Gold And Silver Current Prices Do Not Matter

Commodities / Gold and Silver 2016 Jan 30, 2016 - 04:17 PM GMTBy: Michael_Noonan

Truth be known, short of an uprising or revolution by the masses, which is highly unlikely, the elites have won over the masses, hands down, and the end game is in the final and irreversible stages. Time and again, we have reiterated the elites formulaic strategy of Problem, Reaction, Solution. The most current is the outrageous Mid East refugee situation where European countries are being forced to accept hundreds of thousands of displaced refugees from the war-torn Middle East.

Truth be known, short of an uprising or revolution by the masses, which is highly unlikely, the elites have won over the masses, hands down, and the end game is in the final and irreversible stages. Time and again, we have reiterated the elites formulaic strategy of Problem, Reaction, Solution. The most current is the outrageous Mid East refugee situation where European countries are being forced to accept hundreds of thousands of displaced refugees from the war-torn Middle East.

It is no secret that the US has been covertly responsible for much of the destruction and strife in that area. Where not covertly involved, the US has provided arms and logistics to Saudi Arabia as the Saudis are destroying helpless Yemenis in the proxy war against Iran.

None of the bought-and-paid-for Western press is questioning how and why, all of a sudden, Middle Eastern refugees have the money and means to escape to various parts of Greece and Europe, en masse. How is it that black Africans were never able to be in a position to migrate from far worse war atrocities? Unseen forces are behind this.

Problem, refugees, Reaction, growing antagonism of Europeans justifiably against the rabble rousing, sexual assaulting of women, robbing trucks on highways, etc, etc, etc, creating instability in an already weakened EU. The Solution is yet to come, but you know it will entail further weakening of individual freedom and eroding of the ability of individual countries to protect against this politically motivated destabilization of Europe where the elites will strengthen their stranglehold over Europeans via the artificially created European Union.

Banks, and now select individual countries, are increasing the call for getting rid of cash altogether, ostensibly to fight terrorists who use cash, the prevention money laundering, and a few other nefarious reasons. The terrorists also use cell phones, but there are no plans to ban cell phones, and perhaps the biggest money launderers, by far, are large banks dealing with drug money to keep their banks afloat. However will the CIA launder all of its drug money from Afghanistan being funneled to support groups like al Qaeda and ISIS?

Guess what happens when cash disappears and all so-called "money" becomes digital?

The elite's bankers now keep track of every single transaction you make, where and how you spend your digital "currency." Banks will have a ledger for everyone on which all inflows and outflows of funds are tracked.

"Now that we track and control your money, it would be better if we just deduct all taxes directly from your account," say the bankers.

"Is there some reason why you are spending your money on gold and silver? Did you not know these are transactions not favorably looked upon?"

Control. It is all about control. Get rid of cash. Get rid of all means of hiding anything from the Orwellian elite governments. Should your spending activities raise questions, or if you hold any kind of dissenting political views, you may find there was an inexplicable computer glitch, and your account has been frozen, or simply disappeared. Try feeding and providing for your family under those conditions.

If you do not have, and literally hold gold and silver, or you are waiting for the "right" or a "better" price, how relevant is your reasoning "stacked" up against the increasing odds of what is yet to come? Privacy? You will have none. Right now, governments cannot track whatever gold/silver people hold, and that is unacceptable and it will change.

If anyone thinks China and the BRICS nations are going to be a counter move to the Western globalists, think twice. China will become to the elite's East to what the US has been to the elite's West. Now that the elite's controlling bankers have sucked the wealth out of the US and Europe, China becomes their agenda for the next 100 years, or more. Rinse and repeat.

China has had a relationship with the Rockefellers for decades. Many Fortune 500 companies have been doing business with China since the late 1980s, early 1990s, and to date. China has been vying to become a member of the IMF for over a decade. What more elite-driven a financial tool is there than the IMF, controlled by the Bank for International Settlements [BIS, the central bank for all Western central banks]?

