The Coming Silver Price Rally Will Be Fueled By A Crashing Dow

Commodities / Gold and Silver 2016 Feb 12, 2016 - 03:00 PM GMTBy: Hubert_Moolman

It is good news for silver investors when significant nominal peaks of the Dow are formed. This is because significant nominal peaks in the price of silver tend to come after significant nominal peaks in the Dow. This has been the case for the last 90 years at least.

It is good news for silver investors when significant nominal peaks of the Dow are formed. This is because significant nominal peaks in the price of silver tend to come after significant nominal peaks in the Dow. This has been the case for the last 90 years at least.

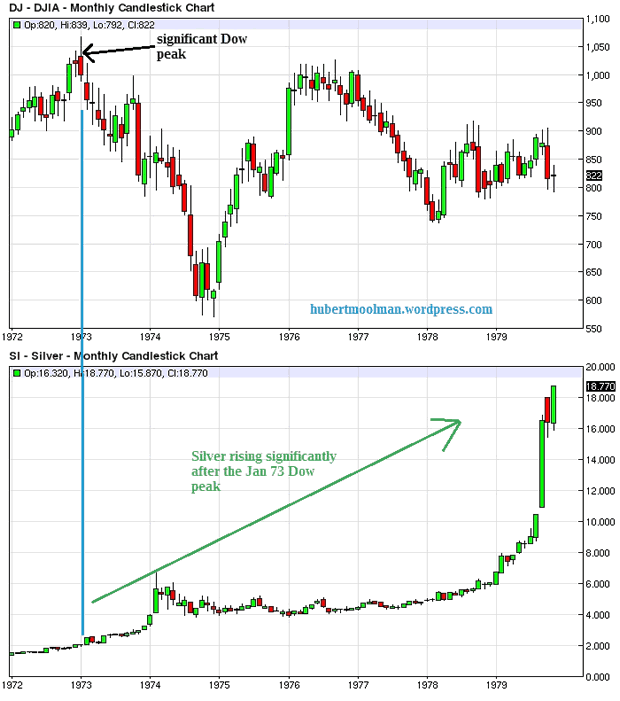

The two most significant nominal peaks of the Dow were in 1929 and 1973. Silver made a significant peak in 1935, about six years after the Dow's major peak in 1929. Again, in 1980, silver made a significant peak, about seven years after the Dow's major peak in 1973.

Below is a graphic to illustrate how the 1973 Dow peak was followed by a silver rally that eventually ended in 1980:

The Dow is currently forming a very significant top, with a current peak having formed in May 2015. If the 2015 Dow peak is the ultimate top, then we could possibly expect a major peak in silver, towards the end of this decade, to early next decade. This means we are likely to have rising silver prices for many years to come.

Most of the money fleeing the stock markets will be going into the silver and gold market, especially since, at the same time, there is a major debt crisis which is causing people to question debt-backed assets such as fiat currencies.

Economic decline (which is in the process of happening) is the main trigger for the coming economic events. When there is economic decline, there is reduced expectation that debts will be paid (This is why the stock market collapse is such an important signal for the coming silver rally). Debt is then considered very risky (this include all fiat currencies), and accordingly will be devalued.

In other words, when money is fleeing the stock markets, most will go into silver and gold instead of cash or bonds.

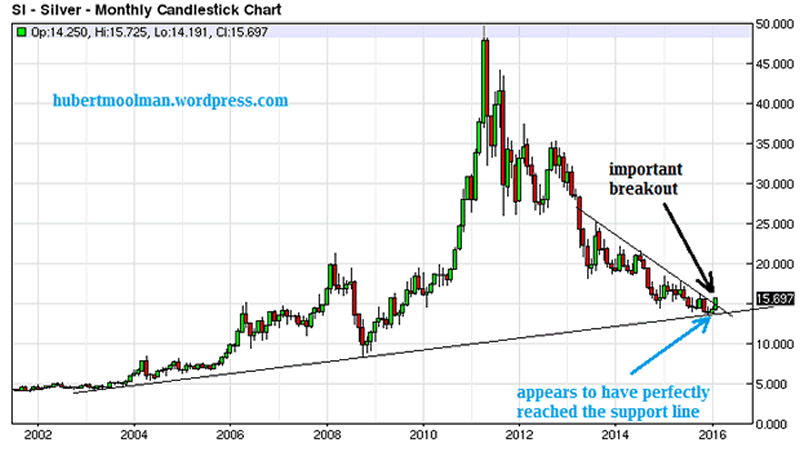

Below, is a silver chart from 2002 to 2016 (from barchart.com)

On the chart, I have drawn a long-term support-line, since 2003. I have found these types of support lines to be extremely relevant when it comes to silver and gold. The December 2015 low in silver appears to have touched the support line. This makes a good case for that being the low for silver. There was also an important breakout as indicated by the black arrow.

The Dow holds the key for this coming silver rally. The Dow's fall will act like fuel for silver's rise.

For more of this kind of analysis on silver and gold, you are welcome to subscribe to my premium service. I have also recently completed a Long-term Silver Fractal Analysis Report .

Warm regards

Hubert

“And it shall come to pass, that whosoever shall call on the name of the Lord shall be saved”

http://hubertmoolman.wordpress.com/

You can email any comments to hubert@hgmandassociates.co.za

© 2016 Copyright Hubert Moolman - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.