Gold Market Overview

Commodities / Gold and Silver 2016 Mar 08, 2016 - 03:21 PM GMTBy: Arkadiusz_Sieron

Despite gold's historical role as money, the contemporary gold market is rather young. Until March 15, 1968, when a two-tier market for gold was established, the price of gold was maintained at a predetermined level (or rather, national currencies were defined as unit weights of gold). From that time, the market forces shaped the price of gold. In 1971, the gold standard was abandoned and the two-tier market came to an end and central banks started transactions in gold at market prices. As the International Monetary Fund pointed out in the paper "The Structure and Operation of the World Gold Market", "since then, a global market for gold as an asset in its own right has developed, remaining open around the clock and using a full range of derivative paper instruments".

Despite gold's historical role as money, the contemporary gold market is rather young. Until March 15, 1968, when a two-tier market for gold was established, the price of gold was maintained at a predetermined level (or rather, national currencies were defined as unit weights of gold). From that time, the market forces shaped the price of gold. In 1971, the gold standard was abandoned and the two-tier market came to an end and central banks started transactions in gold at market prices. As the International Monetary Fund pointed out in the paper "The Structure and Operation of the World Gold Market", "since then, a global market for gold as an asset in its own right has developed, remaining open around the clock and using a full range of derivative paper instruments".

Despite its young age, the gold market is one of the largest and more liquid markets in the world. According to Hauptfleisch et al. (2015), the estimated daily turnover in the international gold market in 2011 was 4,000 metric tons, equivalent to over $240 billion. This is more than for all but four currency pairs and approximately the same as the daily dollar volume of trade on all of the world's stock exchanges combined.

The gold market is truly global and unlike other commodities, continuously operates around the clock, thanks to a cross-continents trading network. When London closes, New York trades. When Americans sleep, Australian and a few hours later Asian investors begin to trade. When Asian markets close, London is already in operation. Moreover, in 2006, Comex moved from an open outcry floor-based system to the fully electronic, nearly 24-hour Globex platform available for investors from all over the world. The international and continuous market for gold is similar to currency trading and indeed gold behaves more like a currency than commodity.

Only a few of the dozens of gold markets around the world have international significance. The London market, the U.S. market, the Swiss market and Hong Kong market create the core, while others are auxiliary (the most famous are Tokyo, Sydney, Dubai, Singapore, Mumbai, Rio de Janeiro and Shanghai, which is recently gaining in importance). The physical bullion is traded at the London market -- the largest gold market in the world(we should not also forget that there is large and active OTC swap market for gold). In London, there is also set a LBMA Gold Price, the world benchmark for pricing the gold. The second most important market is the U.S. which dominates the market in gold derivatives (futures and options), or paper gold, and has a major (along with London market) influence on the price of gold.

The Swiss market is an important marketplace for physical bullion, as Switzerland remains the world's leading gold repository and the world's gold hub. The majority of gold produced in the world physically transits through this country, where four of the world's major refineries are located.

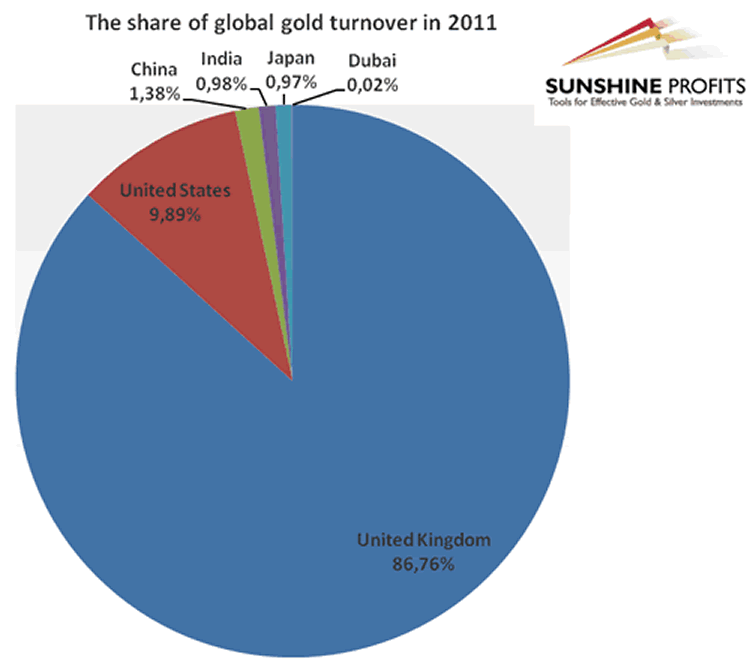

In Hong Kong, investors trade both physical bullion and gold futures. The importance of the Hong Kong market lies in the fact that it is the principal marketplace for Asian investors and it fills empty time left by the U.S. and the UK (London) markets. The chart below shows the share of the six major gold trading countries for all gold-related instruments, including spot and derivatives, in the global gold turnover in 2011.

Chart 1: The share of the six major gold trading countries in the global gold turnover in 2011.

The key difference between the U.S. and the U.K. markets is their structure. Comex, the largest and most influential U.S. gold futures and options market, is a centralized exchange where all orders are executed through one system. Meanwhile, in decentralized over-the-counter dealer market in London the dealers independently quote, bid and ask prices and trades (it means that all risks, including credit risk, are between the two parties ofa transaction). Decentralized exchange means that there is no public record of trade volume or prices, i.e. information about most transactions is not as easily available to the public, which makes this market less transparent. London, for instance, offers confidentiality as transactions are conducted solely between the two parties involved.

This is probably the main reason behind the OTC structure of the London market. Investors must ask themselves whether they want the data on their large positions in physical gold to be publicly available. Gold, unlike other commodities, cannot be consumed (at least not to an important extent), and its large stock in the market is held by diverse people. As such, gold is more decentralized than many other commodities. This unique feature of the gold market combined with the natural unwillingness of big gold holders to reveal their positions (theft or government confiscation may be issues) explains why the London gold market is organized as OTC.

To sum up, the global gold trade takes place in different marketplaces with the two most important located in London (for mainly physical bullion) and the U.S. (for futures markets). They differ in their structure (decentralized OTC market versus centralized exchange), attract different types of investors and influence the price in varying and unique degrees. Exchange trading has perhaps a more speculative nature, but the centralization and higher transparency of the futures market contribute to its disproportionately large role in price discovery.

Thank you for reading the above free issue of the Gold News Monitor. If you'd like to receive these issues on a daily basis, please subscribe. In addition to these short daily fundamental reports, we focus on the global economy and the fundamental side of the gold market in our monthly gold Market Overview reports. We also provide Gold & Silver Trading Alerts for traders interested more in the short-term prospects. If you're not ready to subscribe yet, or are unsure which product suits you, we encourage you to sign up for our mailing list and receive other free alerts from us. It's free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.