Stock Market THREE is a number, Good or Bad, Well that Depends

Stock-Markets / Stock Markets 2015 Dec 15, 2015 - 12:01 PM GMTBy: Submissions

Denali Guide writes:

Denali Guide writes:

Well are we having fun yet? Are you serious? THREE CHARTS.

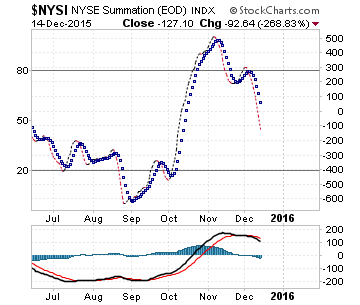

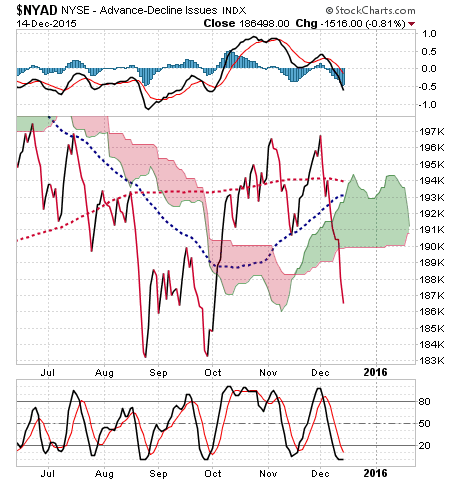

Lets look at the RAT of the bunch, Mr.RATSI. This is the cumulative summation of the Advances - Declines on the NYSE. Seems rather dire for a rallying market, just doesnt match. Now since this doesnt match, is the cause that is is a longer term index V. a shorter term index? Well lets match it up with a DAILY NYSE measure of the same item taken day at a time.

The one possible saving grace, were such possible, is the SLo-STo at the bottom panel, bottomed out, snubbed against the bottom of the tank. What it means is we "should" catch a bounce. My bet ? I bet its a Dead Hippo Bounce, charaterized as SPLAT !!

Why, why for pete's sake are the numbers so out of whack ? Well the DJIA is at 17370, about 1,000 points below its All Time High. BUT IT CANT CLIMB The Hill to get back there. OH yes, various and assorted Govt Agcy's are pumping and juicing and tricking out all they can to keep it floating. And the volume continues to drop. UPVolume keeps dropping. So now you know how they make it float(the DJIA, S&P, etc). Now lets look at on the tripod legs that are rolling over to take this market down........

So lets talk about "The Three".

AND Then there were Three....

“And then there were three, found them and made them fall, to bring them

down and have them bankrupt bound.......”

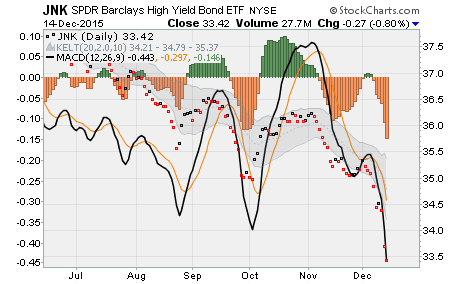

First was Third Ave, gated, then Stone Lion tried to roar, and squeaked and then Lucidius went down in a cloud of dust. They were the Canaries. They are dead.

Bonds, real estate and now the equities, all rolled over, all on the downhill slide. What more does anyone need to be told? Get out ? Get liquidity ? Get specie metal, gold, silver?

I think right about now, the market for “Pet Rocks”, aka GOLD is looking pretty good.

What to do now ? You have a stack, right? You have your money out of funds, and 2/3 or more of your value of portfolio titled to you, in you name. There there were three: Stack, Free funds, and Certificates in your name. Three of three ? Two of three ? One of three ?

Which one or ones ? A/ A stack needs secrecy to stay concealed. ; B/ Your funds are free and clear, and can be withdrawn; C/ If your broker is cooperative, you need your core stocks in your name. Of what you have or do not have, you will need FUNDS. If you cannot get the stock certificates in your name with dispatch, you may sell them, IF you can withdraw the funds from the resulting sales. That solves problem ( C ). You discretion resolves issue

( A ). Issue ( B ) is resolved as is Issue ( C ). You may wish to ck what you can pre-pay either to set money aside to be withdrawn or to pay future expenses now to the level prudent.

Depending upon how you assess risk, and reward, you can disperse the funds as above and you can also acquire some short term hi quality (less than 180 days to maturity, or even shorter, 90 days to maturity, and roll them over), and potentially acquire some specie metal in the form of coins one ounce or less, in whatever for which you have funds availabe. Then there were three, Specie, Short term Debt, and trade hedges. For those of you who want to consider Trade Hedges, drop me a line and we can discuss LIBRA® Strategy as it applies to you.

My personal concern is that someone is going to miscalculate in the THREE HotSpots:

UKRAINE; SYRIA+TURKEY et al And the SOUTH CHINA SEA, and that one, two or three of these Hot Zones turning into an USA vs. Russia or China shootout.

Want more info ? Either sign up on our mailing list or Subscribe to SIMPLE TACTICS or PEAK PICKS, whatever your flavor. PEAK PICKS is your Complete guide to timing and stock picks. SIMPLE TACTICS is for those who prefer to pick their stocks. Be Savvy, Be Aware, Be Careful. Good Luck.

By Denali Guide

http://denaliguidesummit.blogspot.ca

© 2015 Copyright Denali Guide - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.