How Pension Plans are Responding to Financial Repression

Personal_Finance / Pensions & Retirement Feb 05, 2016 - 07:08 AM GMTBy: Gordon_T_Long

In this 35 minute video, Chief Executive of CREATE-Research, Amin Rajan discusses investing in the age of financial repression as well as key points for risk mitigation with FRA Co-founder Gordon T. Long. CREATE-Research is a a network of prominent researchers undertaking high level advisory assignments for governments, global banks, fund managers, multinational companies and international bodies such as the EU, OECD and ILO. In 1998 Amin was awarded the Aspen Institute's Prize in leadership. It is a subject on which he has done extensive research involving some of today's outstanding business leaders. In two resulting publications, he has developed a close link between leadership and the emerging business models.

In this 35 minute video, Chief Executive of CREATE-Research, Amin Rajan discusses investing in the age of financial repression as well as key points for risk mitigation with FRA Co-founder Gordon T. Long. CREATE-Research is a a network of prominent researchers undertaking high level advisory assignments for governments, global banks, fund managers, multinational companies and international bodies such as the EU, OECD and ILO. In 1998 Amin was awarded the Aspen Institute's Prize in leadership. It is a subject on which he has done extensive research involving some of today's outstanding business leaders. In two resulting publications, he has developed a close link between leadership and the emerging business models.

As well as appearing on radio and television regularly, he has contributed feature articles to The Financial Times, The Guardian, The Sunday Times, and The London Evening Standard and IPE. He has published reports and articles on leadership, business cultures, strategic change, globalisation, new technologies, and new business models. He has presented the results of his work at over 100 major events in the USA, UK and Asia-Pacific in the last five years. His expertise covers, amongst others, leadership and new business models in financial services. As an economist, he has held significant positions, including, Secretary; Economic Group, Cabinet Office, providing weekly briefs to the Prime Minister. And as a Forecaster; UK Treasury's Econometric Model, producing forecasts of key macro indicators.

"Financial repression results from a combination of low interest rates and rising inflation. Authorities are keeping interest rates low so they can manage their huge debt and furthermore they're attempting to spike up inflation as a means to eliminate this debt. This combination of low interest rates and rising inflation results in an arbitrary redistribution of wealth from investors to borrowers."

Pension Plans and Smarter Asset Allocation

Risk in equity markets are currently at their all time high. We have a lot of conviction-less trade which means people are taking high amounts of risk because they have no other choice. Under this new approach to asset allocation, a number of things are happening:

- They are taking much more risk in order to get higher return.

- Trying to look for uncorrelated assets

- Having a very broad diversification which covers different geographies, different asset classes etc...

- Practicing dynamic investing

In today's markets lucrative opportunities do appear but they vanish as soon as they appear which results in a tendency to capture value as soon as value appears. Pensioners have been pushed up the risk curve and as a result their main view is they ought to be as opportunistic as possible and get out at the first sign of concern. What they are essentially doing is rebalancing their portfolios much more now than they have ever done before.

Dynamic investing has become the norm in that you have to be very vigilant from where your returns are coming from, how quickly they're materializing and how nimble can you be in ensuring you are capitalizing on those returns. As a result of difficulties in seeking non-correlated assets, institutional investors are moving towards risk factor diversification. They are identifying various risks and are identifying various assets which allows them to compensate for that risk.

"Authorities are looking at all the factors which contribute to portfolio risk and undoubtedly the biggest risk at the moment is policy errors on the part of the Federal Reserve."

There are many risks lurking in the background, risks such as QE. The challenge is to construct a portfolio which factors in such risks. In the past there was tendency to go for stop-loss mechanisms or to go for options contracts, in order to protect the downsides. What we are finding now is there has been so much volatility in the market that many of these stop-loss mechanisms get activated from the wrong information.

Idiosyncratic Risk

"Idiosyncratic risk Deals with the fact correlation between asset classes is very difficult to avoid which essentially makes diversification seemingly ineffective."

