“Ignore The Noise” & Focus On The Fact That Central Banks “Remain Extremely Accommodative

Stock-Markets / Financial Markets 2015 Oct 28, 2015 - 04:43 PM GMTBy: GoldCore

The primary focus this week is again on the “all powerful” Fed. If the Fed leans toward a rate hike in December, gold could come under pressure again in the short term. However, if it leans toward raising rates next year, then gold would be expected to eke out further gains.

The primary focus this week is again on the “all powerful” Fed. If the Fed leans toward a rate hike in December, gold could come under pressure again in the short term. However, if it leans toward raising rates next year, then gold would be expected to eke out further gains.

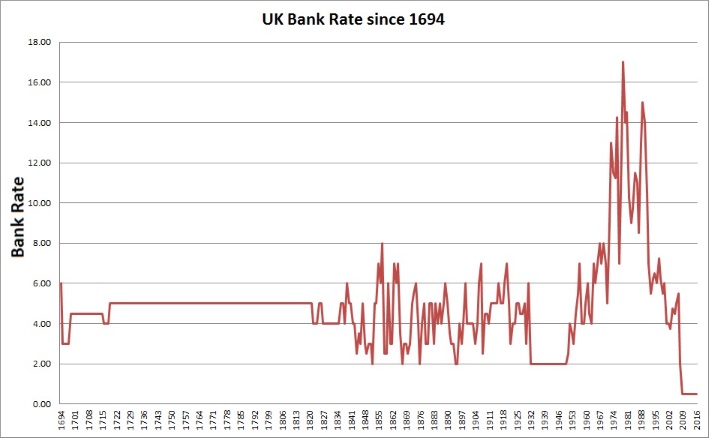

Bank of England – Interest Rates – 1694 to Today

Most physical buyers will ignore the noise and focus on the fact that the Fed’s monetary policies, along with the Bank of England, the ECB and most central banks in the world, remains extremely accommodative.

The perception and narrative is that a rise in rates, even by a very marginal 25 basis points will be negative for gold. This may be true in the short term as perception, even misguided perception, can drive markets in the short term.

However, rising interest rates per se are not negative for gold. What is negative is positive real interest rates and yields above the rate of inflation. This is unlikely to be seen any time soon.

Gold will also be vulnerable towards the end of an interest rate tightening cycle as was the case in January 1980. Today, central banks including the Fed are having difficulty raising interest rates in even a small nominal way.

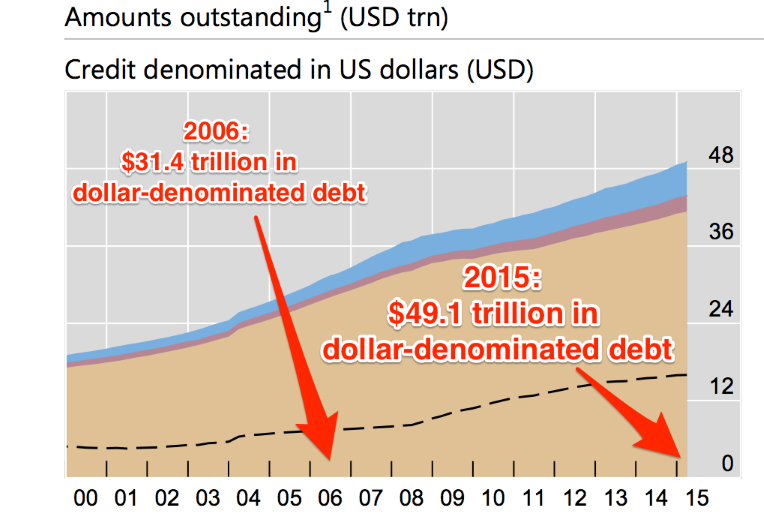

Given the massive global debt bubble of today, it will likely be impossible for central banks to increase interest rates in any meaningful way. We are not going to see an interest rate tightening cycle akin to that which snuffed out gold’s bull market in the 1970s.

Unless, central banks lose control of the bond markets and a new breed of bond market vigilante enforces monetary discipline and pushes bond yields higher in the coming years.

Gold should be supported by data which suggests that economic growth braked sharply in the third quarter in the U.S. and that global demand for physical bullion remains very robust – particularly in India, China and Germany.

A gauge of U.S. business investment plans fell for a second straight month in September. Core capital goods orders fell 0.3 percent in September, August core capital goods were revised sharply down and durable goods orders dropped 1.2 percent.

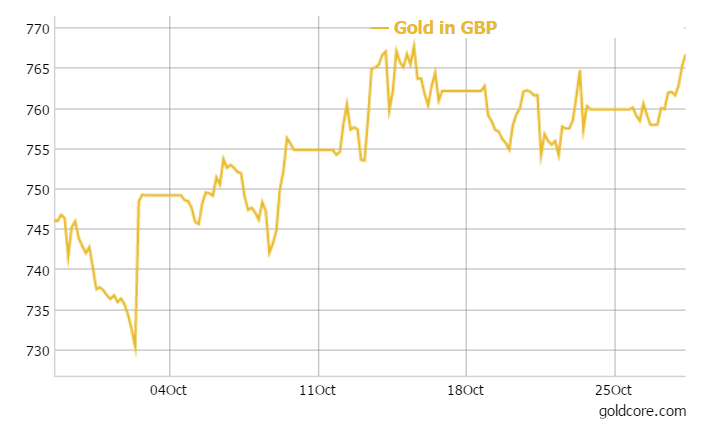

DAILY PRICES

Today’s Gold Prices: USD 1171.50, EUR 1058.98 and GBP 765.94 per ounce.

Yesterday’s Gold Prices: USD 1165.74, EUR 1054.55 and GBP 759.52 per ounce.

(LBMA AM)

Gold in GBP – 1 Month

Gold closed at $1166.40 yesterday, a gain of $2.70 for the day. Silver was also up slightly yesterday, by $0.02 closing at $15.88. Platinum lost $9 to $984.

Gold has retained small overnight gains today ahead of a Federal Reserve policy statement later in the session as investors wait for more clues on the timing of a potential U.S. rate hike.

Download 7 Key Storage Must Haves

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.