Currency Wars and a Job Gain Recession?

Economics / Currency War Feb 04, 2016 - 05:32 PM GMTBy: Mike_Shedlock

I am entertaining the notion of a "Job Gain Recession".

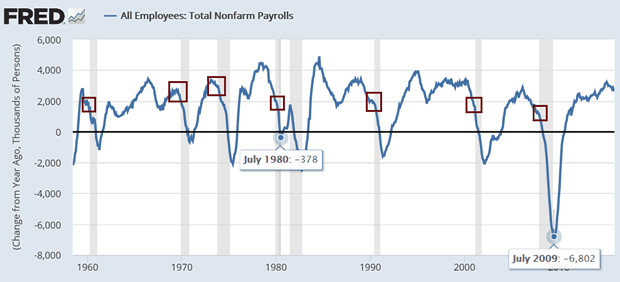

A chart of year-over-year nonfarm employment shows that's nearly what happened in the 1970 and 1980 recessions.

Nonfarm Payroll Job Losses

Jobs a are a horribly lagging indicator. Recessions invariably start with the economy adding jobs as noted by the red squares in the above chart.

Job losses in recessions vary widely. At the deepest point of the 1980 recession, the maximum year-over-year loss in nonfarm jobs was only 378,000. In contrast, the economy shed 6.8 million jobs in the 2007-2009 "great recession."

The peak of the job losses in most recessions is after the recession is over.

What Would a Job Gain Recession look like?

- Reduced hours, especially for part-time employees.

- Workers might lose just one of two part-time jobs making them ineligible for unemployment insurance.

- Corporate earnings take a huge hit as companies cannot shed enough employees.

- Stocks get trashed in the earnings hit.

- Yields on government bonds sink to new lows.

- Yields on corporate bonds rise with increasing default risk.

- Consumer price deflation would again come into play as consumers further cut into spending.

- Rate hikes would be the last thing on the Fed's mind. Cuts would be likely.

- The Fed would strongly consider negative rates even though negative rates would make the situation worse.

- In terms of job losses, this would look like a "mild recession", but it would wreak havoc on the financial system, especially leveraged players.

Serious Risk of Major Currency War

The Fed not hiking as much as expected would pressure the US dollar, at least in isolation. But the ECB, Bank of Japan, and Bank of China do not want to see their currencies rise.

The other central banks would likely counter with beggar-thy-neighbor devaluation tactics to weaken their currencies. And the risk of an all-out currency war of some kind would certainly come into play.

Gold would rate to do very well in such an environment.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2016 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.