We find that all asset classes are highly inflated in values simply because of central bank action. We find that the real returns come from finding individual opportunities at the most micro level. Idiosyncratic risk is about looking at very specific investment opportunities, assessing their risk parameters and making a decision to act upon it or not. These broad brush approach ways in investing just do not work; you have to be much more specific. It is about understanding the risk parameters about specific investment opportunities and understanding what are the inherent risk and opportunities and figuring out how to minimize the risks while maximizing the returns.

"Growth is what everybody is looking for and it is truly what keeps people awake at night."

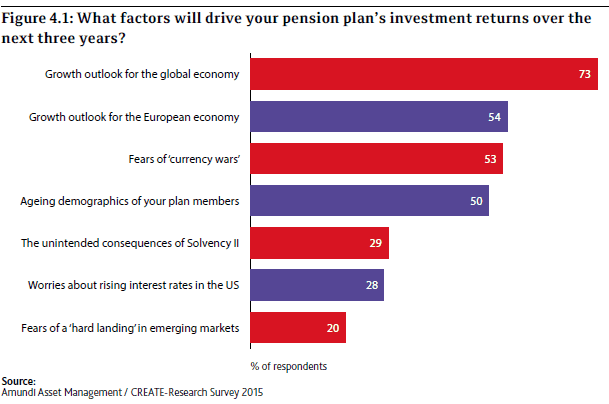

In regards to figure 4.1, what we try to do before asking investors about their asset allocation approaches, we try to find out what they think will be driving the markets over the next 3 or so years. The most common response we got was growth in global outlook and growth in the European economy. There are worries about currency wars, since the beginning of last year we have had 25 nations around the world that have devalued their currencies. Things like aging demographics are having major effects on pension plans because due to the baby boomer generation a mass influx of people will be coming into retirement, and this will dramatically change the asset allocation of pension plans or of individuals who are managing their own funds.

QE programs inflated asset values for both equities and bonds and that saved the day. Now we are in a situation where these asset values are not sustainable in light of economic performance from the last two years or so. We hope that growth will resume, we hope that the situation in China and Japan improves and so on. But if these conditions do not happen we will be in a situation where the current valuation will be very hard to sustain and we could be looking at another major correction.

"Growth has slowed down everywhere. In Europe and Japan we are talking about another round of QE. The biggest worry in all this is that this drug of QE worked in the beginning but for it to work again we have to come out with bigger and bigger doses."

The Goals of Pension Plans

"They key is to try and be a smart investor, don't continue old trends because that is a recipe for disaster."

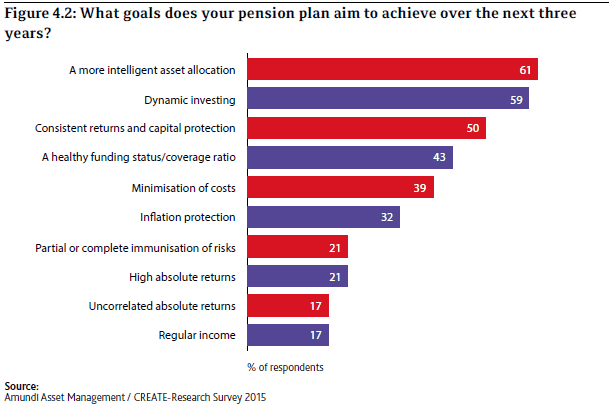

Four key ideas that pension plans have is:

- Don't follow the herd: Have an intelligent asset allocation. Engage in asset allocation which firmly addresses your long term liabilities.

- In so far as long as good returns will come from idiosyncratic forces try to engage in dynamic investing. Identify opportunities, identify value traps, know the difference between the two and take advantage whenever opportunities arise.

- Go for consistent returns and capital protection: If pension plans experience big losses now, it will take a very long time to reconcile those losses. Because of the fact we are in a low return environment you cannot afford to take big hits.

