Financial Crisis in the Making that QE-4 Can’t Stop!

Stock-Markets / Financial Crisis 2016 Jan 20, 2016 - 08:42 AM GMTBy: Chris_Vermeulen

The “Great Credit Crisis” of 2007 led to “The Great Recession”, and yet the FED still repeated the same mistakes. The FED kept the “easy money” policy in effect, and not only that, but, it also introduced “Quantitative Easing” and handed over FREE money to the large banks and corporations. Apparently, they have not learned anything from the last crisis and it looks as though they are on the path of pushing the economy into a deep recession, again. The dangerous part about this, is that they have already used up all of their ammunition, and there is now none left. In order to deal with the forthcoming “financial crisis” that we are presently facing in 2016.

The “Great Credit Crisis” of 2007 led to “The Great Recession”, and yet the FED still repeated the same mistakes. The FED kept the “easy money” policy in effect, and not only that, but, it also introduced “Quantitative Easing” and handed over FREE money to the large banks and corporations. Apparently, they have not learned anything from the last crisis and it looks as though they are on the path of pushing the economy into a deep recession, again. The dangerous part about this, is that they have already used up all of their ammunition, and there is now none left. In order to deal with the forthcoming “financial crisis” that we are presently facing in 2016.

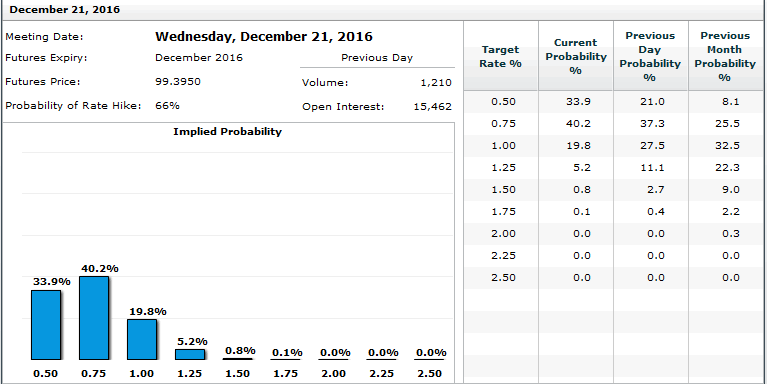

How Wall Street led the US Fed to do what it wants:

The chart above is self-explanatory. It is very clear from the chart above, that throughout, Wall Street has dictated what it wants and the FED has obliged. Each rise has been supported by the FED. This indicates that the “real economy” never recovered in order to support the lofty valuations of the SPX, while all along, it was merely the “easy monetary policy” which kept the markets “elevated”.

The markets are again prodding the FED and other bankers to act:

The markets are once again taunting the FED. Sources indicate that some FED governors are already voicing concerns that raising rates were a mistake. However, many believe that, if the market continues to fall, which it will, it is only a matter of time before the FED announces new measures in order to support the markets.

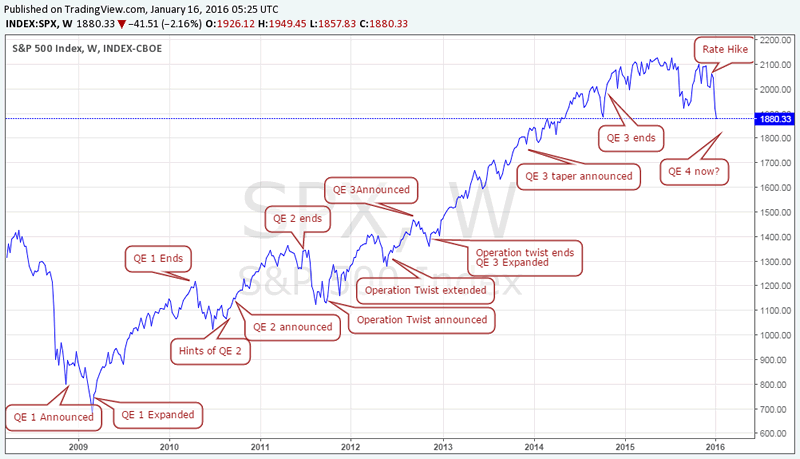

Why the rate cut will not sort out the problem:

The above chart shows the growth of the American economy from 2006 and onwards. After the initial recovery from depressed levels, “real growth” has never taken off. The growth keeps slipping into negative territory which indicates that the QE and the rate cuts have not benefited the “real economy”. All of the benefits have been accrued by the bankers and stockholders of publicly traded corporations.

