Keynes on the Menace of Printing Money

Currencies / Fiat Currency Dec 08, 2015 - 11:58 AM GMT How the celebrated economist might have structured his investment portfolio today

How the celebrated economist might have structured his investment portfolio today

“I find myself more and more relying for a solution of our problems on the invisible hand which I tried to eject from economic thinking twenty years ago.” – John Maynard Keynes, 1946

John Maynard Keynes made that admission to Henry Clay, a member of the Bank of England's Advisory Committee, in 1946. Ten days later he passed away. Keynes had come full circle – from economic interventionist extraordinaire to proponent of Adam Smith's laissez faire. Twenty-five years after that, Richard Nixon would suspend dollar convertibility, scrap the Bretton Woods fixed exchange rate regime system of which Keynes was the principal architect and allow currencies and gold to float freely in international markets. The fiat money system of the late 20th and early 21st centuries was born. Though a radically different system from the one Keynes created in the aftermath of World War II, Richard Nixon declared upon its launch that "we are all Keynsians now."

One wonders what Keynes might have thought of that declaration. What we came to call Keynsian economics in the years that followed had little to do with the economic picture the most celebrated economist of the 20th century had painted. The free-wheeling post-Bretton Woods system reached its zenith in the aftermath of the 2008 crisis under the baton of Fed chairman Ben Bernanke who directly monetized government debt to the tune of trillions of dollars, bailed out an incorrigible financial sector and made saving at the bank a virtue of the past. When Keynes decried the debauching of the currency, this was exactly what he was talking about. Subsequently, central bankers the world over would follow Bernanke's example.

Far from the laissez faire economics Keynes endorsed at the end of his life, we have ended up with the exact opposite: A command economy directed by the state and fueled by the beneficent paper money machine of the world's central banks. Today the world economy floats on a sea of paper money backed by nothing but the promises of the governments that issued it and with little in the way of policy options except to do more of the same. Debasing the currency is no longer something to hide in the back corners of central bank policy, but to be trotted out in full view of everyone including the financial markets. Countries, in fact, compete with each other to see who can devalue their currency fastest. As Richard Russell, the recently deceased critic of central bank policies put it, the mantra has become "Inflate or die!"

Keynes would be buying gold hand over fist

Keynes would be buying gold hand over fist

How might Keynes, as famous for his investing prowess as he was for his advice to statesmen, have reacted to these circumstances in his own investment portfolio? Writing in the Wall Street Journal, Richard Hurowitz, publisher of the Octavian report, offers some interesting conjecture on that score:

"Keynes understood that sound money and stable exchange rates were necessary conditions for world prosperity and peace. Contrary to popular belief, he believed that in most cases currency devaluations were counterproductive, their benefits often outweighed by increased domestic costs and the undermining of sovereign credit. ‘There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency,’ Keynes observed in 1919. He consistently argued that a sound currency was critical to a functioning free economy. He understood that such a currency would ultimately create much greater wealth than the endless and vicious cycle of improvisational debasement we see playing out globally today.

Were Keynes alive today, he would likely be arguing along with German Chancellor Angela Merkel for more monetary discipline and a return to a more balanced international system. No doubt, however, his neo-Keynesian acolytes would be dismissing his concerns as hopelessly outdated and reactionary.

Keynes was an economic theorist, but he was also a clear-eyed market analyst, and a passionate and committed speculator for his own account and for Cambridge University. If he took in today’s economic vista of near-zero interest rates and quantitative easing, it is clear that he would be buying gold hand over fist—regardless of what his disciples might think.”

The economic consequences of inflationism

Those of you who read this newsletter regularly will recognize the quote from Keynes about the dangers of currency debasement. It occupies a place of prominence at the top of the page (see upper left column). Keynes first penned those words as a young man in The Economic Consequences of Peace (1919) – a treatise published in the aftermath of World War I. It argued leniency for the defeated Germany and its allies, but it also warned of what he called the "menace of inflationism" in the defeated central European countries.

Here, for the record, is that quote in its entirety:

"By a continuing process of inflation governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security, but at confidence in the equity of the existing distribution of wealth.

Those to whom the system brings windfalls, beyond their deserts and even beyond their expectations or desires, become 'profiteers,' who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished, not less than of the proletariat. As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and a lottery.

Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose."

