It’s Now, or Never for Yellen, Impact on Gold and Stocks

Stock-Markets / Financial Markets 2015 Nov 09, 2015 - 12:13 PM GMTBy: Bob_Kirtley

It has been seven years in the making, but now the Federal Reserve may be finally ready to lift interest rates from zero. There has been a myriad of reasons to not hike, multiple false starts and huge ongoing debates on what the right course of US monetary policy is, but from the Fed’s point of view the time is at last right to increase rates.

It has been seven years in the making, but now the Federal Reserve may be finally ready to lift interest rates from zero. There has been a myriad of reasons to not hike, multiple false starts and huge ongoing debates on what the right course of US monetary policy is, but from the Fed’s point of view the time is at last right to increase rates.

Yellen had said just this week that the Fed meeting in December would be live if the data supports a move, that the Fed is monitoring the data, and that the Fed thought it could be appropriate to move in December. Then, a +271k NFP print is released to all but seal the deal.

Considering Market Pricing

Heading into the payrolls report, markets were pricing in a 58 percent chance of a hike next month, and that surged to 70% following the payroll report release.

As we have discussed previously, the Fed will be targeting maximum stability around any rate decision in December. This means that the Fed does not want to surprise the market with either a hike or a delay of such. Due to this, the higher the chance of a December hike that the market prices in, the higher the chance is of that becoming a reality. The converse is also true, which means that if the market prices in a lower probability of a hike, then the Fed is more likely to delay.

Between now and the FOMC meeting next month there multiple speeches by members of the Fed. This month this includes Vice Chair Fischer on the 13th and Bullard on the 21st, as well as Yellen herself on December 2nd and 3rd. We expect the Fed’s bias to hike to be re-enforced in these speeches. This will gradually get the market more and more comfortable with a hike in December.

If instead the Fed intends to not hike, then this should be swiftly reflected in these speeches as the Fed will certainly not want to deliver a no hike when pricing indicates that one has a 70% chance of happening.

We expect the market to gradually move towards having a 90%, or higher, probability of a December hike priced in over the next month or so. This will keep the downwards pressure on gold prices. Gold is currently close to its lows for the year, with the support at $1080 unlikely to last for a substantial period of time. Therefore the yellow metal is likely to test the major support level $1030 before the year’s end.

Impact on Gold and Equities

Despite the metal being slightly oversold technically, rallies should be faded here. Gold is already in a major downtrend, which means that any remaining longs are likely significantly underwater on their positions. This means that the reality of the beginning of a new tightening cycle will very likely be too much to stomach, and will cause a significant amount of selling.

The picture for equities is less clear. Whilst stocks have gotten over the initial fear that the end of the era of extremely accommodative monetary policy will cause a collapse, it is unlikely that a hike by the Fed will spark another major rally in stocks. This is especially likely given the performance of stocks in October, the best month since 2009.

Of course, stock market bulls will argue that the start of a new tightening cycle is a vote of confidence in the economy. However, the reality is that a strong economy is not necessarily bullish for stock prices. To see this one need only look at the shaky economy of the last 6 years has and the massive returns in equities over the same period.

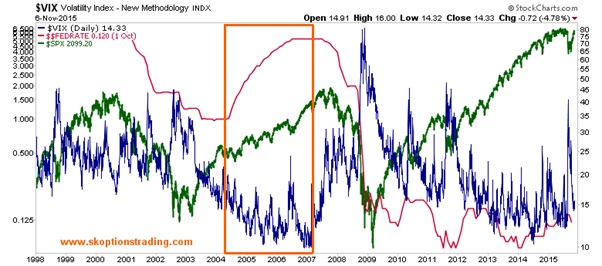

Looking back to last hiking cycle can give us some clues on how stocks could react, but these will be limited. Since the GFC we have seen unprecedented action from central banks across the world. Between record low interest rates and QE on a massive scale, we are in completely uncharted territory.

Stocks will likely go through period of range trading as they digest the Fed tightening and consider how much more there is to come. Adding this together a weak picture for gold does not bode well for the gold miners.

What This Means for the Miners

We wrote last week that “Holders of gold mining stocks are unfortunately in for yet more of the same under this scenario… We are concerned that a pullback in stocks, combined will a fall in gold prices in a December hike situation would see gold stocks fall to yet another low, even though the HUI index is already down 25% in 2015.”

It is very hard to paint a bullish picture for gold stocks from here. We will be targeting rallies to initiate short trades, perhaps in conjunction with trades on the S&P 500 as a complement to our short position on gold. We are currently neutral on equities, having been aggressively selling downside protection earlier this year and adding short VIX positions in the last couple of months. To reflect the change in our view we have now entered options trades that speculate against the S&P 500 breaking to new highs this year.

If you wish to find out what trades we make next as soon as we make them and receive our in-depth analysis each of the markets we trade, including gold, then sign up at www.skoptionstrading.com.

Go gently.

Bob Kirtley

Email:bob@gold-prices.biz

URL: www.silver-prices.net

URL: www.skoptionstrading.com

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. Winners of the GoldDrivers Stock Picking Competition 200

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.