U.S. Housing Market at the Edge of Another Huge Cliff?

Housing-Market / US Housing Feb 24, 2016 - 09:40 AM GMTBy: EWI

Time and again, we've said that financial markets do what they do despite the Federal Reserve.

Time and again, we've said that financial markets do what they do despite the Federal Reserve.

When the central bank raised its key rate in December for the first time since 2006, many thought that would translate into higher mortgage rates.

Instead, mortgage rates are nearly as low as they've ever been. A Feb. 12 CNBC headline reads:

Mortgage rates could cross a record low

I recently talked to a real estate agent who suggested that today's low rates meant that it's a good time to buy a house.

But a historical review and other warning signs suggest just the opposite.

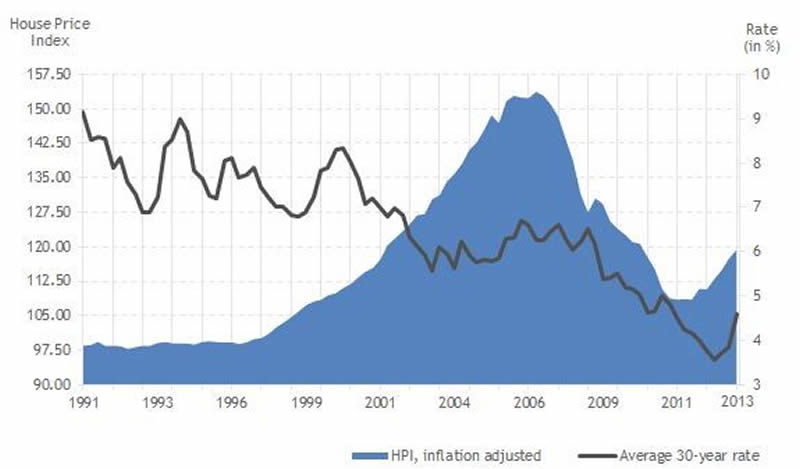

First, let's review a 2014 chart and comments from bankrate.com.

It's a common belief in real estate that house prices are correlated to interest rates. ...

The problem with this belief is that, well, it's not true. In fact, there's no strong relationship between house prices and interest rates, according to [a vice president for Fannie Mae].

Indeed, the chart shows that the home prices fell off a cliff from 2006 through 2011 as 30-year mortgage rates also fell.

More than that, we only have to think back to this year's Super Bowl to get a reminder of the enthusiastic psychology surrounding the housing market just before the 2007-2009 mortgage crisis.

To people with fresh memories of the housing collapse, the most disturbing advertisement during the Super Bowl ... was the one for the new Quicken Loans "Rocket Mortgage," which aims to make it easier to get a mortgage using a mobile device.

The New York Times, Feb. 10

Yes, get a mortgage with the touch of a button on your smart phone.

Here's what our February Financial Forecast has to say:

The return of subprime mortgages and "low-doc" loans, which are loans given to borrowers who do not fully document their income, signals renewed danger. The volume of these loans, known as "liar loans" back in the housing bubble's heyday, is nowhere near the extreme in 2006, but just a whiff of the lending practices that fueled the bubble is probably enough to indicate that ... another leg down is at hand.

Now is the time to prepare for what we see just around the corner.

Editor's note: Video version

|

U.S. Recession: 3 Factors to Watch As the markets have gone off the rails since the start of this year, the one persistent question market pundits have been trying to answer is: How likely is a recession in the U.S.? In this new report from the February issue of The Elliott Wave Financial Forecast, you'll see what our analysts are watching so you'll know how to plan your finances for the weeks and months ahead. |

This article was syndicated by Elliott Wave International and was originally published under the headline Housing: At the Edge of Another Huge Cliff?. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.