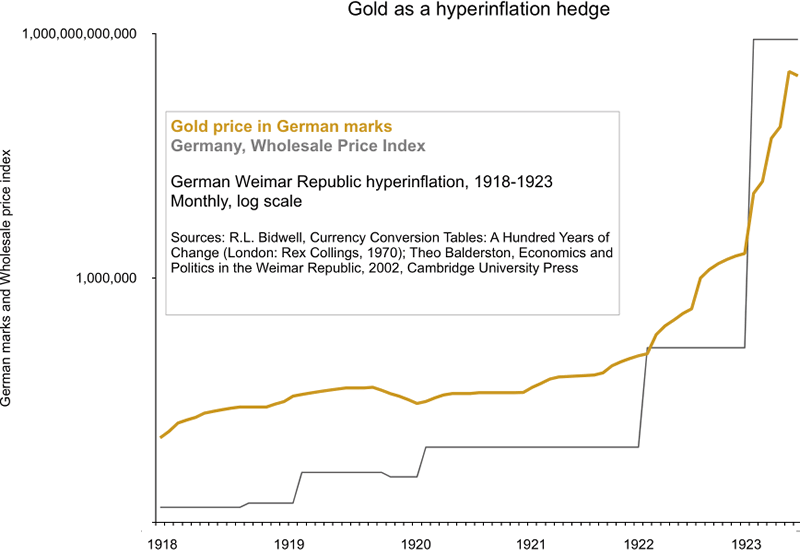

It will not escape the notice of the reader that Keynes description of the inflationary process eerily fits the set of social and economic circumstances in which we find ourselves today. Whether or not the advanced economies will proceed from asset inflation to rapid price inflation – remains to be seen, but we should not overlook the fact that the ground has been prepared and the seed sown. In 1919, when Keynes wrote those words, money printing in Germany, its point of reference, had yet to produce price inflation. In fact, the German economy experienced deflation in the period 1920-1921. (See chart below.) In the end though, Keynes was right. By 1922 the hidden forces of economic law were unleashed. Hyperinflation gripped the German economy suddenly and with a vengeance.

I believe Hurowitz is right about Keynes and gold. He would have understood the wolf hammering on the door and adjusted accordingly – both in his personal finances and as an advisor to governments. I keep coming back to former Fed chairman Alan Greenspan’s comment last October that "Gold is a good place to put money these days given its value as a currency outside of the policies conducted by governments."

“The whole point about gold, and the quality that makes it so special and almost mystical in its appeal, is that it is universal, eternal and almost indestructible. The Minister will agree that it is also beautiful. The most enduring brand slogan of all time is, ‘As good as gold.’ The scientists can clone sheep, and may soon be able to clone humans, but they are still a long way from being able to clone gold, although they have been trying to do so for 10,000 years. The Chancellor may think that he has discovered a new Labour version of the alchemist’s stone, but his dollars, yen and euros will not always glitter in a storm and they will never be mistaken for gold.”

– Sir Peter Tapsell in a speech before the British parliament in opposition to the sale of British gold (1999)

“The end of capitalism will be due to the unbelievable amount of debt that is currently being created. This will create monster inflation that will destroy every currency. The only currency that cannot be destroyed is gold. When investors realize this, we’ll have the makings of the greatest bull market in gold ever seen.”

– Richard Russell, Dow Theory Letters (Mr. Russell passed away in late November at 91 years of age. This is his final observation on gold published at King World News)

The numbers you see in the left axis are not a misprint. At the height of Germany's Weimar Republic hyperinflation, gold traded at 118.23 billion marks per ounce. In 1918, it traded at 87 marks per ounce. Wholesale prices went from 2.34 to 725.7 billion index points in the course of five years. At the height of the inflation, prices were doubling every two days – a nearly immeasurable inflation rate. An individual's life savings could not purchase a newspaper. As you can see by the chart, those who converted their marks into gold early in the process were able to hold on to their savings. Those who did not were at the mercy of the destructive forces unleashed by the hyperinflation.

References: The Economic Consequences of Peace by John Maynard Keynes (1919); John Maynard Keynes Career Timeline, maynardkeynes.org; Wikiquote - John Maynard Keynes

Reader invitation: If you like this type of gold-based analysis, you might want to consider becoming a regular visitor to this page – our live daily newsletter. Please bookmark if you have an interest. For free, in-depth analysis and special reports, we invite you to subscribe free of charge to our regular newsletter. New release notifications are sent by e-mail and our upcoming issue will be out soon.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.