Gold Price in 2016

Commodities / Gold and Silver 2016 Jan 15, 2016 - 05:10 PM GMTBy: DeviantInvestor

We all know that gold prices in US dollars have been in a downtrend for about 4.5 years.

We all know that gold prices in US dollars have been in a downtrend for about 4.5 years.

We all know that gold prices rise, on average, as the underlying currency declines in value. Gold in the US was priced under $21 per ounce when the Federal Reserve was established. Since then the dollar has been devalued and gold has increased in price by a factor of about 50.

It is the same story around the world, whether you evaluate in terms of British pounds, euros, rubles, yen, or any other debt based fiat paper currency.

So what are gold prices today and what will they be in the next two years?

- As I write gold is priced at about $1,100, down over 40% from its all-time high but more than $50 above recent lows.

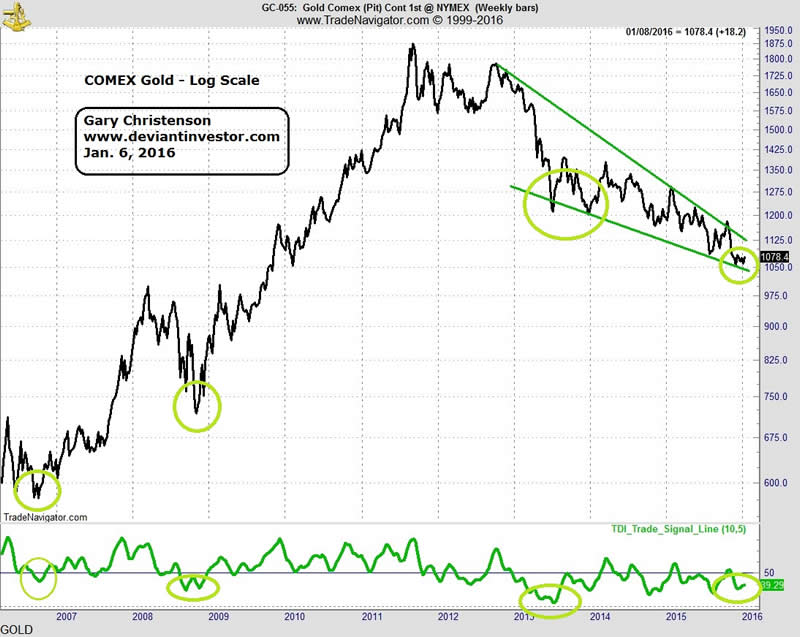

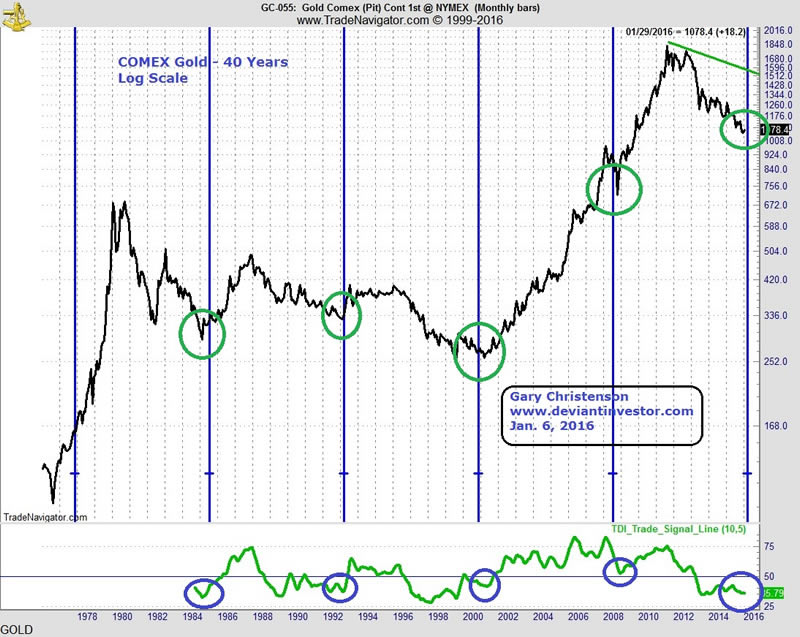

- Gold prices – paper gold prices established on COMEX – are oversold weekly and monthly. The next big move is likely higher. See charts below.

