Gold Selling “Malevolent Force”? – Dennis Gartman

Commodities / Gold and Silver 2015 Nov 02, 2015 - 01:51 PM GMTBy: GoldCore

Dennis Gartman, author of the institutionally well followed ‘The Gartman Letter,’ has asked questions about gold’s peculiar price action last week and raised the question as to whether there was official central bank manipulation of gold prices.

Dennis Gartman, author of the institutionally well followed ‘The Gartman Letter,’ has asked questions about gold’s peculiar price action last week and raised the question as to whether there was official central bank manipulation of gold prices.

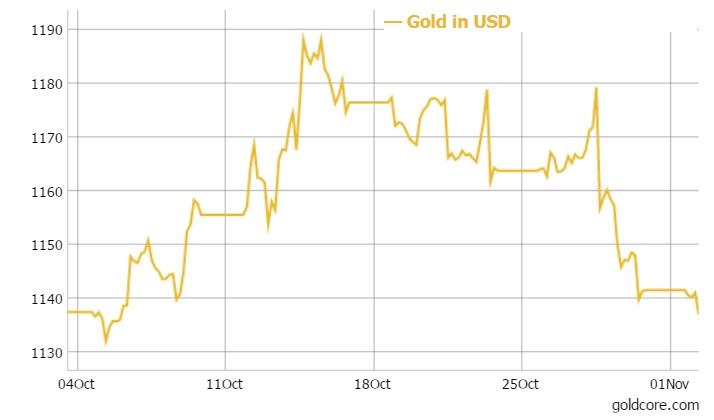

Gold was 2.4% higher in October but fell 2% last week as the Fed again suggested they may soon increase interest rates. Gartman’s assertion is significant as he is no so-called ‘goldbug’. In fact, he is the darling of Wall Street, Bloomberg, CNBC and is highly respected and followed by large hedge funds and financial institutions.

Gold in USD – 1 Month

He has been bearish on gold in recent months but the recent turmoil in currency markets has Gartman bullish on gold also in dollar terms since August.

“I think for the first time in a while, you can actually say the lows may have been in dollar-dominated gold,” Dennis Gartman told CNBC’s “Fast Money.”

Gartman is on record regarding his belief that gold is in a long term bull market in all currencies.

Here is the key extract regarding potential gold manipulation from the Gartman Letter on Friday:

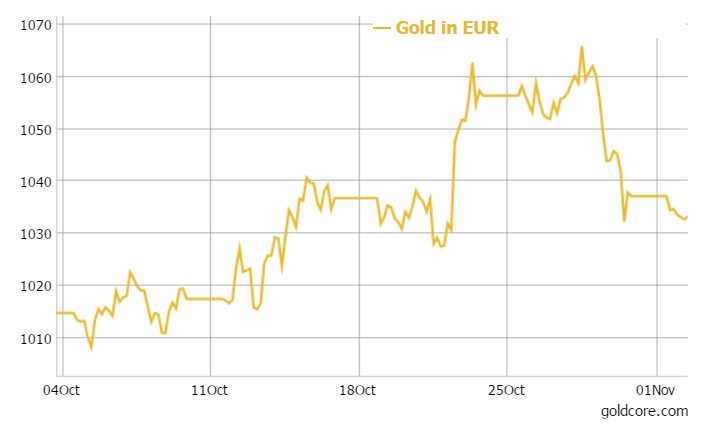

“As for the precious metals, the selling late Wednesday and all day yesterday was indeed severe, and even our positions in gold/euro and gold/yen have seen severe damage wrought upon them.

We find it hard to believe that the mere suggestion by the Federal Open Market Committee in its post-meeting communique on Friday that “liftoff” on the overnight Fed funds rate may take place at its December meeting can be responsible for this sort of egregious, serious, and now relentless selling, and we are almost of the mindset associated with the likes of the gold bugs and GATA that some malevolent “force” was behind the selling.

However, we are not going to travel down that road at the moment and sit tight with our positions, believing that the continued “experiments” with QE undertaken by the Bank of Japan and the European Central Bank shall work to the detriment of their currencies and to the support of gold. Nonetheless, the last 36 hours have been terribly dismaying …”

GoldCore Note: As ever, we view such manipulation as an opportunity for investors as it allows them to accumulate gold at artificially depressed prices.

The history of manipulation of the gold market is of short term success followed by ultimate failure and then much higher prices as was seen after the failure of the “London Gold Pool” in the late 1960s and gold’s massive bull market in the 1970s.

The golden beach ball has been pushed near the bottom of the ‘gold pool.’ The lower it is pushed in the short term, the higher it will surge in the long term.

DAILY PRICES

Today’s Gold Prices: USD 1135.80 , EURO 1030.86 and GBP 733.86 per ounce

Friday’s Gold Prices: USD 1147.75, EUR 1042.70 and GBP 748.04 per ounce.

(LBMA AM)

Gold closed at $1141.50 on Friday a loss of $4.30 and -1.98% overall for the week. Silver lost $0.08 to close at $15.52, showing a -2.14% loss for the week. Platinum lost $6 to $982.

Gold fell 2% last week as the Fed again suggested they may soon increase interest rates. However, it was 2.4% higher in October due to strong demand for physical gold bullion globally and especially in Germany, India and China.

We are now entering gold’s seasonal sweet spot from early November to the end of February as we enter the Indian festival and Chinese New Year periods.

Download Essential Guide To Storing Gold Offshore

Download 7 Key Storage Must Haves

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.