When Will Gold and Gold Stocks Correct?

Commodities / Gold and Silver Stocks 2016 Feb 20, 2016 - 04:25 AM GMTBy: Jordan_Roy_Byrne

Wednesday evening we raised a question in a subscriber update. We wrote: The current question for Gold and gold stocks is if they will push to higher targets before or a correction or if a correction has already started. We should know the answer in the next day or two. The gold stocks exploded higher on Thursday. GDX gained 6% while GDXJ surged 7.4%. Meanwhile, Gold solidified its support at $1200/oz. Markets that become overbought within strong trends can become extremely overbought before they correct. Recent price action in the precious metals complex argues that the path of least resistance in the short term continues to be higher.

Wednesday evening we raised a question in a subscriber update. We wrote: The current question for Gold and gold stocks is if they will push to higher targets before or a correction or if a correction has already started. We should know the answer in the next day or two. The gold stocks exploded higher on Thursday. GDX gained 6% while GDXJ surged 7.4%. Meanwhile, Gold solidified its support at $1200/oz. Markets that become overbought within strong trends can become extremely overbought before they correct. Recent price action in the precious metals complex argues that the path of least resistance in the short term continues to be higher.

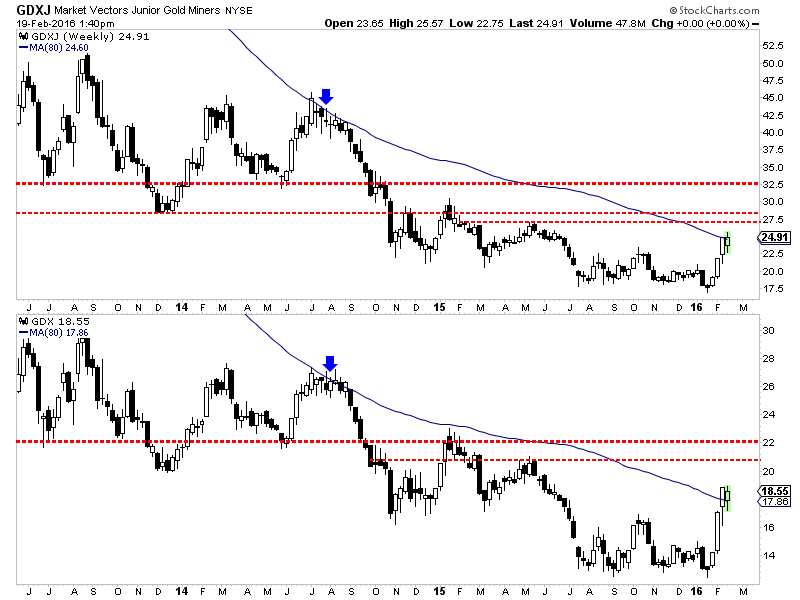

The chart below plots the weekly candle charts of GDXJ and GDX. The first observation is although the miners are very overbought on the daily charts, they aren't that overbought on the weekly charts. They will close this week flat after three strong weeks of gains. Also, the miners figure to face stronger resistance at higher levels. GDXJ is trading pennies below $25.00. If it surpasses its 80-week moving average then its next target is $27-$28. (Note that a measured move from the July 2015 to January 2016 consolidation projects to $28). Meanwhile, GDX is holding above previous resistance at $18. Its next strong resistance targets are $21 and $22. (The measured move from the July 2015 to January 2016 consolidation projects to $21).

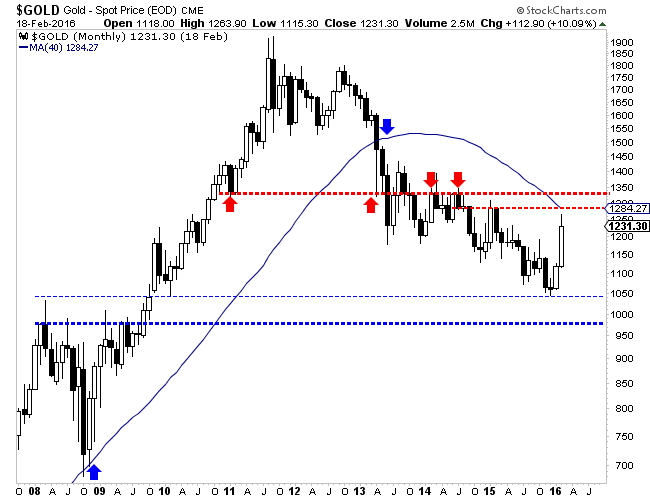

The monthly chart of Gold continues to give the most clarity on its prognosis. We have written about the importance of Gold holding support at $1180-$1200/oz, which it did this week. A monthly close above that support adds greater confirmation to a change in the primary trend. Gold has near-term upside potential to $1285/oz which marks monthly resistance and contains the 40-month moving average. Note that weekly resistance is at $1294. In addition, there should be very strong monthly resistance at $1330.

The odds favor Gold and gold stocks continuing to move higher before a correction begins. Both GDX and GDXJ could gain more than 10% before reaching stronger resistance while Gold has upside potential to $1285-$1294/oz. The counter-trend moves within very strong trends occur quickly. Gold declined from $1264/oz to $1192/oz in less than three days while the miners (GDX and GDXJ) have corrected 9-10% twice in the past ten days. Unless Gold and gold stocks fall below Thursday's lows then we should anticipate higher prices in the short-term. A bigger correction will come but not yet.

Consider learning more about our premium service including our favorite junior miners which we expect to outperform in 2016.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.