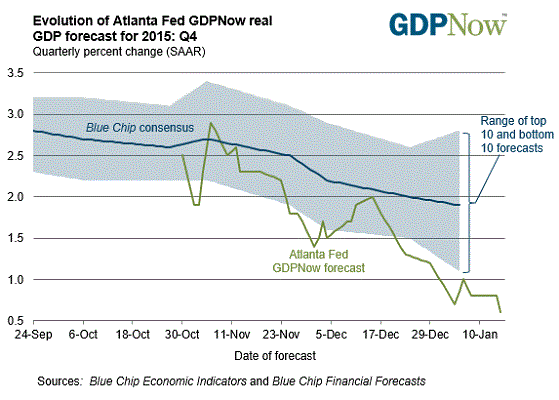

What are the latest GDP forecasts ?

According to the chart above, the records for 2015, Q4, real GDP is down The trend continues to fall, making the economic outlook appear dismal, in the upcoming financial quarters.

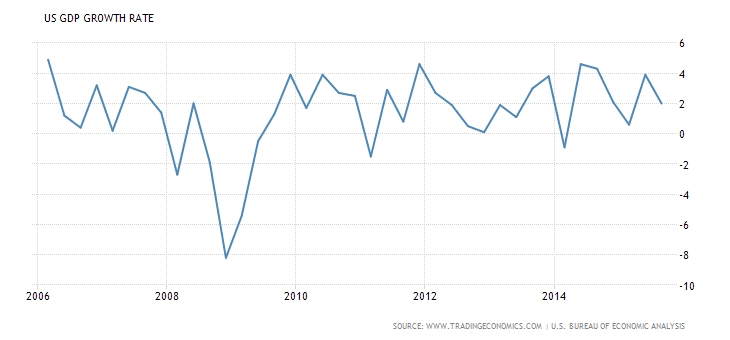

The Fed Fund Future suggests a minor hike ( if any in 2016):

The market participants have already toned down their expectation of any FED rate hikes occuring in 2016. As many as 33.9% of people believe there will be NO HIKE, however, the number is likely to rise within the coming few weeks. I believe that instead of any rate hikes, the FED will be looking to correct their mistake of raising rates, while the world economy was/is still “fragile”.

The San Francisco FED President John Williams, admitted, “We got it wrong” (in reference to the earlier statements by FED officials regarding oil being good for the economy).