China has developed a social behavior card for each and every Chinese citizen to monitor their citizen's behavior, much like a report card. Citizens will be graded and/or held accountable for the contents of their behavior code, ensuring each good little citizen is conforming to the Chinese model of what constitutes acceptable behavior and attitudes.

China and the BRICS will not be a part of the solution. They will become a greater part of the problem. Anyone who thinks China's massive purchases of thousands upon thousands of tons of gold is for an eventual gold-backed Yuan is not keeping in touch with reality.

China does subscribe to the tenet of the Golden Rule, in that he who has the gold, rules. China wants to rule, not be the world's policeman against the globalists.

In addition to a social behavior card, China is also developing its own digital currency.

From the People's Bank Of China:

The People's Bank attaches great importance from 2014 to set up a special research team, and in early 2015 to further enrich the power of digital distribution and business operations monetary framework, the key technology of digital currency, digital currency issued and outstanding environment, digital currency legal issues facing the impact of digital currency on economic and financial system, the relationship between money and the private digital distribution of digital currency, digital currency issuance of international experience conducted in-depth research, has achieved initial results. [Our emphasis]

This effort is being conducted in concert with the international agencies, foreign financial institutions, and traditional credit card entities. Christine LaGarde, head of the globalist's IMF, has embraced this means of virtual currencies.

Welcome to our world, China. Rule or be ruled. That choice was made long ago.

What possible relevance can there be to the current artificially suppressed price for gold and silver, in light of all that is going on around the world in full view, with no attempts to hide either motive or intent?

If you do not have, or are planning to purchase gold and/or silver, price is not the issue.

It is personal and financial survival at risk, and the globalists take no prisoners. Under this scenario, it is better to be a year, even two too early, than a day too late. We are just scratching the surface for reasons why world enslavement may not be far-fetched, or even far off.

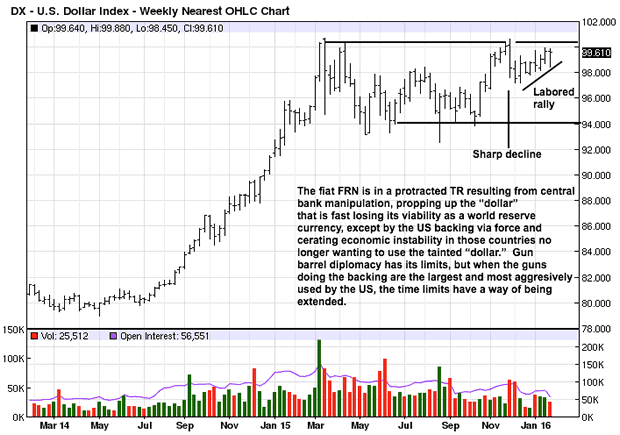

The US military might and Federal Reserve continue to keep the fiat FRN propped up.

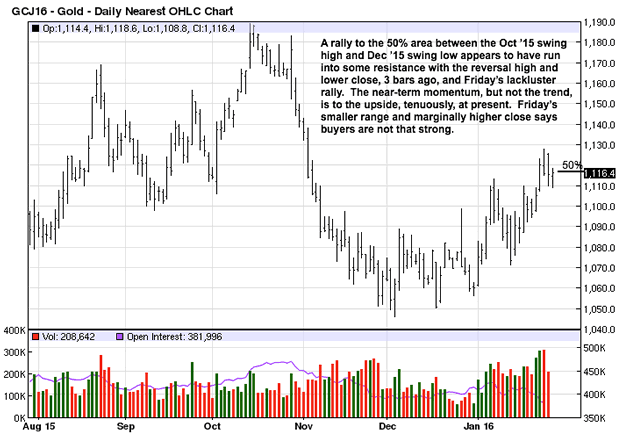

The developing activity, seen in the weekly TR, could be setting the stage for a final gasp to the upside, or the globalists are losing control sooner than expected, and we are seeing a distribution phase. In artificial markets, it is unreasonable to be reasonable in reading a chart with a greater degree of reliability.

