ISM a Leading Indicator of Jobs? Why 2016 Will Shock to the Downside!

Economics / Employment Jan 06, 2016 - 05:35 PM GMTBy: Mike_Shedlock

ISM a Leading Indicator of Jobs?

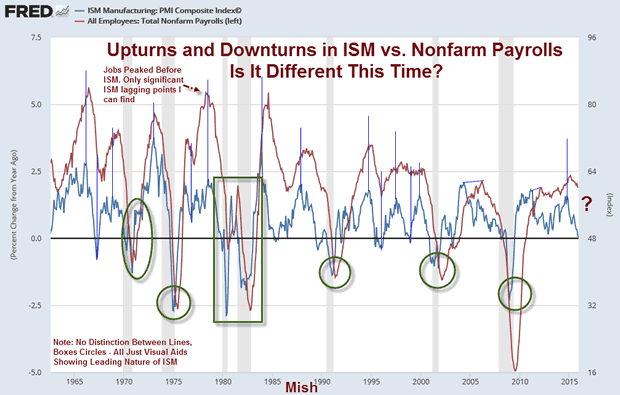

I expect monthly jobs reports in 2016 will shock to the downside. Before I list all the reasons, here's an interesting chart that suggests manufacturing ISM is a leading indicator of jobs.

The above chart plots percent change in seasonally-adjusted nonfarm payrolls vs. the seasonally adjusted ISM manufacturing index.

Looking at about 30 turning points since 1965, I can only find one key top or bottom where ISM did not lead jobs. Unless manufacturing turns here, 2016 looks to be a rough year for jobs, especially vs. expectations.

Why 2016 Will Shock to the Downside!

Manufacturing is not the only reason to think jobs will sour in 2016. Here's a litany of reasons of all the reasons.

- Manufacturing has been in an outright recession for nearly a year. Contrary to popular belief, production, not spending is the driver for growth.

- Housing is slowing. This was evident even before the construction revisions. Home prices are not affordable.

- Higher minimum wages that take effect in January in many states will act as a huge drag on hiring.

- Many big box retailers including Walmart and Macy's are struggling. Struggling retailers do not build as many stores as they would otherwise.

- Mall vacancies are rising.

- Corporate profits are under pressure.

- The strong dollar continues to hurt exports.

- Inventories have risen far more than sales. This will impact future hiring.

- Auto sales, a key component of spending took a hit in December. The auto party, fueled in part by subprime loans cannot last forever.

- Canada, the US's largest trading partner is in recession.

- Migration issues are straining European relationships. Spillover will affect global trade including trade with the US.

- Interest rates are rising even as GDP weakens. The treasury yield curve and Fed fund futures signal caution.

- Judging from the Chicago PMI, the service economy is weakening dramatically.

- Rent prices and the employee cost of Obamacare have outstripped growth in wages.

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2015 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.