Gold Bullion Retains “Key Role Of A Major Diversifier” – Dr Gurdgiev

Commodities / Gold and Silver 2016 Jan 15, 2016 - 02:32 PM GMTBy: GoldCore

- 2015 and start 2016 “worrying” for markets

- 2015 and start 2016 “worrying” for markets

- Gold’s long term performance strong in all currencies (see table)

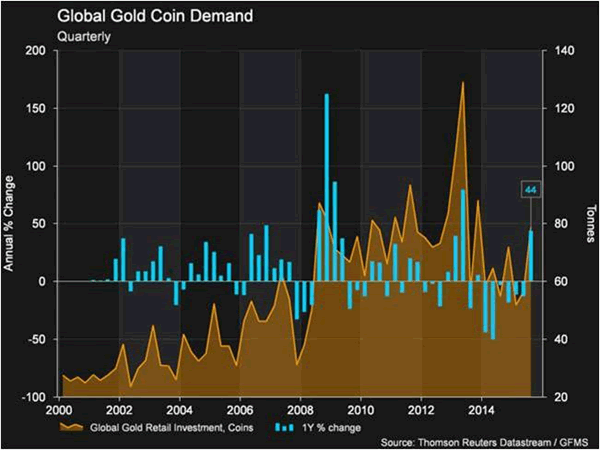

- “Improved performance in market for gold coins”

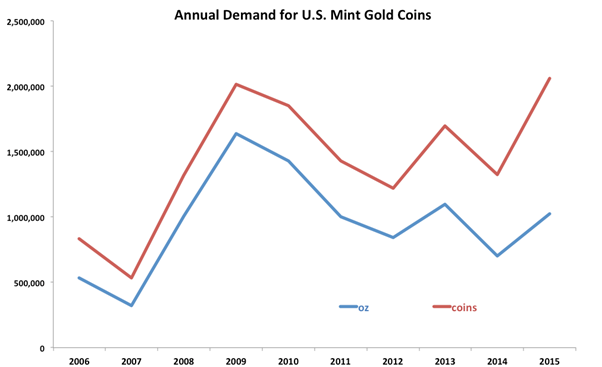

- “Demand for U.S. Mint issued gold coins rose 45.6% y/y in weight terms”

- “2015 the third busiest year over the last ten years”

- Gold has key role of a major diversifier in portfolios

2015 was a troubling year for the financial markets. Across currencies, commodities, equities and fixed income, full year performance was lacklustre in terms of aggregate returns and worrying in terms of risk metrics. Market volatility at the outset of 2016 suggests we are likely to see more volatility in 2016.

Source: True Economics and GoldCore

In contrast, gold performed relatively well, compared to other commodities, coming out of 2015 with negative returns more mild than those for silver, wheat, copper, and oil (both Brent and WTI). About the only major commodity that outperformed gold in 2015 was corn, with price downside in corn controlled by poor supply due to inclement environmental factors.

In dollar terms, gold was down 10.4% y/y through December 31, 2015, with last month decline of 0.3% m/m being comparable to the performance of the Barclays US Aggregate Bond Index. This ranked gold in dollar terms as 5th worst performing asset class across 21 broader class indices in yearly terms and 7th best performing in terms of December 2015 performance.

In simple terms, gold played reasonably well its historical function as a hedge against emerging markets bonds, emerging markets equities and broad commodities indices, as well as oil.

In addition, gold continued to act as a hedge against key currencies. As the result, as shown in the table below, gold performed strongly in terms of currencies that experienced significant devaluations against the USD, JPY and Euro, while suffering against core advanced economies’ currencies, with exception of AUD and CAD.

Gold’s defensive positioning was further confirmed by its resilience to volatility. As chart above indicates, gold price volatility (based on 26 weeks rolling standard deviations) continued to decline over 2015 compared to previous years. This stands contrasted with rising volatility in a range of other asset markets, especially in fixed income, and with improving performance over the course of the year – as contrasted by the global equity markets that witnessed some 48 national stock markets indices falling into a bear market over the course of the year.

Through December 31, 2015, ex-US Emerging Markets bonds were down 5.5% y/y, repeating negative returns over 1, 3 and 5 year horizons, while ex-US corporate bonds were down 9.8%. High yield corporate bonds (ex-US) fell 9.3% while US high yield paper was down 5%. In equity markets, MSCI EAFE (index covering Advanced Economies equities ex-US) was down 0.8%, with negative returns accelerating in 4Q 2015, while Russell 3000 (broadly based US equity index) was up only 0.5% y/y, albeit down 2.1% in December compared to November. Similarly, S&P 500 managed to end the year on a weakly positive note, rising 1.4% y/y, while falling 1.6% m/m in December.

In line with other asset classes, Bloomberg Commodity index covering broad range of global commodities was down massive 24.7% y/y, with December monthly fall-off measuring 3.1%. The Index is now down 17.3% over the last 3 years and 13.5% over the last 5 years. While index components were generally in the red across all commodities, crude oil (WTI) was the general underperformer within the commodities class, falling 30.6% y/y in 2015 and down 26.1% over the 3 years through December 2015, as well as down 16.2% over the last 5 years.

The theme of defensive positioning of gold holdings in diversified portfolios was reinforced by improved performance in the markets for gold coins.

The above was driven primarily by robust demand in the advanced economies where gold coins serve as traditional store of wealth functions for longer term savers and as a vehicle for inter-generational wealth transfers by retail investors (see What Gold Coins Sales Tell Us ).

Chart below shows full year demand for American Eagle and Buffalo Gold coins. Over 2015, demand for U.S. Mint issued gold coins rose 45.6% y/y in weight terms, making 2015 the third busiest year over the last ten years. Average coin sold in 2015 contained 0.5 oz of gold, representing the lowest average since the series for Buffalo coins became available in 2006. This signals more prominent role in the market for U.S. Mint coins from smaller retail investors – a sign of continued interest by savers in Gold coins.

Hence, overall, gold prices evolution over 2015 closely tracked both global macroeconomic and markets trends, allowing gold to retain some of its core defensive and hedging properties vis-à-vis global currencies and fixed income, as well as oil and a range of other commodities.

Declining volatility trend, present from 2012 on is further reinforcing the argument that gold retains a key role of a major diversifier in well-structured retail investment and pension portfolios, despite continued pressures on spot prices.

by Dr Constantin Gurdgiev

Sources:

Seeking Alpha: Major Asset Classes: December 2015 Performance Review

Reuters: 2016 Insights: Gold and Silver

True Economics

Precious Metal Prices

15 Jan LBMA Gold Prices: USD 1,081.80, EUR 991.38 and GBP 753.17 per ounce

14 Jan LBMA Gold Prices: USD 1,090.75, EUR 998.03 and GBP 759.10 per ounce

13 Jan LBMA Gold Prices: USD 1,081.80, EUR 1,000.00 and GBP 749.04 per ounce

12 Jan LBMA Gold Prices: USD 1,094.95, EUR 1,008.76 and GBP 756.92 per ounce

11 Jan LBMA Gold Prices: USD 1,104.70, EUR 1,014.08 and GBP 758.18 per ounce

8 Jan LBMA Gold Prices: USD 1,097.45, EUR 1,009.86 and GBP 750.67 per ounce

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.