- Global debt exceeds $200 Trillion. Central banks will borrow currencies into existence to support overspending by their governments, devalue their currencies, and do whatever they believe is necessary to support a wobbly financial system. Expect more devaluations and higher gold prices in fiat currencies.

The vertical purple lines on the monthly chart are spaced about every 7.5 years, approximately marking lows in 1985, 1993, 2001, 2008, and 2015. Gold prices are currently in the zone for an expected cyclic bottom. In our central bank managed financial system, we should NOT rely upon cycles, but we should not ignore them either.

- Cycles indicate gold prices are in the time zone for a low.

- The purple ovals at the bottom of the monthly chart on the TDI indicator show that monthly gold prices are oversold and due for a bounce.

- The light green ovals at the bottom of the weekly chart on the TDI indicator shows that weekly gold prices are oversold and due for a bounce.

Other Considerations:

- After multiple promises about “no boots on the ground” the US now has boots on the ground in Iraq, Syria, and over 100 other locations. A large military is expensive and must be supported by debt, deficits, taxes, and promises. Expect more dollar devaluation.

- US government expenses are out of control – currently around $4 Trillion per year – and going higher. Revenues lag expenses. Expect more debt, deficits, promises and dollar devaluation.

- The US stock market is rolling over in its 7+ year cycle. The recession and stock market losses will hurt the economy and US government revenues. Expect more debt, deficits, promises and dollar devaluation.

- “Regression to the mean” suggests gold will correct higher and the S&P will correct lower. The correction in both is in process.

- China, India, and Russia are trading dollars and bonds for gold. They want physical gold, not paper promises such as COMEX gold contracts. They know the truth – gold thrives, paper dies.

- Global banks have created and profited from the creation of about a $1,000 Trillion in derivatives. This has been good for bank profits and bonuses, BUT … what could go wrong? Is your bank at risk? Your pension fund? Will physical gold and silver even be available to buy when it becomes devastatingly clear in 2016 – 2017 that we need it as insurance and as a store of value to protect from devaluing fiat currencies?

Gold Valuation Model:

Harry Dent thinks gold prices may drop to $250. In a hyperinflation, gold prices could easily exceed $10,000. What should we believe? My solution was to create a valuation (not a timing model) model for gold prices, which I published over a year ago. Since 1971, using moving-average smoothed prices, the valuation model had a 98% statistical correlation with actual smoothed gold prices. The model tells us that a “fair” value for gold in 2015 is $1,200 – $1,300. Gold prices on COMEX are too low today.

The model is based on US national debt (massive and exponentially increasing), the S&P 500 Index (rolling over) and the price of crude oil (bottoming – I think). The model indicates gold prices should be valued much higher in the next several years — UNLESS you think national debt will flat-line or decrease, the S&P 500 will rally much higher, and crude oil prices will stay at currently depressed levels for several more years.

CONCLUSIONS:

- Gold prices are in the time zone for a 7 year bottom. Buy for insurance.

- Gold prices are oversold on a weekly and monthly basis and indicate higher prices are likely. Buy for insurance.

- The financial world is more unstable and dangerous each day. War is escalating globally. Economies are rolling over into recession. Derivatives …. much could go wrong. Buy gold for insurance.

- Central banks will devalue their currencies as certainly as the sun will rise and politicians will make promises they do not intend to keep. Buy gold for insurance.

- My gold valuation model indicates gold prices are too low.

- Gold (and silver) are insurance to protect from devaluing currencies, central bank manipulations, deficit spending, massive unpayable debt, and politicians pushing their countries into expanded wars. We need such insurance.

Gold thrives, paper dies!

Gary ChristensonGE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

My books are available on Amazon and at gechristenson.com

- “Gold Value and Gold Prices From 1971 – 2021” (gold valuation model)

- “Who Killed Doctor Silver Cartwheel?” (silver demonetization and future prices for silver)

© 2016 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.