- Healthy funding levels: At the moment the funding levels are not good in any part of the world except for Canada. In the US every funding level in the private sector is about 78 and numbers do not vary much in the UK, Japan and other markets.

Macro Risks to Idiosyncratic Risks

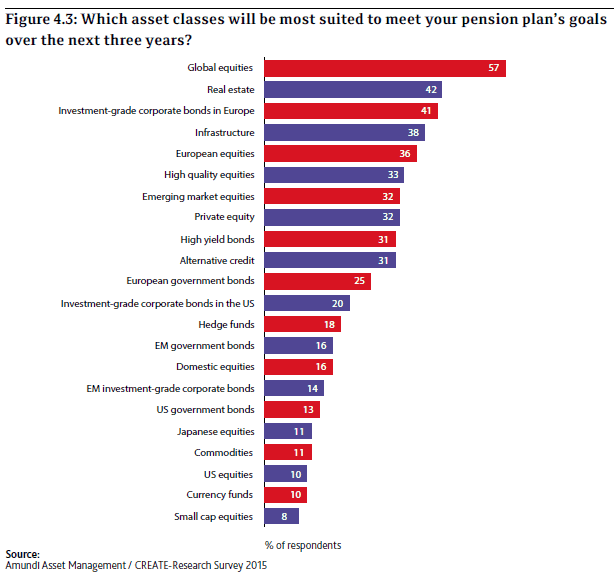

What we did was analyze amongst these asset classes which ones are people most likely to fear. And sure enough at the top came out global equities and real estate. Secondly, within these asset classes are people going to use them the same way they have in the past? For example, to think that as long as you're invested in global equities you will be okay or are you going to be much more selective? We concluded that being selective is definitely the way to go, to be very selective in the way we invest in global equities, real estate etc.

It used to be a belief that fixed asset allocation in numbers would follow as well as that 90% of returns come from doing the right asset allocation. Now this is outdated and nobody holds on to those beliefs anymore. If we believe in this we will only think that some 50% of returns come from correct asset allocation and the other 50% comes from making the right choices of specific securities.

The Aims of Asset Managers

"There is a rampant feeling that we are entering a long period of low returns. QE isn't going to work second time around in the way that it worked the first time. It has lost its potency."

What asset managers need to do is having their business models change in four fundamental ways:

- Asset managers need to get much closer to their clients. Understand their clients risk profiles, identify if clients are being provided service that they need and so on. Client focus is paramount.

- Investment Capabilities: What makes an investment professional at a time when markets are so distorted? It is a tough question to answer but I believe an investment professional should know the difference between value traps and value opportunities. The fact that markets are falling in emerging markets does not necessarily mean that it is a great buying opportunity. A smart investor knows that emerging markets have very strong price momentum. Prices in these markets have tendency to be falling for much longer.

- Understanding correlations under different phases of market cycles: Yes, correlations are rising but what we also find is that there are different regimes emerging. Under certain regimes correlations are higher and under others they are lower. Learn to understand what those different regimes are and then devise your portfolio accordingly.

- Alignment of interest: Asset managers need to have a strong financial alignment of interest. It can be from having things such as performance related fees or making sure they are not a part of a structure which basically says, heads I win and tails you lose. Innovation processes that asset managers have need to be rethought. Products need to be tested and tried before being released.

A link to Amin Rajans' full report, Investing in the Age of Financial Repression can be downloaded at: DOWNLOAD (Registration required)

Abstract written by, Karan Singh

Gordon T. Long

Publisher - LONGWave

Signup for notification of the next MACRO INSIGHTS

Request your FREE TWO MONTH TRIAL subscription of the Market Analytics and Technical Analysis (MATA) Report. No Obligations. No Credit Card.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that you are encouraged to confirm the facts on your own before making important investment commitments. © Copyright 2013 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or suggestions you receive from him.

Copyright © 2010-2016 Gordon T. Long

Gordon T Long Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.