The sharp decline, week of 30 Nov '15 noted on the chart, shows greater EDM [Ease of Downward Movement], particularly compared to the labored rally over the next eight weeks. In a strong up trend, ease of movement should be up, and reactions down more labored, so while nearing recent highs, the market is not internally strong.

If a new high is to be had, it could be short-lived, but this is not an interpretation for picking a top, just seeking context in this fiat.

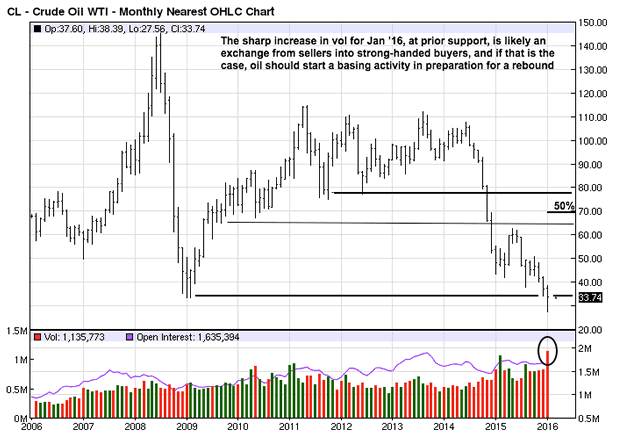

Beyond gold and silver, the next keen interest, maybe even greater than gold and silver, is oil. The highest monthly volume occurred at an area of support. More than once, we say that increased volume comes about from what we call smart money, controlling market interests. Smart money buys low and sell high, trite but accurate. There is a growing likelihood that this could be the start of a base or rapid turnaround rally in oil. If a base, a nominal lower low is possible, but price may find more support at current levels.

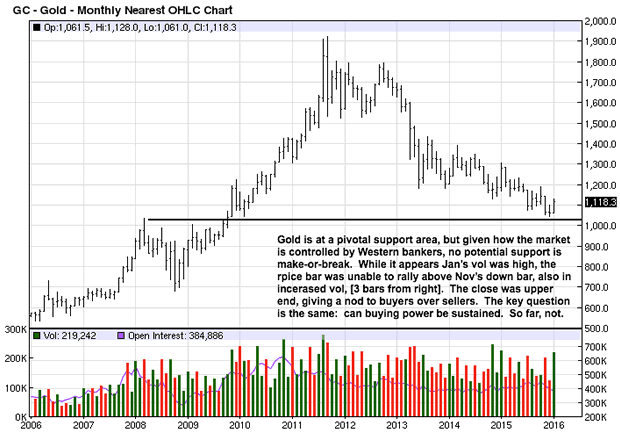

Viewing these PM charts in a vacuum, ignoring many of the existing factors evolving around the world, a few of which we covered above, absent a surprise sustained rally, gold is not indicating a turn around in its current down trend. It is at an area where some basing can be expected, but there is not sufficient positive activity to say it is happening.

