US Subprime Mortgage Meltdown - Financial Fiascos Everywhere!

Housing-Market / US Housing Mar 15, 2007 - 05:20 PM GMTBy: Clif_Droke

“Millions at risk of losing homes” was the headline on the news wires on Wednesday, March 14. This happened on the day when the stock market showed a positive intraday reversal on strong trading volume. Obviously, the stock market wasn't put off by this negative piece of news.

If it were true that millions of Americans risk losing their homes over the sub-prime mortgage fiasco, the market would have already tanked by now.

Remember, the stock market is a leading indicator and the men in positions of power to control it see all and know all, well in advance of the rest of us. If the money controllers saw a massive housing collapse, and knowing full well what it would mean for the economy and financial system, they would have sold out long ago and the market wouldn't be at the relatively high levels of today. Moreover, we wouldn't be seeing high levels of insider buying, which we most certainly are right now.

You may remember back in 1999 in the days and weeks leading into the fateful “New Millennium” of Jan. 1, 2000. So many people were expecting the lights to go out worldwide, figuratively and literally. Worst-case scenarios and an “Apocalypse Now!” mentality abounded. Yet as the fateful date drew near it became obvious that the so-called Y2K Crisis wouldn't materialize because the stock market was making all-time highs right up until the last trading day of 1999. Had the powers-that-be foreseen a genuine Y2K collapse they would have cashed out well in advance of the date and in so doing cracked the markets big time. A strong stock market in the face of a supposed “crisis” generally means the crisis is overblown, at least as far as its ability to severely impact the economy.

Could the scare stories over the sub-prime lending debacle be the final wash-out phase of the U.S. housing market correction? I think it could be. It's certainly typical of past wash-outs of bear markets and as usual the mainstream press is doing a stellar job of exaggerating the negatives and trying to scare the country out of its collective wits. They've got everyone and their brother-in-law running for the cellar screaming “The sky is falling, the sky is falling!” You can't pick up any newspaper without seeing it plastered all over the front page in big, bold headlines. An Internet friend sent me the following example from the front page of the St. Paul (MN) Pioneer Press:

SUBPRIME MORTGAGE MELTDOWN

It doesn't get much more bearish than that! I take this barrage of pessimistic headlines to be a contrarian indicator that the worst has already been discounted by the markets and it shouldn't have that great of an impact on the national economy. This isn't to say that the sub-prime mortgage problem is just going to vanish overnight without any pain or negative consequences, for there almost certainly will be more. But as far as major national economic pain…doubtful. Sub-prime borrowers are more often than not equity rich and yet don't always pay their bills on time. It's not as if they're dirt poor and one paycheck away from the curb as the media would have us believe.

There always has to be financial crisis to support the “Wall of Worry” for the economy and financial markets. In the ‘80s it was the S&L fiasco. A few years ago it was the corporate accountability scandals. Major long-term tops aren't characterized by problems coming to the surface: this is one of the attributes of a bottoming or digestion (consolidation) process. At the top of a major bull market the news is nearly always upbeat, especially on the economic front, and bad news is nowhere to be found on the front pages of newspapers. News outlets are never known for giving you a heads-up on what's coming down the road. Their specialty is telling you what is already past and convincing you that it still remains a pressing concern for today and tomorrow. So whenever you see the “fiasco parade” in the headlines day after day you're normally safe in assuming the worst has already been discounted and that the crisis of the hour (whatever it happens to be) has already done most of its damage.

While we're on the subject of the real estate market and the discounting mechanism of the markets, it's interesting to note that despite all the hoopla surrounding the sub-prime mortgage fiasco the action of some of the leading real estate and homebuilding stocks hasn't been all that bad, all things considered. The Dow Jones REIT Index (DJR) has been showing some relative strength recently compared to the S&P 500 Index (SPX). Even the Housing Sector Index (HGX) is still well off its lows of last July and has only retraced about 50% of its July-February recovery rally. If the national real estate market were in nearly as bad of shape as the media would have us believe, then HGX and DJR would be in much worse condition.

|

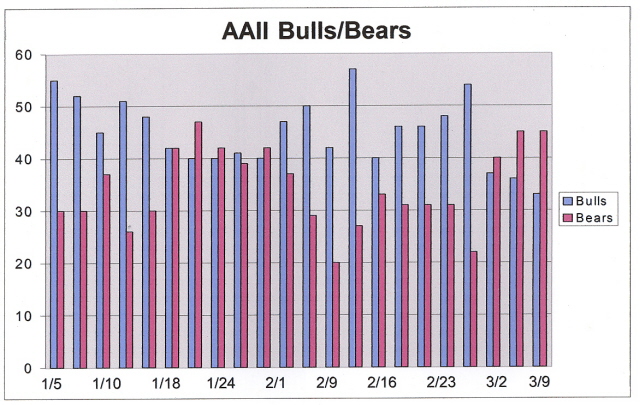

The tape action of Wednesday's (Mar. 14) intraday turnaround was promising. Volumes were good and investor sentiment couldn't be more bearish right now (which is positive from a contrarian standpoint). The AAII investor sentiment poll came out showing only 33% bulls (one of the lowest readings of the past year) while the percentage of bearish investors was a fairly high 45%. This is the third consecutive net bearish reading of the weekly AAII poll and the bear-to-bull ratio this week was second only to the major interim low of last July.

Another area that isn't as bad as it's being made out is the emerging markets. Veteran market forecaster Steve Todd brought something to my attention recently that's worth repeating. He pointed out that the Emerging Market ETF (EEM) tends to lead the S&P at turning points and as such can be used as a leading indicator for the SPX. At the most recent low the EEM made a distinctively higher low compared to the SPX. This shows relative strength and suggests the SPX should find its legs and regain its strength.

The best relative strength has been shown among the semiconductor stocks, however. There are quite a few “semis” that have significantly outstripped the market on the upside in the past couple of weeks and many have recently appeared on the list of stocks making new 52-week highs. That's quite promising for the broad market outlook, especially since the semiconductors also tend to be leading indicators.

The gold and silver mining stocks as a group have pretty much performed in line with the broad market since the late February correction with quite a few relative strength out-performers among the PM stocks. There are still some attractive stocks among the gold and silvers despite the sharp correction in the XAU and HUI indices recently, and of course the actual metals have held up despite the across-the-board weakness. The dominant interim momentum indicator for the gold and silver stocks is still rising and hasn't reversed yet, which should add to the positive outlook for the relative strength stocks within the sector.

By Clif Droke

www.clifdroke.com

Clif Droke is editor of the 3-times weekly Momentum Strategies Report which covers U.S. equities and forecasts individual stocks, short- and intermediate-term, using unique proprietary analytical methods and securities lending analysis. He is also the author of numerous books, including most recently "Turnaround Trading & Investing." For more information visit www.clifdroke.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.