Does Draghi's Coup Secure Yellen's Interest Rate Liftoff?

Interest-Rates / ECB Interest Rates Dec 04, 2015 - 02:42 PM GMTBy: Ashraf_Laidi

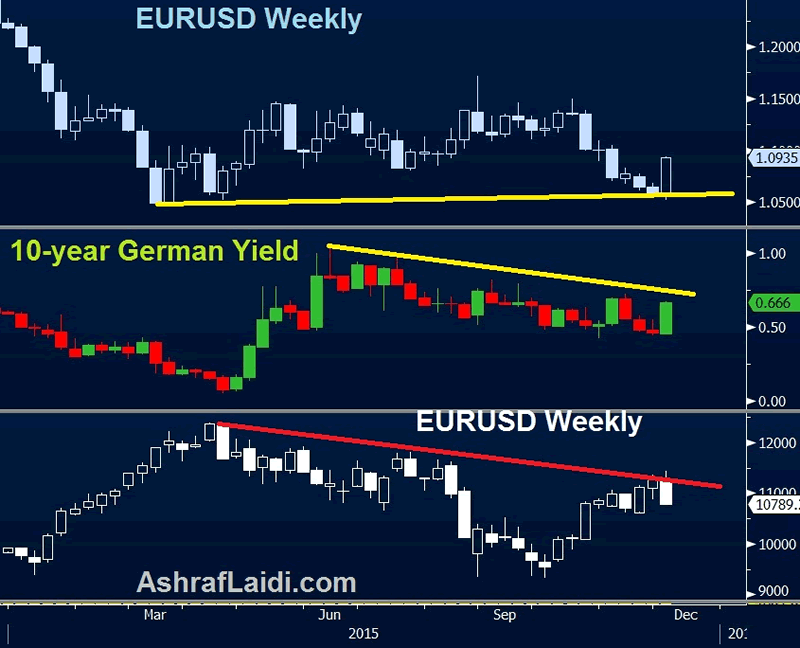

To some, the ECB has underdelivered today by not only cutting rates by a smaller than expected 0.10 bp in the deposit rate to -0.3% from -0.2% (vs exp -0.4%) but also disappointed most market players by only extending the duration of QE to an additional 6 months and not adding to the monthly $60 bn QE. The ECB's decision to opt for QE extension rather than QE expansion reflects the broad signs of improvement in German growth business surveys. Germany's IFO and various Eurozone PMIs and confidence surveys have hit 17 to 52-month highs.

The Car Example

We long said here that a rate cut of 10-20 bps would be a desperate move to drive down interest rates deeper into negative territory, but would be of no effectiveness, if not accompanied by any substantial rise in monthly purchases. In fact, even a rise of EUR 10-20 bn euros in monthly purchases would not have mattered beyond the odd 100-100 point rally in the Dax. Why? The ECB succeeded in unleashing its policy shock-&-awe (sharp rally in equities, positive shock in Eurozone system liquidity and a lasting decline in the euro's exchange rate) thanks to an increase in monthly asset purchases from EUR 0 bn to EUR 60 bn. That was in March. Today, any announcement of QE expansion from EUR 60 bn to EUR 75 bn or EUR 90 bn, would have been less effective, just as a car would more likely to be noticed accelerating from 0 to 30 km/hr than a car going from 50 to 70 km/hr.

13 days is a long time in today's markets

Keeping powder dry in the form of interest rates and QE size is the evident excuse/explanation for the ECB's under-delivery. Yet, the more fundamental question is the following: "Will Draghi coup guarantee a US rate hike?" If today's USD declines are built upon with additional (possible) selling from a disappointing US November jobs report tomorrow, could well pave the way for December liftoff -- although I continue to have my doubts and stick with my prediction for no rate hike this month. The risk of a market-driven tightening (in the form of equity markets sell-off (this time from the US not China) may go so far in blocking a December rate hike. The earnings and manufacturing recessions in the US have been overshadowed by explanations and excuses of temporary phenomena. 13 days is a long time in today's markets. A 110K NFP figure coupled with a rise in the jobless rate and neutral average hourly earnings can go a long a way in transforming 70% odds of a December liftoff down to 40%.

Many of our Premium subscribers had initially been sceptical towards our 052008 Parallel postulated in various charts of global indices. Today's market moves have further bolstered the theory, which could assault long established seasonals.

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi CEO of Intermarket Strategy and is the author of "Currency Trading and Intermarket Analysis: How to Profit from the Shifting Currents in Global Markets" Wiley Trading.

This publication is intended to be used for information purposes only and does not constitute investment advice.

Copyright © 2015 Ashraf Laidi

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.