was forced to drop major import tariffs. Accordingly, over a generation practically 80% of “native” industrial production ceased, laid waste by cheap European imports. I always remember Frank Kenny a 65 year old Dublin gentleman tearfully tell me in 1995 that he was forced to close his 3 generation old suit tailoring factory due to inferior imports from Italian producers. He felt ashamed that this “failure” occurred on his watch. When he visited one of these Italian factories in Milan he discovered that European trade law allowed these Italian producers export anywhere throughout the EU, including Ireland, provided a certain percentage of the product was produced in Europe. My friend enquired how much of the garments produced in Milan were Italian: “the label alone” he was cynically informed. It turned out “the balance” was produced in a sweat shop in the Far East, branded with a pure silk label and marketed as the finest in European tailoring.

The bush fire that is “free- trade” continues its destructive force in Ireland and Europe as we speak. Only last month, to much public consternation, one of the last remaining steel manufactures in the UK was forced to close. This was mainly due to China dumping cheap steel onto the European market as a result of a collapse in its “home” market. The Guardian newspaper had this to say on the 28th. September 2015:

“Britain’s Redcar steel plant to close with 1,700 job losses.

One of the UK’s biggest steelmaking plants, at Redcar on Teesside, is to stop production after nearly 100 years, with the loss of 1,700 jobs.

The plant’s owner’s said that after reviewing the business it had no choice but to mothball the operations. Management had put production on hold ten days ago ahead of a final decision on its future. Coke ovens and a power station at the site would continue to function, it said.

Falling steel prices for its decision to close the blast furnace, the second-biggest in Europe. The company said it would talk to the government about reopening in the future but this was unlikely in the short term. The steel industry and trade unions called on the government to intervene.

Cornelius Louwrens, the steel plant’s UK chief operating officer, said: “I think this is devastating. There’s no words you can use which would be overstating it.”

He added: “This is an extremely sad day for all of us at Redcar, and in particular our employees and their families. Together with our parent company and the various other stakeholders, they have worked so hard in their endeavours to try and make this business successful. Market conditions this year have been extremely challenging and unfortunately this has led to the decision we are announcing today.”

The plant, on the banks of the river Tees on the outskirts of Middlesbrough, is 98 years old and its steel has been used to build the Sydney harbour bridge and New York’s One World Trade Center. Campaigners in Redcar, where unemployment is high, had warned that a shutdown would mean many thousands more jobs will be lost from nearby businesses.

Steelmakers last week urged the government to rescue the industry by cutting green taxes and banning cheap imports that have pushed prices to levels that made UK plants unviable. The industry said the government now needed to do more to support the sector, including stopping the dumping of cheap steel from China and cutting business rates”.

Why enlightened European leaders allow Chine get away with such practices amazes me? The only way I can see wide-spread manufacturing returning to Ireland, England and Europe is through the re-introduction of protective tariffs. The insights of Freidrich List need to be more widely taught and understood among students of economics and the destructive pro-China policy, which is destroying Western capitalism, must be altered before it is too late.

Market’s Technical Strength Grows.

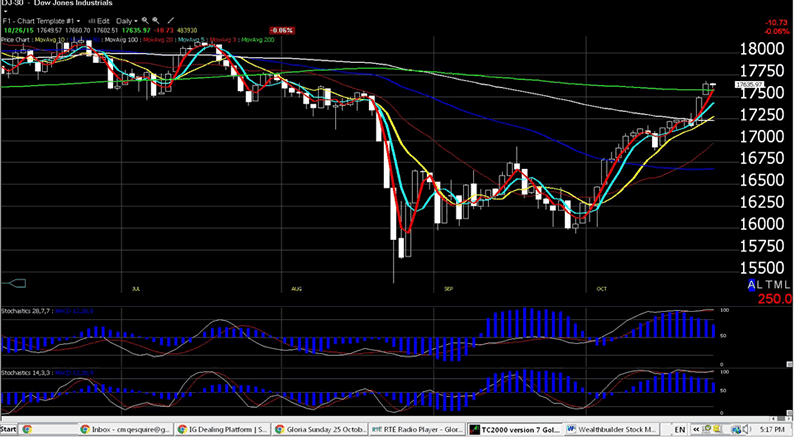

The rebuilding of the technical strength of the market since its collapse in August 20th has been astonishing. I did not expect this development but as always one must leave personal sentiment aside and listen to the truth of price action.