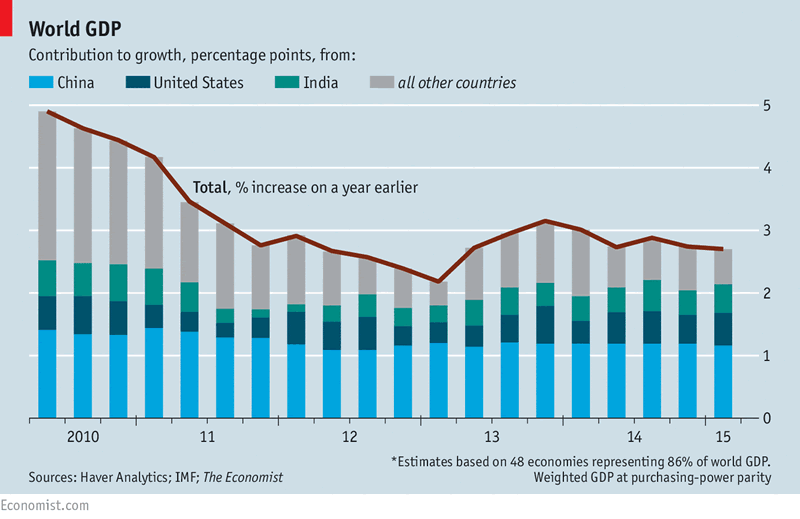

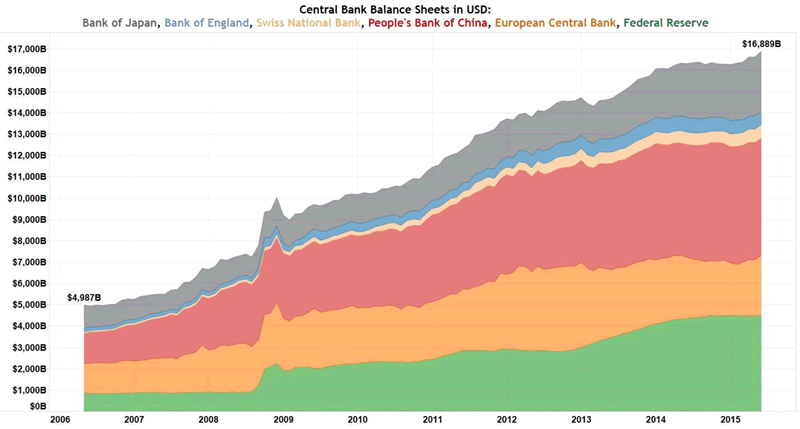

Is the FED the only one who has followed “easy money policy ?”

No! Along with the US FED, the ECB, the Bank of Japan, People’s Bank of China, the Bank of England and various other nations, have resorted to maintaining an easy monetary policy, for far too long. Presently, it is impossible to correct the original forces that created these problems, many years ago.

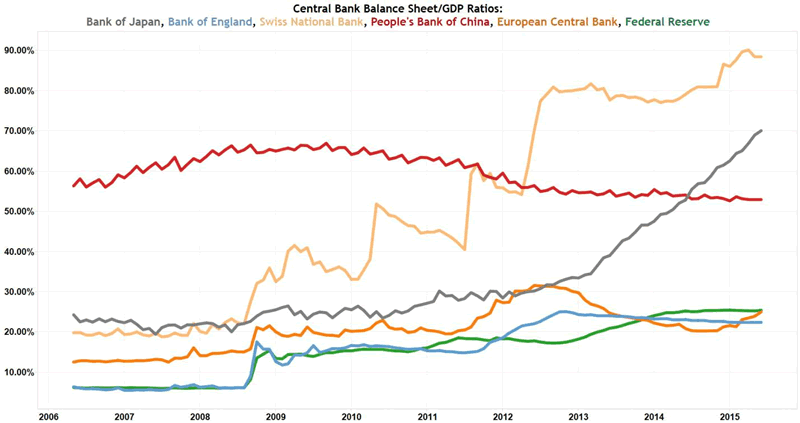

Compare the expansion of the balance sheet of the respective central banks with their GDP, the numbers are freighting!

Even with concerted efforts of the entire world, the world growth is struggling and going into “economic contraction”. With China likely to continue to enter into a slow growth trajectory, US forecasts are also reflecting a slowing growth. Chances are extremely high that the growth in 2016, is going to be much lower than what has been currently reported.

“The Global Reset”

The world leaders as well as the central banks, around the world have merely placed a bandage on their bleeding economies rather than enduring the pain, and pumping money into the “real economy” to generate long-term growth, they have opted to appease the stock markets, thus, creating a large “Asset Bubble”, today. The outcome of their actions, have placed the world economy in jeopardy, which is evident by the collapse of the commodity markets which are being lead down by collapse of oil and currency wars among nations, etc.

The only way we can get out of this predicament is to do what is now required, and let the markets implement “The Global Reset”. Growth has always returned to the economy after the excesses have been ironed out.

Conclusion:

It is going to be a sordid year for the stock markets! The US markets have just finished their worst two weeks of the New Year that have ever been recorded. This is an indication of what is to come in 2016. The FED is likely to panic and try to correct their past mistake of raising rates, of last December 2015. They will most likely do whatever it takes, but this time, the markets will not be receptive to their actions, mostly.

The best investments are going to be in gold and US Government Bonds, which I will share in my next post. Continue to follow my analysis and trade signals so as you know when the best time to invest in them is, and how to invest in them, SUCCESSFULLY.

Join Fellow Trades and Myself at: www.TheGoldAndOilGuy.com

Chris Vermeulen

Join my email list FREE and get my next article which I will show you about a major opportunity in bonds and a rate spike – www.GoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.