Stock Market Nifty-Fifty Becomes Fab-Five; Return of the 'Four Horseman'

Stock-Markets / Stock Markets 2015 Nov 20, 2015 - 01:09 PM GMTBy: Mike_Shedlock

Anyone recall the logic in the 1960s and 1970s that suggested there were only 50 stocks one needed to look at, and those 50 stocks could never go wrong?

Anyone recall the logic in the 1960s and 1970s that suggested there were only 50 stocks one needed to look at, and those 50 stocks could never go wrong?

That theory was labeled the "Nifty-Fifty ".

Nonetheless, the long bear market of the 1970s that lasted until 1982 caused valuations of the nifty fifty to fall to low levels along with the rest of the market, with most of the Nifty-Fifty under-performing the broader market averages.

The "Nifty-Fifty" of the 1960s gave way to the "Four Horseman" of the tech era: Microsoft, Dell, Cisco and Intel.

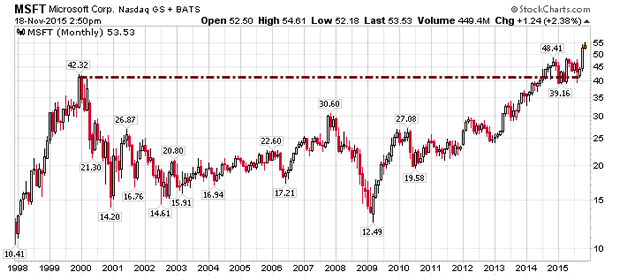

Microsoft

Microsoft opened the year 2000 at $41.19.

It is now $53.85.

Congratulations, you are ahead, but it did take 14 years. Counting dividends, you are now well ahead.

Dell

Historically Dell last traded at $13.73 on 10/29/2013. It opened the year 2000 at $50.40. You are seriously underwater and will never catch up. Dell is now private.

Intel

Intel opened the year 2000 at $29.65. It is now $33.16.

Congratulations, you went ahead in 2014.

Does it feel like it?

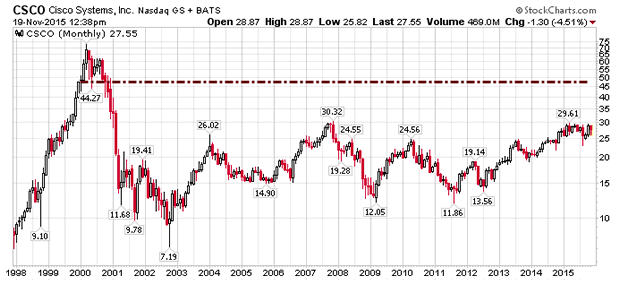

Cicso

Cisco opened the year 2000 at $47.43. It is now $27.12.

You are seriously underwater still.

If you bought the hype-of-the-day "Four Horseman" in 2000 and held on, you are still underwater fifteen years later.

Recall that EMC, Oracle, Sun Microsystems, and Juniper Networks were all regarded as must own for the long haul "gorillas".

New Four Horseman

On January 6 2012, GeekWire proclaimed Meet the new 'four horsemen' of tech: Sorry, Microsoft, Dell, Cisco and Intel .

Oh, how the technology landscape has changed. Ten years ago, the industry was dominated by names such as Microsoft, Intel, Dell and Cisco.

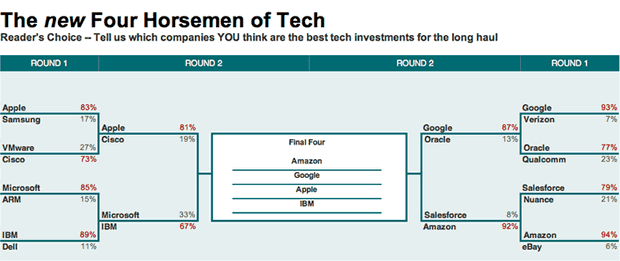

Fast forward to 2012, and the makeup looks quite different. CNN recently surveyed 30 technology experts and thousands of readers to come up with what it dubbed the Four Horsemen of tech.