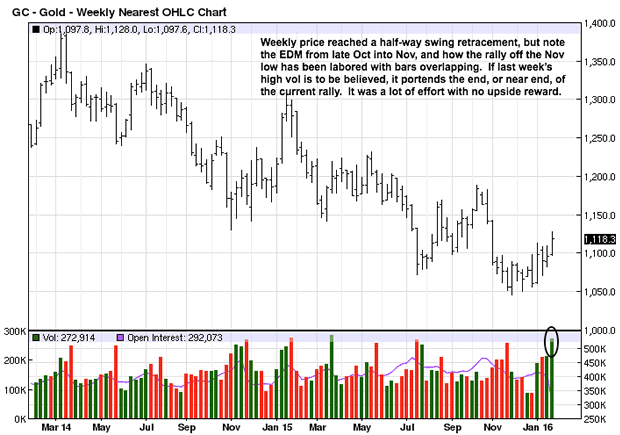

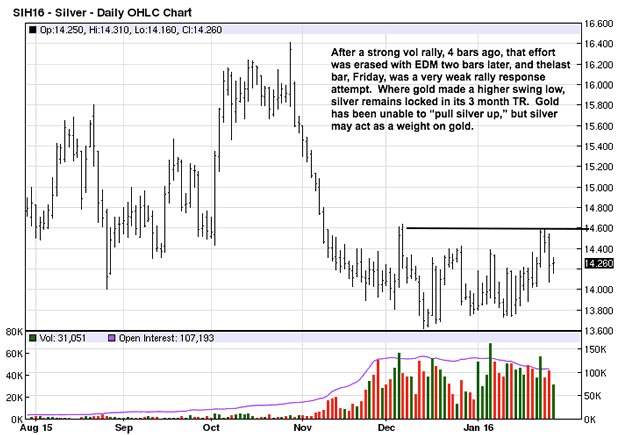

As with the analysis of the fiat FRN, there was a shape EDM at the end of October going into November, and the ensuing rally off the November low has been labored with bars overlapping, indicative of a lack of buyer control. The last volume can be troublesome.

For all of that buying effort, the range of last week's bar was small. The reason for that is sellers were meeting the effort of buyers and prevented the range from extending higher.

The daily activity supports what the weekly chart shows in potential weakness. For the paper market, it is too risky to pay up and buy into a rally, at this early stage. We need to see more evidence that buyers are gaining control.

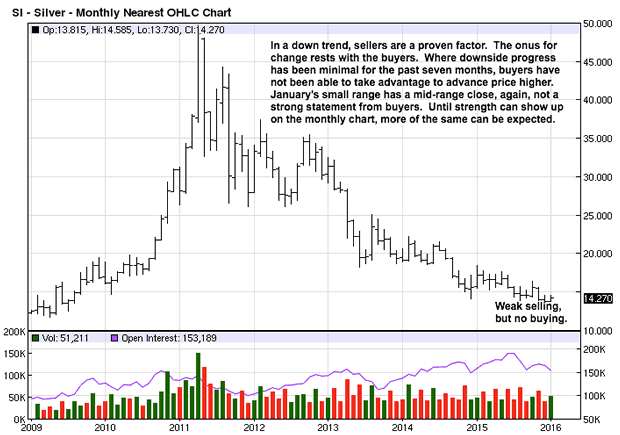

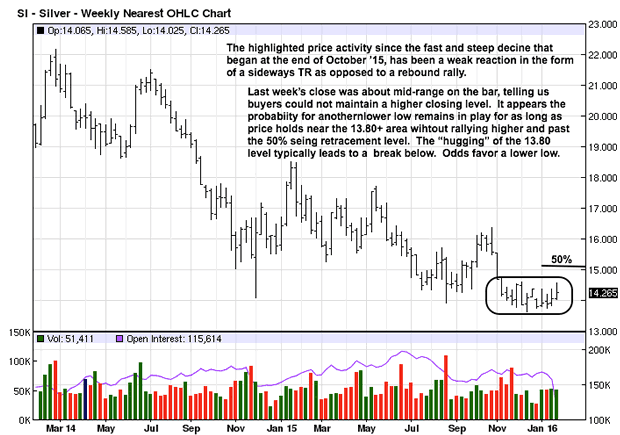

Sellers have ceased making any meaningful gains lower in silver, not surprising given the ultra bullish fundamentals, and that may be the reason. However, we read charts without consideration to underlying fundamentals. The premise is all considerations have already been taken into account, is a known factor, and has been priced in. For as little downward direction sellers are making, buyers are totally unable to take advantage and push price higher. Until you see such change where rally bars have a wider range and strong closes on strong volume, silver remains stuck at these levels.

We look for synergy between the various time frames, and the weekly supports what the monthly chart conveys. There has been no meaningful rally over the past three months, and price remains well under a 50% retracement, a general guide to lack of market strength.

All three time frames tell the same "story" of weakness, an inability to rally above TR resistance. Trading ranges are hard to analyze, so we leave this one alone, other than to reiterate is stems from weakness and shows no internal strength.

There are no reasons to buy paper gold or silver. The reasons for buying and holding physical gold and silver are more compelling than ever, and we expect those reasons to become even more compelling. Price is irrelevant and way, way undervalued.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2016 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.