Silver Price Forecast Plunge to as Low as $10

Commodities / Gold and Silver 2015 Nov 09, 2015 - 02:07 PM GMTBy: Clive_Maund

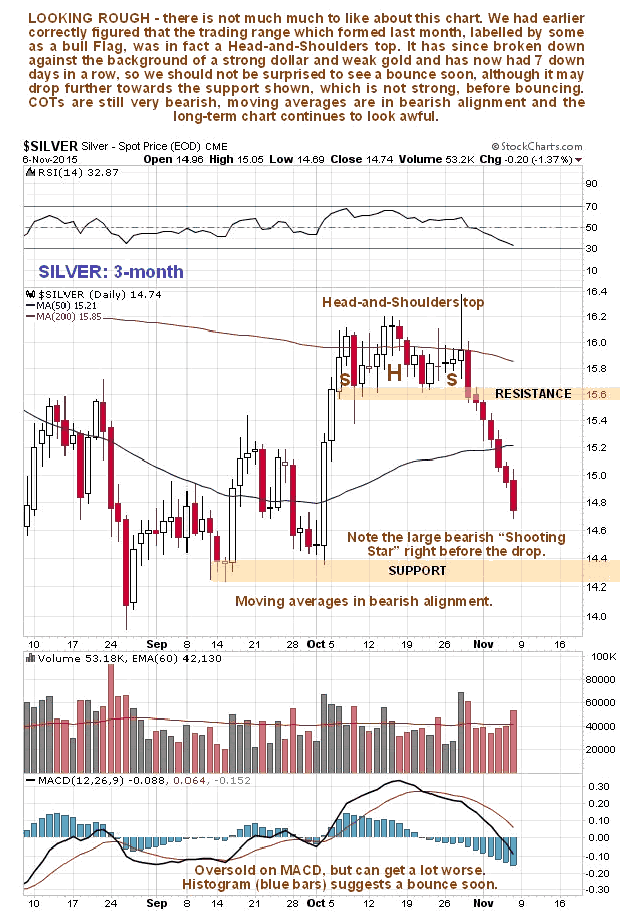

The last update posted on 18th October called a top in silver, and that is what it turned out to be. On its 3-month chart we can see that silver broke down from a small Head-and-Shoulders top at the end of October and then went into a steady day after day decline with the result that it has dropped now for 7 trading days in a row. While it could drop further towards or to the support shown, it is getting short-term oversold and is increasingly likely to bounce soon. As with gold this weakness was triggered by dollar strength, with the dollar rising sharply on Friday in response to a stronger than expected jobs report which the market thinks makes an interest rate rise more likely.

The last update posted on 18th October called a top in silver, and that is what it turned out to be. On its 3-month chart we can see that silver broke down from a small Head-and-Shoulders top at the end of October and then went into a steady day after day decline with the result that it has dropped now for 7 trading days in a row. While it could drop further towards or to the support shown, it is getting short-term oversold and is increasingly likely to bounce soon. As with gold this weakness was triggered by dollar strength, with the dollar rising sharply on Friday in response to a stronger than expected jobs report which the market thinks makes an interest rate rise more likely.

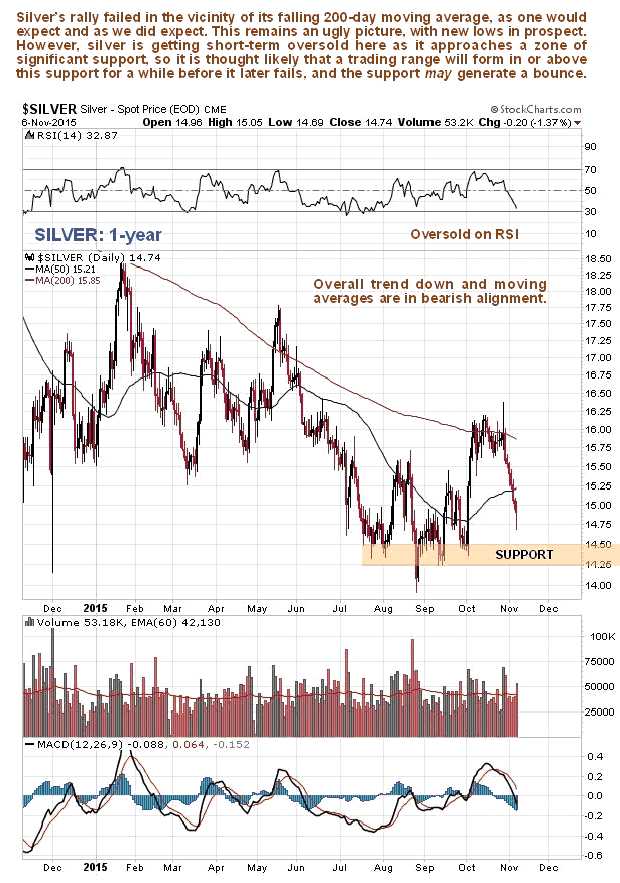

The 1-year chart provides more perspective and on it we can see that the support in the $14.25 - $14.50 zone is quite substantial, so that even if silver is destined to go on to break below this support, it is likely that it will at least pause and mark out a trading range in this zone, and possibly bounce. As we can see from moving average alignment the overall ttend remains down.

