Stock Market Correction Nearing Its End...

Stock-Markets / Stock Markets 2015 Dec 02, 2015 - 10:19 AM GMT What appears to be a final fifth wave has appeared, morphing the former double zigzag into an a-b-c Wave 2…

What appears to be a final fifth wave has appeared, morphing the former double zigzag into an a-b-c Wave 2…

…that is, if it reverses very soon. You see, Wave (iii), which is 18.39 points long, cannot be the smallest wave in the series. That may happen if the SPX peaks above 2105.16. So the issue remains unresolved until morning.

Should SPX rise above that level, we may have to find an alternate accounting of what is going on.

Remember, we are at an extreme of overvaluation second only to the 2000 high. ZeroHedge opines, “So to summarize the day, CEO's outlook for next year is the weakest in 3 years, US Manufacturing ISM is the weakest in 2009, bond yields are collapsing, and rate-hike odds are dropping... so stocks rallied (because auto sales in the past were soaring?)...”

This is not Wave 3 behavior yet. We will know when it arrives.

VIX has retraced 76.7% of its rally thus far. The natural limit on retracements are normally 78.6%, so it is still within a “comfort zone,” even though it closed at a daily low. The maximum it may decline in this scenario is to 14.41, where Wave (iii) becomes the smallest wave.

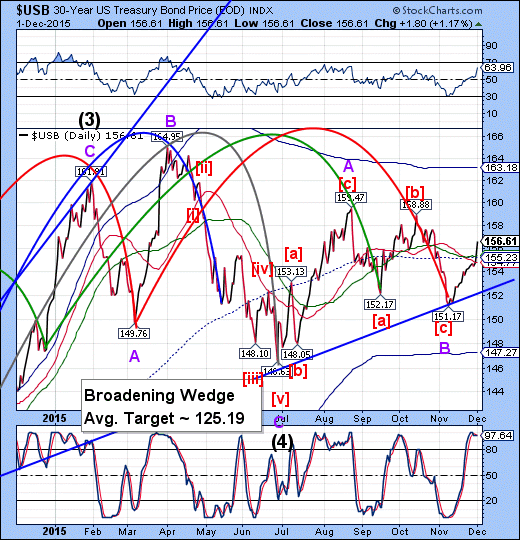

USB also appears to have made a running correction and may already be in a Wave [iii].

ZeroHedge reports, “When the US reached a debt ceiling deal in the beginning of November, it was common knowledge that there would be a debt accrual "catch up" to make up for lost time when the US was operating under emergency measures to avoid breach of the debt ceiling. And sure enough, when the accurate total debt number was released on November 2, this was indeed the case, when we learned that the US had added some $339 billion in debt during the "emergency measures" period.

However, what is unclear is how in the remaining 4 weeks of November, the US managed to add another $335 billion in total debt, bringing the total increase for the month of November to a whopping $674 billion, and total US debt to a record $18.827 trillion.”

Isn’t our new debt ceiling at $19,900,000,000.00? What happened if we get there sooner than March 2017?

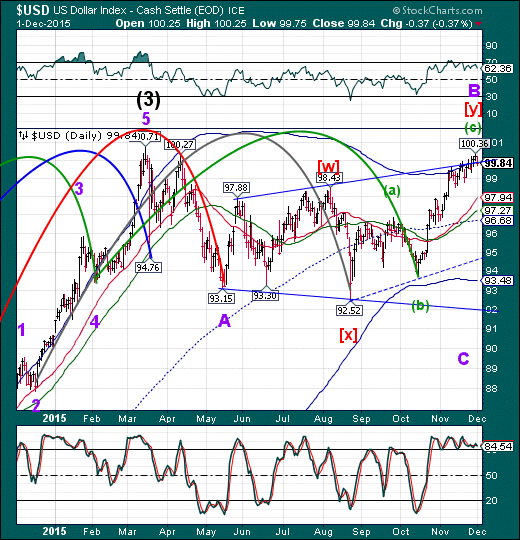

The US Dollar has slipped beneath its Cycle Top and trendline at 99.88 after completing its double zigzag Wave B. We should now see the dollar decline along with the USD/JPY Forex pair that supports the Yen carry trade. Based on the Cycles Model, the most likely scenario is an 8.6 day decline lasting to December 10.

It appears likely that the decline in Equities may last at least that long, if there is no extension.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.