The U.S. Shadow Interest Rate Casts Gloom

Interest-Rates / US Interest Rates Nov 13, 2015 - 06:01 PM GMTBy: Peter_Schiff

Nearly 92% of economists surveyed this week by the Wall Street Journal expect that our eight-year experiment with unprecedented monetary easing from the Federal Reserve will come to an end at the next Fed meeting in December. Since we have had the monetary wind at our back for so many years, at least a few have begun to question our ability to make economic and financial gains against actual headwinds. But in reality, the tightening cycle that the forecasters are waiting for actually started last year. Sadly, the markets and the economy are already showing an inability to handle it.

Nearly 92% of economists surveyed this week by the Wall Street Journal expect that our eight-year experiment with unprecedented monetary easing from the Federal Reserve will come to an end at the next Fed meeting in December. Since we have had the monetary wind at our back for so many years, at least a few have begun to question our ability to make economic and financial gains against actual headwinds. But in reality, the tightening cycle that the forecasters are waiting for actually started last year. Sadly, the markets and the economy are already showing an inability to handle it.

While it's true that we have yet to achieve "lift-off" from zero percent interest rates, rates have not been the only means by which the Fed has provided stimulus. We also have to account for the effects of Quantitative Easing (QE) and forward guidance of the Fed. Changes in those inputs over the past year have already created conditions of monetary tightening.

QE has been the process by which the central bank expands its balance sheet (otherwise known as printing money) to buy government and asset-backed bonds on the longer end of the duration spectrum. In so doing, it is able to help hold down long-term interest rates, a result that it would be difficult to achieve by changes in the federal funds rate. Zero percent interest rates represent a loose monetary policy, but once at the zero lower bound, QE is the way the bank eases even further.

Another big input is Fed "forward guidance." This comes in the form of official and unofficial pronouncements from top Fed policy makers as to the possible trajectory of rates in the future. If the Fed communicates that rates will stay low, or QE will remain in place, for some time, then policy becomes looser still. Such assurances effectively remove near term interest rate risk, which stimulates financial activity. Ever since the Financial Crisis of 2008, the Fed has engaged in unprecedented forward guidance, without which monetary conditions could have been expected to be tighter.

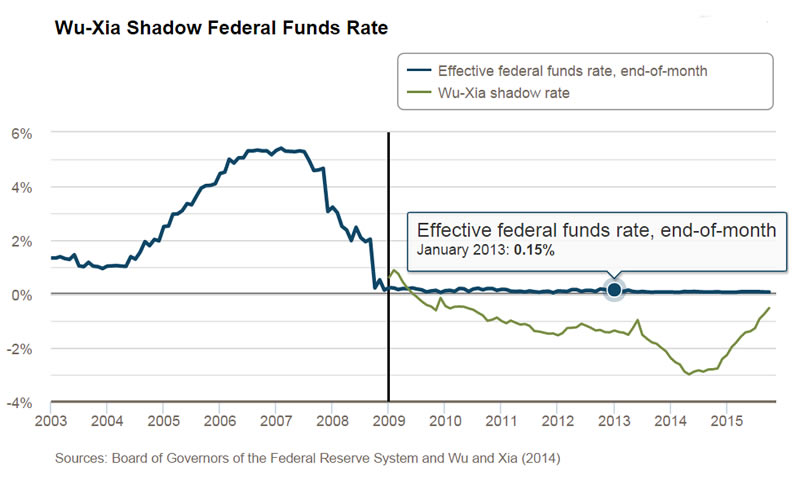

To account for these important factors, University of Chicago professors Cynthia Wu and Fan Dora Xia, constructed a model for the "Shadow Rate." While the fed funds rate has remained between 0.0% and 0.25% ever since November of 2008 (Federal Reserve Board), the Shadow Rate moved much lower, factoring in the effects of QE and forward guidance. That rate got as low as -2.99% in May of 2014. (Federal Reserve Bank of Atlanta, CQER, Shadow Rate)

But the Fed's QE tapering campaign, which gradually reduced the amount of securities purchased monthly by the Fed, effectively began a campaign of monetary tightening that helped push up the Shadow Rate sharply even as the fed funds rate itself did not budge. After QE was officially wound down in October 2014, the Fed began to change its forward guidance to actively suggest that a long-term campaign to lift interest rates would begin in 2015. This also worked to help tighten monetary conditions. As a result, the Shadow Rate moved up from -2.99% in May of 2014 to just -.74% in September of 2015, (FRB Atlanta, CQER, Shadow Rate) an increase of 225 basis points in just over a year.

This is a fairly robust tightening trajectory that can be said to have clearly taken a toll. Since January of this year, the major market index, the S&P 500, has essentially been flat. While in contrast, it had been up by double-digits in five of the last six calendar years. Similarly, GDP growth has slowed considerably in the months since the QE program was finally tapered down to zero in October of 2014.

U.S. stock investors may be complacent regarding the ability of the stock market to withstand higher interest rates. Their confidence may come from the fact that, historically, markets have not peaked until 12-24 months after the Fed begins to tighten. This assumes the tightening cycle begins with the first official rate hike. But if it really began with the increase in the Shadow Rate, then a December rate hike will already be 19 months into the tightening cycle! Plus, given how overvalued stocks may currently be, and the amount of corporate debt accumulated to finance share buybacks, this bull market may be far more vulnerable than most to higher interest rates.

