US$ Breakout Could Unleash Capitulation in Gold and Silver

Commodities / Gold and Silver 2015 Nov 14, 2015 - 09:16 AM GMTBy: Jordan_Roy_Byrne

Last Friday we wrote that precious metals were very oversold and due for a bounce or a pause. We also argued that the overall prognosis remained very bearish. The technicals argue for more downside and sentiment indicators remain far from bearish extremes. The strength in the US$ index is another reason precious metals should remain under pressure. If the US$ index makes a strong break above 100 it could trigger a final wave of liquidation in Gold and Silver.

Last Friday we wrote that precious metals were very oversold and due for a bounce or a pause. We also argued that the overall prognosis remained very bearish. The technicals argue for more downside and sentiment indicators remain far from bearish extremes. The strength in the US$ index is another reason precious metals should remain under pressure. If the US$ index makes a strong break above 100 it could trigger a final wave of liquidation in Gold and Silver.

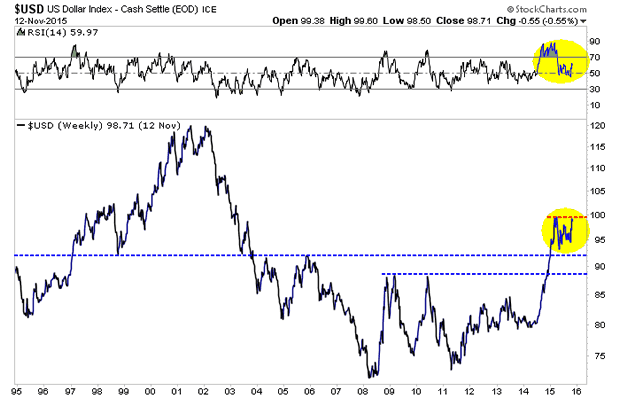

The US$ index has spent much of this year consolidating and digesting its huge advance from summer 2014 into 2015. After surging nearly 25% within eight months, the greenback has managed to hold above previous resistance (2004-2005 highs and 2008-2010 highs) and the 38% retracement of the advance (at 92). Today it is trading less than 1.2% from a new high. These are signs of strength and typically precede a breakout to the upside rather than a move lower.

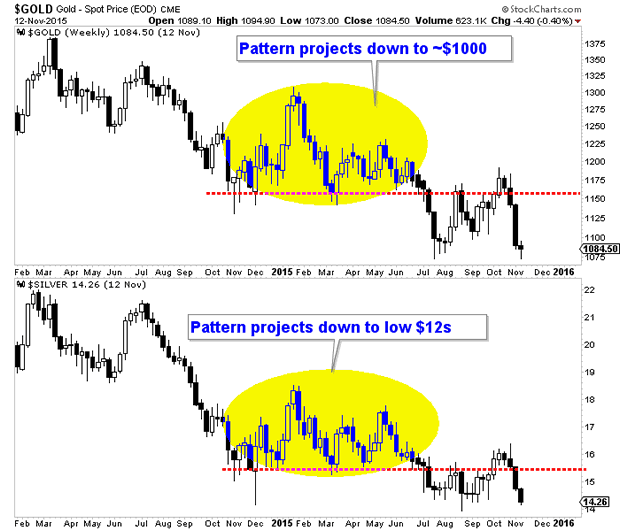

As one would expect, the very bullish outlook for the US$ stands in contrast to the outlook for precious metals. Below we plot the weekly candle charts of Gold and Silver. The swift decline over the past few weeks confirms that the recent rebound was essentially a retest of the summer breakdown to new lows. When a market breaks a key level it will often retest that break in a counter trend move. The break is confirmed when the market reasserts itself in the direction of the break. That is precisely what has occurred in Gold and Silver over the past few weeks. We should also note that the eight month consolidations project to much lower targets than current levels.

A big breakout in the US$ index above 100 would likely coincide with precious metals moving to new lows. Last week we published Gold's monthly chart which has strong support targets at $970/oz and $890/oz. Gold is trading at $1082/oz as we pen this. Many Gold bulls think that the bear has already gone far enough and that further losses are highly unlikely. While that could make sense in theory, the reality is further losses are definitely possible in the weeks ahead. As Gold bulls we do not want to be buyers until we see a sector that becomes extremely oversold and is trading near strong support levels amid extreme bearish sentiment.

As we navigate the end of this bear market, consider learning more about our premium service including our favorite junior miners which we expect to outperform into 2016.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.