Respondents were asked to choose only from publicly-traded companies, so Facebook didn't make an appearance.

Apple easily was the top vote getter, followed by Google, Amazon.com and - an oldie, but a goodie - IBM.

IBM, Apple and Amazon certainly could qualify as comeback stories, while Google has yet to really be tested in terms of its market dominance in Internet search. (Possibly signaling a fall).

Nonetheless, what's fascinating is how Microsoft no longer makes the cut. (In reader polling, IBM edged out Microsoft with 67 percent of the vote). Microsoft is still a juggernaut, but as CNN's editors point out "the PC is no longer driving technology growth."

Final Four, Elite Eight, Sweet Sixteen

Amazon, Google, Apple, and IBM were billed as the new four horsemen in 2012.

Oracle, Salesforce, Microsoft, and Cisco were in the "elite eight" with Qualcomm, Verizon, VMware, Samsung, Nuance, eBay, ARM, and Dell rounding out the "sweet sixteen".

Really? Yes, really.

Giddy Up!

In July of 2015, CNN Money proclaimed Why you need to own the Four Horsemen of Tech .

Move aside IBM, you were replaced by Facebook as a "need to own".

Fab-Five

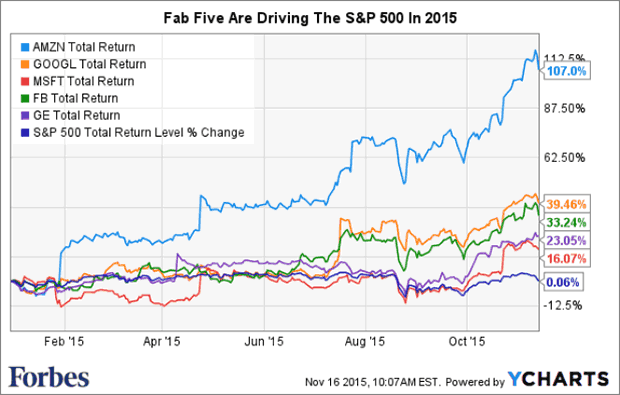

On November 16, Yahoo Finance reported How A Monster Year For Amazon, Google And Facebook Is Carrying The Stock Market .

There are 500 companies* in the S&P 500, but 2015 has been a year for the top 1%. Five companies -- Amazon.com, Alphabet/Google, Microsoft, Facebook and General Electric -- have collective returns that account for more than the entire return of the index year-to-date, according to a note from Goldman Sachs.

Excluding the aforementioned quintet, the S&P 500 would be down 2.2% this year, instead of being virtually flat, up 0.1%. Goldman's chief U.S. equity strategist and the firm's portfolio strategy research team note that narrow market breadth, with just a handful of strong performers carrying the load for a slew of weaker performers, tends to favor high-quality stocks with strong balance sheets and lower volatility.

Netflix also warrants mention, as the S&P 500's top performer for the year. But even with its stock up 120% in 2015, Netflix is far smaller than the companies above and its $46 billion market cap dims its influence on the cap-weighted S&P.

Notably absent from the list is Apple, which has returned just 3.7% in 2015, and Wal-Mart, down 33% and suffering through its worst year in stock performance terms since 1973.

Fab-Five Drive S&P

Warnings Signs

Breadth is a huge warning sign. That fewer and fewer stocks participate in rallies is synonymous with topping action.

Netflix Key Stats

Check out the Netflix Key Stats .

- Trailing PE: 319

- Forward PE: 462

- Market Cap: $51.53 billion

- Book Value: $5.07 per share

- Share Price: $120

- Price/Book: 23.09

Amazon Key Stats

- Trailing PE: 950.63

- Forward PE: 117.65

- Market Cap: $311.04 billion

- Book Value: $26.50 per share

- Share Price: $663.54

- Price/Book: 24.27

Facebook Key Stats

- Trailing PE: 108.20

- Forward PE: 37.68

- Market Cap: $304.77 billion

- Book Value: $14.72 per share

- Share Price: $107.77

- Price/Book: 7.14

Hey, no problems there!

