Bond Traders have not been this Short Since Early 2010

Stock-Markets / Financial Markets 2015 Nov 16, 2015 - 04:20 PM GMT ZeroHedge reports, “Bond traders have not been this speculatively short Treasuries since early 2010. Since The Fed turned uber hawkish at the last FOMC, and convinced the market that it will raise rates in December - despite dismally dropping data everywhere, speculators have drastically increased their short positions across the entire Treasury spectrum. The last time the world was this short Treasuries, the 10Y yield collapsed from 3.94% to 2.39% in just 3 months.”

ZeroHedge reports, “Bond traders have not been this speculatively short Treasuries since early 2010. Since The Fed turned uber hawkish at the last FOMC, and convinced the market that it will raise rates in December - despite dismally dropping data everywhere, speculators have drastically increased their short positions across the entire Treasury spectrum. The last time the world was this short Treasuries, the 10Y yield collapsed from 3.94% to 2.39% in just 3 months.”

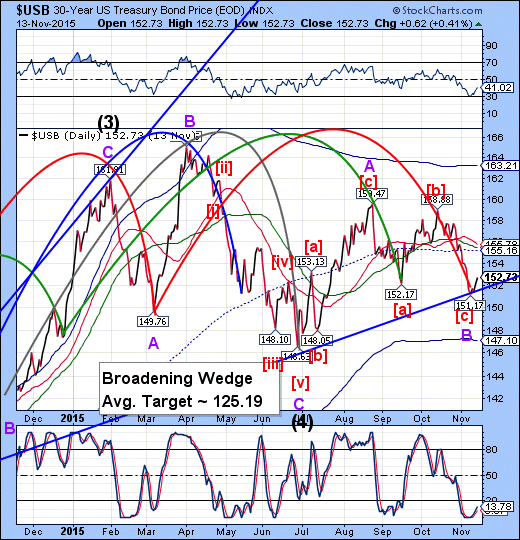

USB made its Master Cycle low last Monday, but speculators have been piling on the short side of the trade. This is a classic example of not following the crowd. Traders see the downside breakout, but don’t put it in the larger context of a bullish trend. One additional piece of information is that The long-term Treasury bond Cycle is approaching 34.4 years long. With the estimated low near October 1, 1981, we may see the all-time high in treasuries, on or near February 20 to February 25, if they were to go the full cycle.

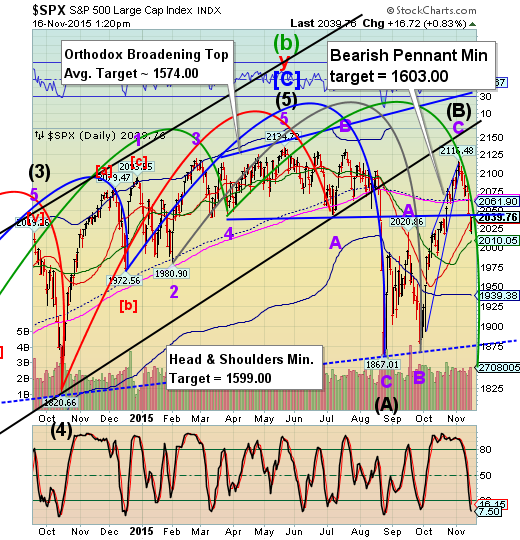

SPX has two resistances here. The first is 2039.01, as shown in the daily chart, but right above it is the Broadening Top trendline at approximately 2045.00. It appears that this area offers maximum resistance and may be a good place for a turn down. Be aware that the decline pattern may be incomplete and may have any number of variations on its way to a Master Cycle low at the end of November or early December.

Most analysts are still calling for new highs in the SPX, including a few prominent Elliott Wave practitioners. That is very low on my list of alternate patterns at this time.

ZeroHedge reports, “"I don’t fault anyone for taking some money off the table here. The stock market is not cheap," warns one portfolio manager as valuations that have been above historical averages for months are being pushed higher even as revenue and profits decline. "The correction didn’t really solve a whole lot," notes Leuthold CIO Doug Ramsey - whose bearish research foreshadowed the U.S. stock market’s first correction since 2011 in August - warning, as Bloomberg reports, that "you have all the same underlying market fissures in place, yet they will have lasted another six months," forecasting the S&P 500 will be 20 percent to 25 percent lower in 2016 from its record high in May of this year.”

