Gold Price Weekly Reversal : This is IT !

Commodities / Gold and Silver 2015 Dec 05, 2015 - 10:55 AM GMTBy: Dan_Norcini

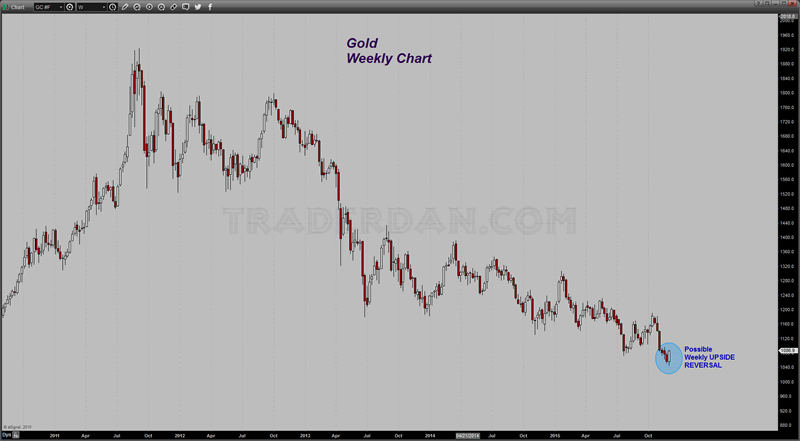

In watching the short squeeze taking place in the gold market this AM, I am noticing that the push higher is creating a WEEKLY UPSIDE REVERSAL PATTERN on the intermediate term chart.V

As the Euro recovers off its lows and as the Dollar fades from its best levels, shorts are covering in gold and that is setting off a wave of buy stops as upside technical levels are getting taken out. Hedge funds are short, not in large numbers, but large enough to produce this buying.

It looks like the bulls have managed to dodge a bullet with Mr. Draghi bailing them out yesterday and thus we have a massive amount of repositioning taking place that started yesterday and apparently is continuing this morning.

I want to see how this market closes this afternoon to see whether the buying is going to fade but for now, the gold market is working on a reversal pattern meaning that the low below $1050 might be it for a while longer.

It might very well be a case where now that the market has effectively fully priced in a December rate hike, the emphasis is now going to shift from “WHEN will they hike” to “AT WHAT PACE WILL THESE RATE HIKES FROM THE FED NOW COME?”.

In other words, the markets are now in a “SELL THE RUMOR, BUY THE FACT” mode when it comes to gold. This does not mean gold is about to embark on a new bull market. What it does seem to mean for now is that the market is going to stabilize down here. We will have to continue watching the charts as well as the Dollar price action as well as looking at GLD to see if reported holdings actually begin to rise. My thinking is that if we do not see an increase in the holdings, then this rally is going to fade.

It is one thing for shorts to cover; it is another thing for a bull market to take place. Keep a level head and do not get goofy out there. Control your emotions and stay objective and above all, avoid getting snared by all the “THIS IS IT’s” that are now going to start coming out of the gold bug camp once again.

Dan Norcini

Dan Norcini is a professional off-the-floor commodities trader bringing more than 25 years experience in the markets to provide a trader's insight and commentary on the day's price action. His editorial contributions and supporting technical analysis charts cover a broad range of tradable entities including the precious metals and foreign exchange markets as well as the broader commodity world including the grain and livestock markets. He is a frequent contributor to both Reuters and Dow Jones as a market analyst for the livestock sector and can be on occasion be found as a source in the Wall Street Journal's commodities section. Trader Dan has also been a regular contributor in the past at Jim Sinclair's JS Mineset and King News World as well as may other Precious Metals oriented websites.

Copyright © 2015 Dan Norcini - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

Dan Norcini Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.