Looking For The Next Financial Crisis; Try Student Debt

Stock-Markets / Student Finances Feb 12, 2016 - 05:11 PM GMTBy: Sol_Palha

"Calamities are of two kinds: misfortune to ourselves, and good fortune to others." ~ Ambrose Bierce

"Calamities are of two kinds: misfortune to ourselves, and good fortune to others." ~ Ambrose Bierce

Student debt is increasing at the rate of almost $3000.00 per second; this is stunning considering that education tour system does not even rank in the top 10 globally ; we are ranked 18 out of 20. Worse yet, it indicates that colleges are simply forcing young individuals to take on mind-boggling amounts of debt in the hopes of landing a good job when they graduate. Getting a student loan is about as easy it was to get a loan during the booming housing market cycle and look how that story ended.

All you had to do was be able to scratch an X on the signature line, and you would qualify for a loan that most had no hope of every paying back. Now college's keeping increasing tuition rates while the Job market is far from rosy. College students are graduating today with an insane amount of debt on their hands. Wages as a whole have been dropping instead of rising over the past decade when inflation is factored into the equation.

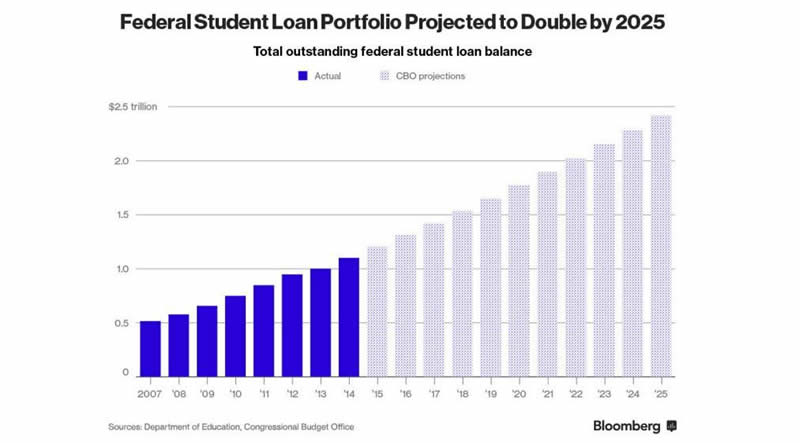

Students are taking on too much debt, with almost no hope of being able to pay it back. The student loan portfolio is set almost to double by 2025 to almost $2.5 trillion by 2025. Already almost 12% of individuals are delinquent on their student loans, and given the far from bright job outlook most students face after graduating; this trend will only accelerate in the years to come.

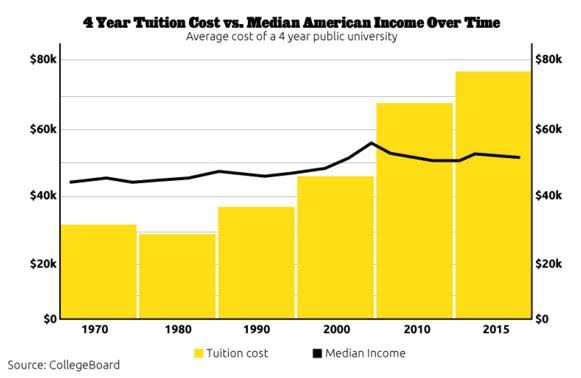

The chart below seems to confirm this assertion. The cost of four-year education versus median income shows that tuition rates are increasing at a far faster pace than median income. Since 2000, the cost of 4-year education has surged by almost 65%, yet median income keeps declining; this is an unsustainable trend and eventually it will lead to another disaster.

Is there a solution?

Well, one solution would be to make it harder to qualify for loans, which in turn would cut down the number of available students willing to pay exorbitant rates for substandard education. This, in turn, would force colleges to compete for students and as we know that competition is the best way to lower prices. However, this will not happen soon. We live in an era where money is thicker than blood; the can will be kicked further down the road until there is no road. When the road ends, though, the consequences could be extremely far reaching and will most likely make the subprime mortgage crisis look like a walk in the park.

In such an environment book publishers should fare well over the long run. Some companies worth paying attention to are SCHL and AMZN. Yes, AMZN sells more EBooks than print books, and it sells a massive amount of them. If you are looking for a children' book publisher than EDUC is quite strong; on a relative strength basis, it is stronger than both AMZN and SCHL. The overall strategy should be to wait for strong pullbacks before deploying any new funds into these companies.

Lastly, it appears that Gold is set to put in some sort of bottom; a small confirmation that a bottom is in place would be a monthly close above $1200. Hence, it makes sense to put some money into Gold bullion, even if only to take some insurance against a future catastrophe; the downside is limited from here. We are referring to bullion only (Gold, Silver and Palladium).

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2016 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.