Soaring Bond Yields - This Is How Fast It Happens

Interest-Rates / Corporate Bonds Dec 12, 2015 - 10:26 AM GMTBy: Raul_I_Meijer

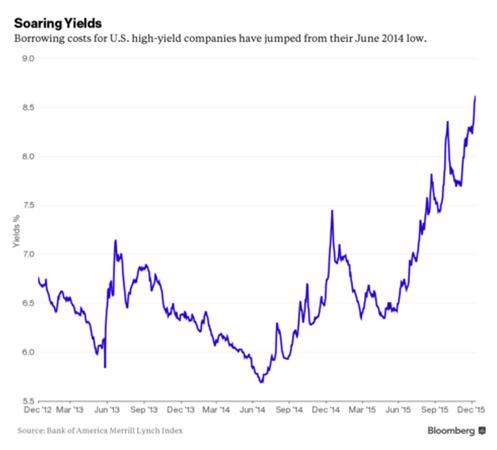

For a while there, companies deemed to be highly risky were nonetheless able to borrow money for less than 6%. And borrow they did. Frackers, ultra-high-leverage retail chains and various other close-to-the-edge entities slurped up trillions from yield-starved investors who had forgotten about the other side of the risk/return equation.

That this hasn’t worked out so well is not much of a surprise. But the speed with which it has gone bad is still breathtaking. The following chart from Bloomberg illustrates just how fast an illogical market can be brought back to reality:

Now a growing number of reach-for-yield investors are finding that not only are they down on their bets but they can’t get at their capital.

Next up, dividend stocks?

In addition to junk bonds, the hunt for yield has led retirees, pension funds and other formerly conservative investors to pile into high-dividend stocks like energy producers and pipeline operators, on the assumption that not only would those companies provide cash in the near-term but they would increase their payouts over time.

Or not.

Just as “This time it’s different” are the four most dangerous words in finance, “What’s going to blow up next?” are the six scariest. When once-burned investors and speculators decide they won’t be burned again, markets go risk-off almost instantaneously. Babies get thrown out with the bathwater and it’s 2008 all over again.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)© 2015 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.