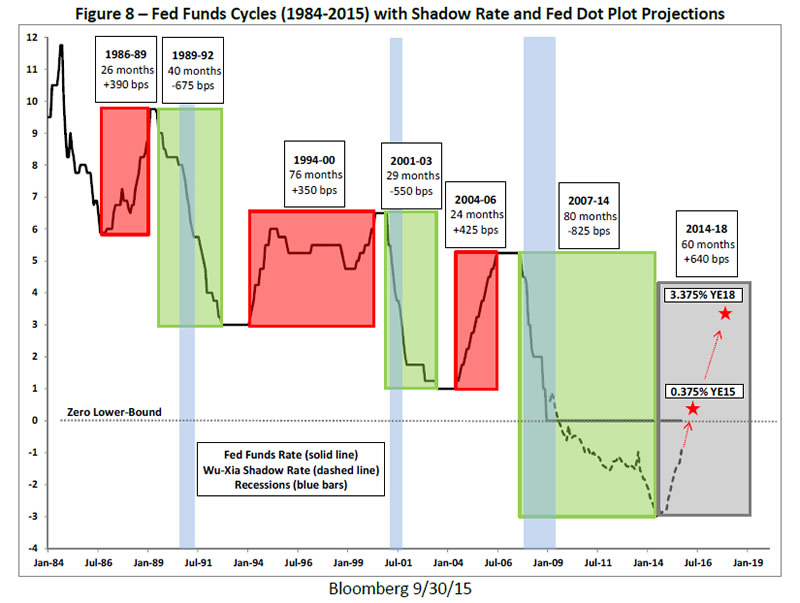

The last three times that the Fed had conducted a rate tightening cycle (1986-1989, 1994-2000 and 2004-2006), the increases in rates averaged 388 basis points. But those moves upward occurred when QE did not exist and when forward guidance was hardly a factor (the Fed only started doing press conferences in the last few years). So the tightening that has occurred to the Shadow Rate in the last year is already 58% of the size of the average of the last three tightening cycles.

Created by Euro Pacific Capital with Data from Bloomberg

If the Fed does as it has suggested it will, and takes fed funds up to 2.6% by the end of 2017 (which is the Fed's own median forecast), then the total effective move (that includes the tightening of the Shadow Rate) would be a tightening of 559 basis points, well larger than the average of the last three tightening cycles. Does anyone really believe that our fragile and slowing economy can deal with that kind of headwind?

Generally, the Fed tends to wait until the economy is on solid footing before tightening. For instance, in the 12 months prior to the 390 basis point tightening that occurred between 1986-1989, real GDP was 3.2%. GDP was 2.65% in 1993, the year before a six-year tightening cycle raised rates by 350 basis points. GDP was a solid 4.3% in 2003, the year before Alan Greenspan began raising rates in 2004, a move that took up fed funds by 425 basis points. But current GDP, which is somewhere around 2.0% over the past four quarters, is not nearly as robust. (Bureau of Economic Analysis)

But what's more concerning is the magnitude of the easing cycle that has gotten us to this point. It began in 2007, lasted a full 80 months, and took the effective fed funds rate (accounting for the Shadow Rate) down by 825 basis points. In contrast, the prior two easing cycles averaged 612 basis points and 34.5 months. This huge dose of stimulus is certain to have caused distortions in the economy that won't be seen until we get more normalized levels of monetary policy. As Warren Buffet has most famously quipped, "We have to wait till the tide goes out before we see who has been swimming without bathing suits."

Since the Second World War, recessions have begun, on average, every seven years. Since the current recovery is already seven years old, how much longer should we expect this historically anemic recovery to last? If the slowdown occurs next year, can we really expect the Fed to remain on the sidelines and risk the possibility that the economy goes into a recession leading into a presidential election? Both the chairperson and vice chairman of the Fed are solidly associated with the left side of the political spectrum. Should we expect that they would be hesitant to support the markets and the economy and thereby create conditions that might help Republicans take the White House?

Nevertheless, most people assume that rates are on the way up to 2% or more. But from my perspective it's much more likely that the rates never get close to that level. I would argue that any positive rate of interest would be enough to stop this economy cold. Years of negative rates have so corrupted our economy that I believe it is now fully addicted and cannot survive under any other condition.

Since this historically weak recovery is already decelerating, one might expect the removal of stimulus could cause the next recession to start quicker and be far deeper than any experienced in the past. Since the Fed may recognize this, the next easing cycle could likely start much sooner, and the accompanying monetary stimulus be much larger than just about anyone believes.

Each of the last three easing cycles took rates lower than where they were at the end of the prior easing cycle. Given that the fed funds rate is at zero (and the Shadow Rate got to as low as -2.99%), one shudders to think how low the Fed is prepared to go the next time around. As a result, investors may want to consider re-positioning their assets for another period of possible monetary easing not a period of tightening, which I believe, in fact, is already well underway and will soon be a thing of the past. December is far less significant than what almost everyone has been led to believe.

Best Selling author Peter Schiff is the CEO and Chief Global Strategist of Euro Pacific Capital. His podcasts are available on The Peter Schiff Channel on Youtube

Catch Peter's latest thoughts on the U.S. and International markets in the Euro Pacific Capital Summer 2015 Global Investor Newsletter!

Read the original article at Euro Pacific Capital

Regards,

Peter Schiff

Euro Pacific Capital

http://www.europac.net/

Peter Schiff Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.