After all, Facebook and Amazon are "need to own" stocks according to CNN Money.

Ozone Layer

Momentum players ignored the PE warts, thereby pushing the market higher and higher so that it's now well into the ozone layer .

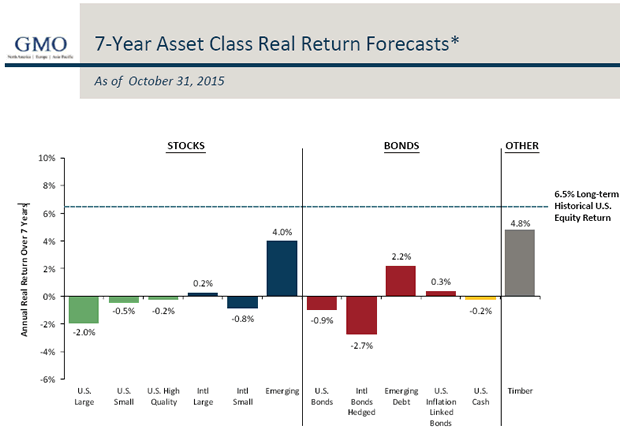

GMO Forecast

In contrast to mainstream media "must own" analysis, GMO just came out with its Seven Year Forecast .

GMO's Disclaimer

"The chart represents real return forecasts for several asset classes and not for any GMO fund or strategy. These forecasts are forward-looking statements based upon the reasonable beliefs of GMO and are not a guarantee of future performance. Forward-looking statements speak only as of the date they are made, and GMO assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results may differ materially from those anticipated in forwardlooking statements. U.S. inflation is assumed to mean revert to long-term inflation of 2.2% over 15 years."

Real Returns

GMO depicts "real" inflation adjusted returns. If one assumes 2% inflation and the forecast hold true, then seven years from now, the stock market will be where it is today.

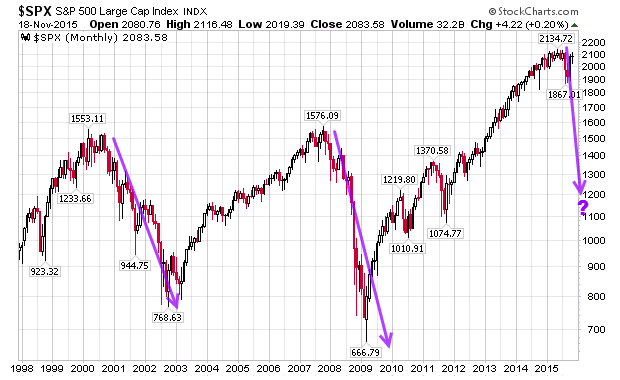

But the stock market will not be flat for seven years. It is far more likely to look like this.

Greater Fools Game

I actually believe GMO is overly optimistic.

Only those playing the greater fools game (whether they realize it or not) are investing in stocks at these prices.

Nifty-Fifty Becomes Fab-Five

A friend of mine pinged me with this comment in regards to the "Fab Five":

I think this is another one of those instances where the extreme nature of the topping process (and the market advance has thinned out to an incredible extent) probably hints at the significance of the top being formed. The only other time a topping process took this long was during the last stage of the tech bubble.

If the future rhymes with the handful of previous cycles we have to guide us, the "real" stock prices we see today may not be seen again for another 20-30 years.

Valuations Matter

There is never a point in which a handful of stocks or even a basket of 50 stocks are "must own" and you can put them away and forget about them. Valuations must be taken into consideration along with changing times and changing technology.

Yet, here we go again, with the same theories telling people they can do precisely that. Today's version of the "Nifty-Fifty" is now called the "Fab-Five".

And another set of "Four Horsemen" are galloping again .... for now.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2015 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.