Yellen has Lift Off, But Rates Won’t Go To The Moon

Interest-Rates / US Interest Rates Dec 21, 2015 - 02:25 PM GMTBy: Sam_Kirtley

At the FOMC meeting last week the Fed raised interest rates for the first time since 2006. This was a historic moment marks the first rate hike after the Fed engaged in massive quantitative easing programs to combat the Global Financial Crisis and the Great Recession. However, we are not economists or economic historians. We run a trading service and are therefore concerned with where the markets will go next. This means that our key point of analysis is around where rates will go next, rather than what they did last week.

At the FOMC meeting last week the Fed raised interest rates for the first time since 2006. This was a historic moment marks the first rate hike after the Fed engaged in massive quantitative easing programs to combat the Global Financial Crisis and the Great Recession. However, we are not economists or economic historians. We run a trading service and are therefore concerned with where the markets will go next. This means that our key point of analysis is around where rates will go next, rather than what they did last week.

We were short gold going into last week’s FOMC meeting, but reduced our short exposure following the hike and consequent fall in gold. What happens with interest rates over the next year and beyond will determine how gold trades going forward. Therefore our analysis of the future of interest rates will be the most significant component in calculating the risk reward dynamics on potential new gold trades.

Connecting the Dots

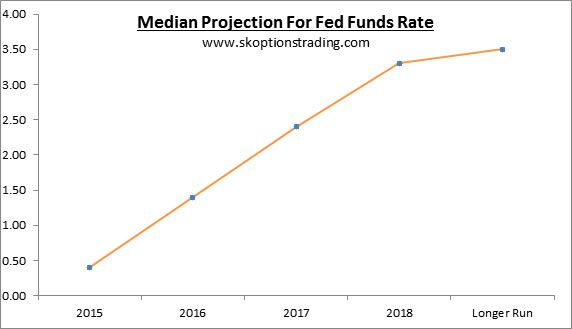

The FOMC meeting last week also included the release of the dot plot projections. These show where members believe key economic data series will be going forward, but also, and more importantly, show where members believe interest rates should be. These dot plots are thus vital for speculators in determining the future of interest rates.

The chart above shows how FOMC members believe interest rates over the coming years. The current implication is that rates will rise to 1.40% by the end of 2016, which would take four hikes of 25 basis points each. It is also implied that rates will rise another 100 basis points in 2017. If we believed that these projections would be realised, then we would be limit short gold. However, we instead hold the view that rates will in fact rise more slowly over the coming years.

Oil & ECB

These are two factors that will lead the Fed to tighten at a slower pace than the dot projections currently imply.

Lower oil has led to falling energy prices, but this is not the only reason falling oil prices have caused disinflationary pressures. Energy companies under financial stress have seen credit spreads widen and selling across the board in High Yield debt. This has increased the borrowing costs for the US corporate sector.

When this is combined with the fact that oil prices are lower, it is clear that new projects, particularly involving high cost shale, are becoming more and more unviable. This has hurt the jobs sector, which means that the multiplier effect must be considered. When the energy sector lays off or cannot hire a worker, that worker may not buy the new house they were looking at, which would have involved credit and a mortgage. This means that it is not just the salary that is lost, but future spending using borrowed funds as well.

The higher borrowing costs also in of themselves are likely to cause the Fed to hike at a lower rate. The widening credit spreads effectively increase interest rates for US businesses, which means it has the same effect as rates being higher. Therefore the Fed will not need to hike as fast as the effect of the hike will already be in play.

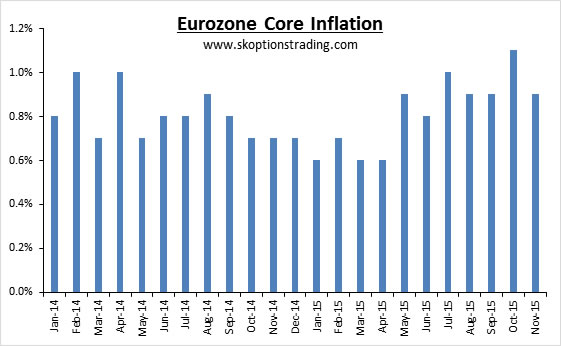

Moving across the Atlantic to the Eurozone, we believe that the ECB will have to embark on an expansion of their current QE program. Although the ECB recently lowered rates further, there is still a lack of inflation with core inflation also printing lower in the Eurozone. This means that further QE is likely to be needed and we believe that this will come early next year.

Such action will further weaken the Euro while strengthening the US dollar. This will generate more headwinds for the US economy by increasing the costs of US exports for foreign buyers, which will hurt the exporting sector and thus growth. A dampened growth rate will mean that inflationary pressures will be further limited, and therefore there will be less urgency for the Fed to hike.

Therefore it is likely that 2016 will see far less need for hikes than the Fed currently expects, so it is unlikely that we will see the projected 100 basis points of hikes.

No Christmas Catalyst

Now that the FOMC has passed and rates have risen, gold needs a new catalyst to move lower. However, there is little that can act as such a catalyst. The next payrolls print is not until January 8th, more than two weeks away, while other data prints are unlikely to move the metal lower. This means there is a significant amount of trading time wherein gold will be without a bearish catalyst.

There is instead the potential for bullish factors to push gold higher. Any type of risk off event will likely trigger safe haven buying in gold. Without a major bearish factor in play to counteract this, such an event would likely see gold rally.

We Sold The Rumour And Bought The Fact

There is an old market saying of “buy the rumour, sell the fact”. Often assets trade higher ahead of significant positive events, but then begin to selloff afterwards. Since the beginning of the bear market in gold the metal has often rallied ahead of FOMC meetings or payrolls releases, but then sold off once the event passed and was shown to be bearish for gold.

Earlier in the year some speculated that the Fed hike would come with dovish connotations. During this time we increased our short gold exposure, gaining very favourable entry levels. The speculation that the Fed would be more dovish led gold to rally up until the October meeting when the Fed signalled that they would hike in December, after which it began to selloff.

This decline continued until the rate hike was announced. Following this gold initially moved lower, but then began to recover and regained ground on Friday, and has the potential to continue this recovery with no bearish catalyst to keep the price falling. However, we reduced our exposure on the day of the rate hike by taking a 70.21% profit on a short GLD call spread position. This ensured that we avoided Friday’s rally and the risk of it continuing.

Enjoy The Holidays

Following a tough year for financial markets we will take a brief break over the holiday period before returning in 2016. Currently our portfolio is running light with a considerable 75% in cash. This allocation gives us sufficient dry powder to action new trades in the upcoming year and ensures that we do not have any unwanted exposure on the books.

Our model portfolio returned 28.86% on closed trades in 2015. While this has not our best year and we have come in below our 52.31% annualized return since inception, we are content to have outperformed both long and short positions on the markets we trade. 2016 will no doubt hold another round of fresh challenges and we look forward to the opportunities next year will bring. If you wish to read future articles or become a subscriber to receive trading signals as and when they are issued, please visit www.skoptionstrading.com.

Sam Kirtley

Email:bob@gold-prices.biz

URL: www.silver-prices.net

URL: www.skoptionstrading.com

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. Winners of the GoldDrivers Stock Picking Competition 200

Disclaimer: www.gold-prices.biz makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents our views and replicates trades that we are making but nothing more than that. Always consult your registered adviser to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this letter. Options contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. Past performance is neither a guide nor guarantee of future success.

Sam Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.