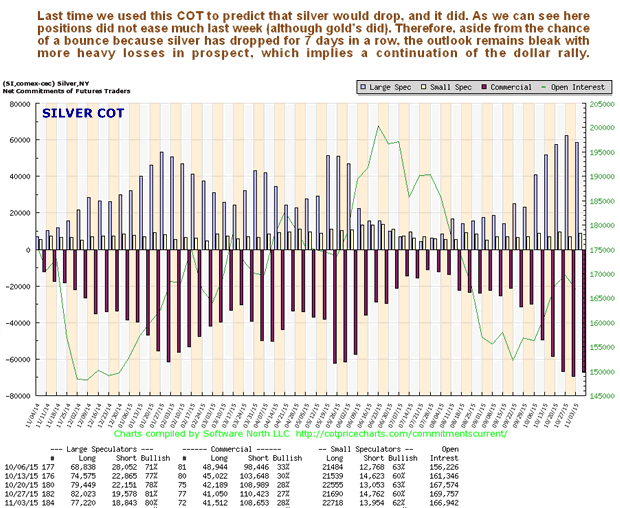

Although Commercial short positions in silver eased somewhat by last Tuesday, as we can see on the latest COT chart, and will probably have continued to improve late last week, this latest COT chart still looks awful and implies that, short-term bounce or not, silver is set to drop much more, which implies that the dollar rally will continue.

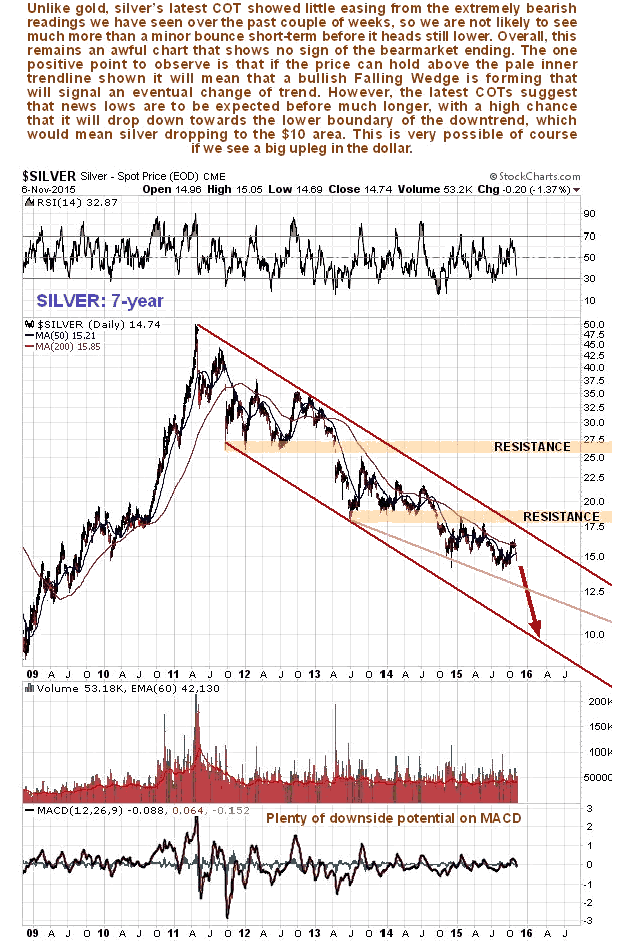

How far could this nascent downleg take silver? On its 7-year chart it looks probable that silver will drop to the lower boundary of its major downtrend, in which case we are looking at it dropping to the $10 area. Bulls had better hope that it stays above the inner pale trendline shown, which would hold out the chance that the downtrend is morphing into a bullish Falling Wedge, but the still awful COTs suggest that this is a forlorn hope and that much lower prices lie ahead.

The dollar strength which is the root cause of the weakness in gold and silver, and other commodities, is discussed in the parallel Gold Market update , where we see that the dollar may be starting a big uptrend that takes it as high as the 120 area on the index, as a result of continuing extreme weakness in the suro.

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2015 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.