Keep Alert for a Stock Market Breakdown

Stock-Markets / Stock Markets 2015 Dec 31, 2015 - 10:25 AM GMT SPX remains above its 50-day Moving Average at 2066.13. However, it may be finalizing a reversal pattern that may lead to lower prices. Keep an eye out for the breakdown.

SPX remains above its 50-day Moving Average at 2066.13. However, it may be finalizing a reversal pattern that may lead to lower prices. Keep an eye out for the breakdown.

ZeroHedge comments, “2015's stock market range (from high to low) is among the narrowest since World War II. This 'compression' has led the horde of asset-gatherers and commission-takers to suggest that stocks are a "coiled spring" ready to burst higher from this newly-formed permanent plateau. However, as S&P Capital IQ's Sam Stoval notes, that is the exact opposite of what to expect based on history. In fact a narrow range year is typically followed by a low return year, not a high return year.”

On a more positive note, VIX has broken above its resistance zone. It appears to be back-testing that area and may emerge above it again soon. Keep an eye peeled for it to re-emerge above its mid-Cycle resistance at 16.81.

TNX has made its reversal and appears to be back on a sell signal. This reversal comes hot on the heels of an “Ugly 7 Year Treasury Auction.” Thankfully, this is the last auction of the year, so it appears that yields are on the way down again.

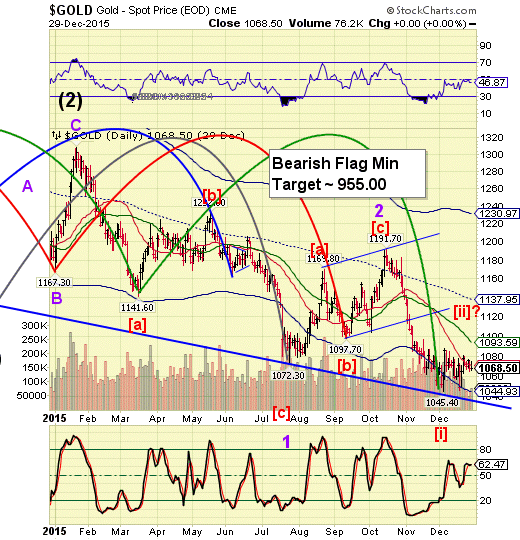

Gold may have started is decline again by losing Shot-term support at 1075.26. Currently the futures are priced below 1060.00 and appear to be sinking. This would be considered a sell signal from a neutral position.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.