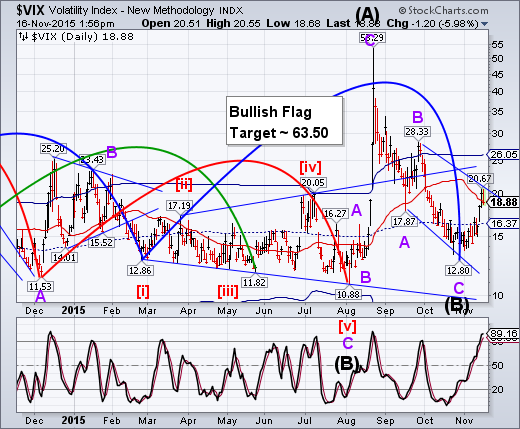

VIX is testing its 50-day Moving Average at18.90 this afternoon. A bounce from this level is likely to trigger the Bullish Flag formation.

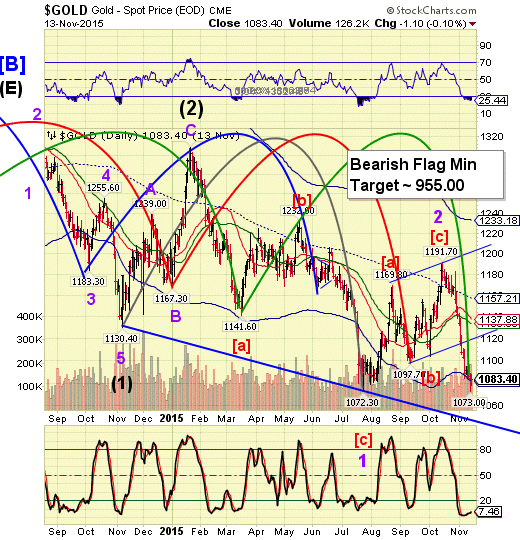

Gold futures surged to 1094.58 in Sunday evening trading as the news of the Paris attacks evoked a nervous reaction from traders. However, it has settled back down to 1082.00 and may yet fall beneath its Cycle Bottom support again at 1081.24.

This move was anticipated. I had mentioned last week that the Master Cycle low may not be expected until the end of the month. In the meantime, volatility in the precious metals is rising.

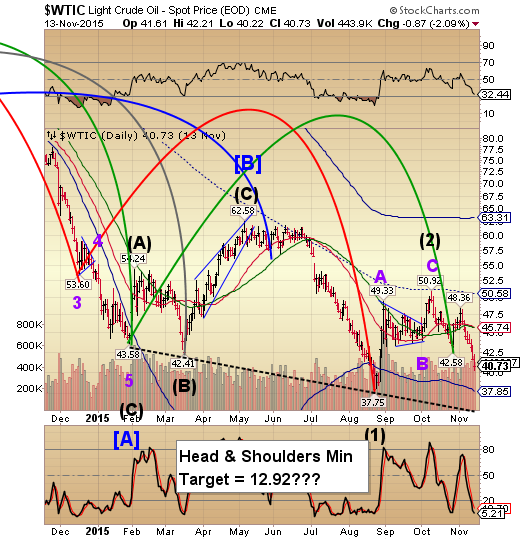

Crude also jumped to 41.64 on the news, but proceeded to make a new low at 40.06 in the futures today. Crude is also not expected to see a Master Cycle low until the end of the month.

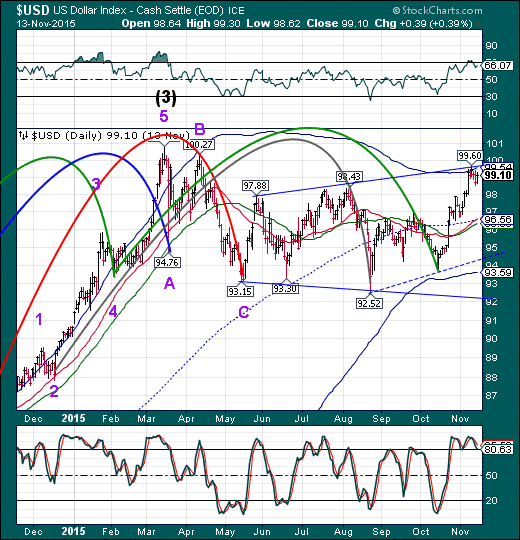

US Dollar futures made a bid to go higher this morning, but stalled short of its Cycle Top at 99.54. The high in USD was 99.49 today. The 99.60 high was made last Tuesday.

All the best,

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.