Stock Market Forecast: What Next for the S&P 500?

Stock-Markets / Stock Markets 2015 Dec 14, 2015 - 11:55 AM GMTBy: Submissions

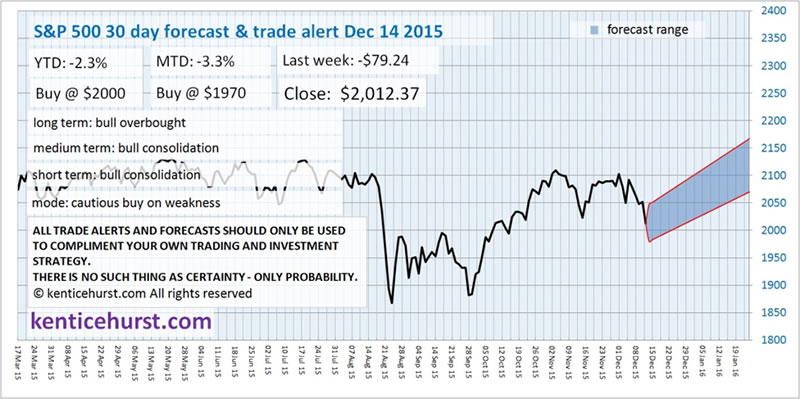

Ken Ticehurst writes: The S&P 500 fell last week towards what we think is more than likely support. As we close in on the end of the year it finds itself struggling to print a positive yearly close. We remain bullish the S&P 500 as our forecast shows, however we are cautious as we watch to see how this bull consolidation forms over the next few months.

As far as we are concerned we are in a solid bull trend on a long term basis regardless of the persistent bearishness and eerie similarities to the financial crisis with respect to commodity crashes, the market structure still paints a more bullish picture.

We expect at this stage to see higher prices ahead but maybe not immediately a sideways grind for a few weeks is more than probable. The reason we are cautious and you should be to is that on a long term basis the S&P 500 is overbought. Logic would dictate that with so much happening globally that a fall from such a lofty valuation is all but inevitable but markets can become even more overbought than even the most optimistic could believe.

The August panic of this year relieved some of the overbought structure of the market on a weekly basis. The S&P 500 looks to be in a bull market consolidation and building a platform for higher prices to come. Our forecasts are looking towards a final blow off phase next year to push this market in to a severely overbought state.

We expect current trends to continue in to next year a strong dollar and a stock market that is attractive to capital as it is essentially the cleanest shirt in the laundry bag, in our opinion being the best of a bad bunch in a global economy awash with bad money and dangerous central banks is enough to drive a market to extremes.

We follow recurring patterns that repeat over different time scales from years to months to weeks our forecasts are generated through the rigorous discipline of analysing these patterns over different time scales and creating a most probable outcome. This is a phenomenon that has been observed for years as the great Jesse Livermore explained.

“I absolutely believe that price movement patterns are being repeated. They are recurring patterns that appear over and over, with slight variations. This is because markets are driven by humans - and human nature never changes." - Jesse Livermore

During the last year we have consistently forecast lower gold prices we have never deviated from this long term position. All our analysis has shown that we spent the last two years in a bear market consolidation and we are now continuing the bear market that began in 2013. Unusually for most analysts you can see our track record right on our front page.

We now create forecasts for a wide range of markets, stocks, forex, interest rates and energy along with gold using our unique forecasting logic that has kept our followers on the right side of the gold market for so long.

Ken Ticehurst

To view some of the most accurate and unique market forecasts available visit us at: http://www.kenticehurst.com

Copyright © 2015 Ken Ticehurst - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.