Stock Market December 2015: Into 2016

Stock-Markets / Stock Markets 2015 Dec 31, 2015 - 10:21 AM GMTBy: Donald_W_Dony

Bull market tailwinds continue to push the S&P 500 forward in 2016. Positive markers include the rising U.S. dollar, the trend of the U.S. Yield Curve, the on-going decline in unemployment and the steady upward trend in the U.S. Consumer confidence.

Bull market tailwinds continue to push the S&P 500 forward in 2016. Positive markers include the rising U.S. dollar, the trend of the U.S. Yield Curve, the on-going decline in unemployment and the steady upward trend in the U.S. Consumer confidence.

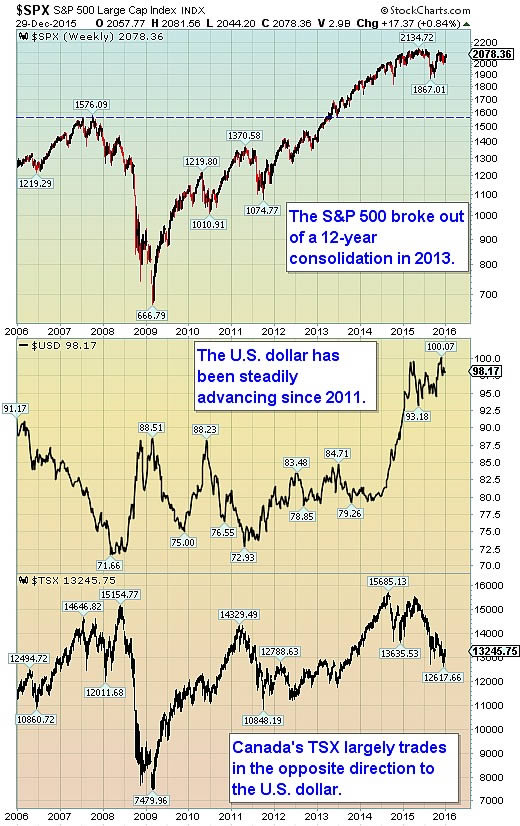

Over the past 40 years, the U.S. dollar has had a close relationship with the S&P 500.

In recent years, a rising dollar suggests the U.S. economy is improving faster than the other G9 economies. Indeed, unemployment in the U.S. is at levels not seen since 2000 and below the 60-year average of 5.83%.

The current unemployment level is 5.00%.

This rate compares to Euro zone's unemployment rate at 10.70% and Canada's at 7.10%.

The U.S. Yield Curve is another optimistic flag for 2016.

The Curve remains at a normal positive angle with short-term rates well below long term rates.

In comparison, in 2000 and 2007, the Curve was inverted meaning short-term rates were higher than longer term 20-30 year rates. When this inversion develops, the markets sharply decline.

Consumer confidence also plays an important role in the outlook for the stock market.

Consumer confidence is the largest single component of U.S. GDP equaling about 70%. The trend has been steadily advancing since 2011 bolstered by low inflation and higher income expectations (Chart 2).

However, the optimism in the U.S. is not being felt in Canada's TSX.

The rising U.S. dollar is having a negative impact on the large commodity component of the TSX.

Natural resources companies (energy, agriculture, mining and precious metals) equal over 30% of the weighting of the TSX.

As the U.S. dollar advances, it makes commodities more expensive and, therefore, less attractive.

Bottom line: The positive tailwinds continue to push the U.S. equity indexes forward in 2016. Key economic factors (U.S. dollar, the Yield Curve, unemployment and Consumer sentiment) suggest the the U.S. stock market has more room to advance in 2016.

Canada's TSX, with its large commodity component, is expected to be greatly constrained next year, although still in a modest upward trend.

We are anticipating a positive upcoming year for equity markets with a near-term target for the S&P 500 at 2,210, and 14,100 for the TSX.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2015 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.