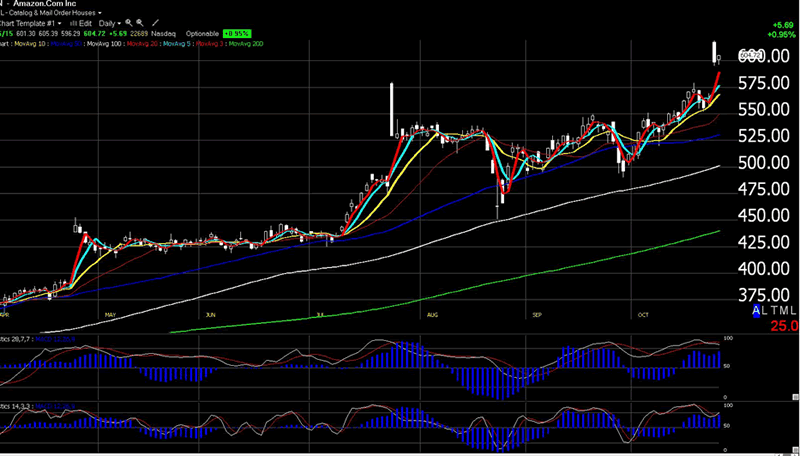

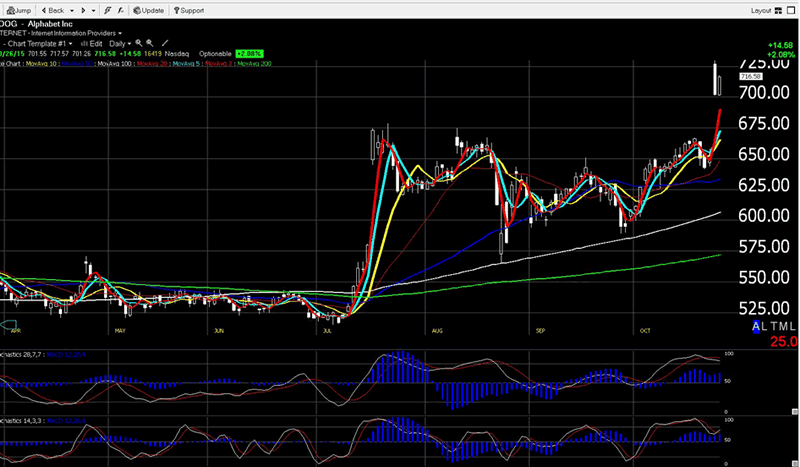

Currently the market is oversold and a correction is on the cards. However, given the recent strength of such companies as Amazon, Google (now Alphabet) and Microsoft it is well within the bounds of probability that new highs will be reached on the Dow by year end, thus reversing the Dow Theory sell signal received in January and confirmed during the summer.

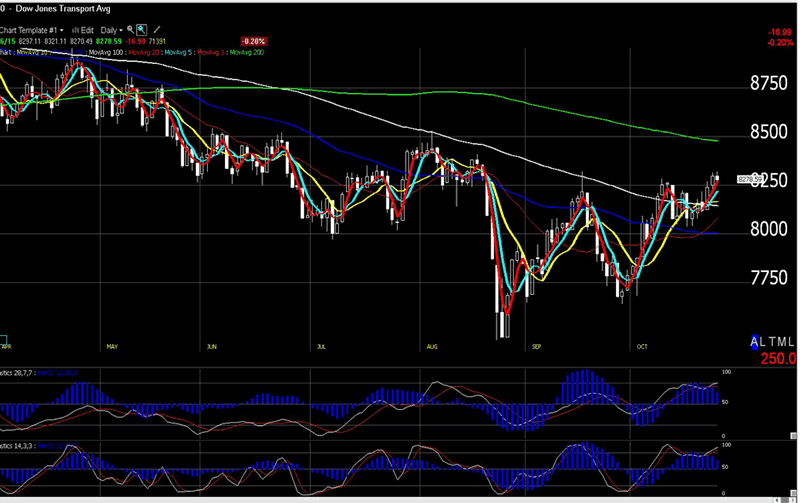

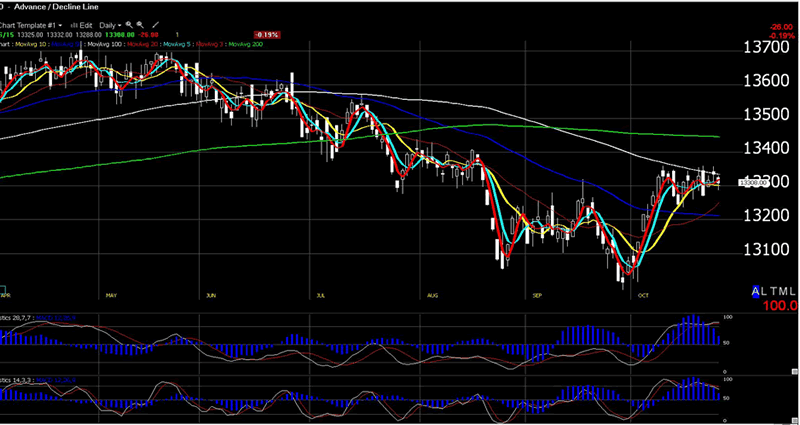

Clearly the market is now beginning to accept that the FED will not raise interest rates until well into 2016. The only “fly in the ointment” is the fact that the NYSE A/D line is still bearish but this situation could change if technology continues to report strong growth, mitigating the effect of the strong dollar on international earnings.

Chart: Dow Industrials: 26th. October 2015: Daily.

Chart: Dow Transports 26th. October 2015: Daily.

Chart: NYSE A/D Line 26th. October 2015: Daily.

Chart: Amazon.Com Inc. 26th. October 2015: Daily.

Chart: Goog (Alphabet Inc.) 26th. October 2015: Daily.

Chart: Microsoft Corp. 26th. October 2015: Daily.

Reference:

Freidrich List: "The National System of Political Economy"

Charts courtesy of Worden Bros.

By Christopher M. Quigley

B.Sc., M.M.I.I. Grad., M.A.

http://www.wealthbuilder.ie

Mr. Quigley was born in 1958 in Dublin, Ireland. He holds a Bachelor Degree in Accounting and Management from Trinity College Dublin and is a graduate of the Marketing Institute of Ireland. He commenced investing in the stock market in 1989 in Belmont, California where he lived for 6 years. He has developed the Wealthbuilder investment and trading course over the last two decades as a result of research, study and experience. This system marries fundamental analysis with technical analysis and focuses on momentum, value and pension strategies.

Since 2007 Mr. Quigley has written over 80 articles which have been published on popular web sites based in California, New York, London and Dublin.

Mr. Quigley is now lives in Dublin, Ireland and Tampa Bay, Florida.

© 2015 Copyright Christopher M. Quigley - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Christopher M. Quigley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.