Unlocking Value into the Oil Bear

Commodities / Oil Companies Mar 18, 2016 - 02:53 PM GMT The low price of oil has meant that a lot of companies are going broke, but not so with Torchlight Energy. A subsidiary of D.R. Horton is spending $50 million, fully funding the development of Torchlight's Orogrande project over the next 24 months.

The low price of oil has meant that a lot of companies are going broke, but not so with Torchlight Energy. A subsidiary of D.R. Horton is spending $50 million, fully funding the development of Torchlight's Orogrande project over the next 24 months.

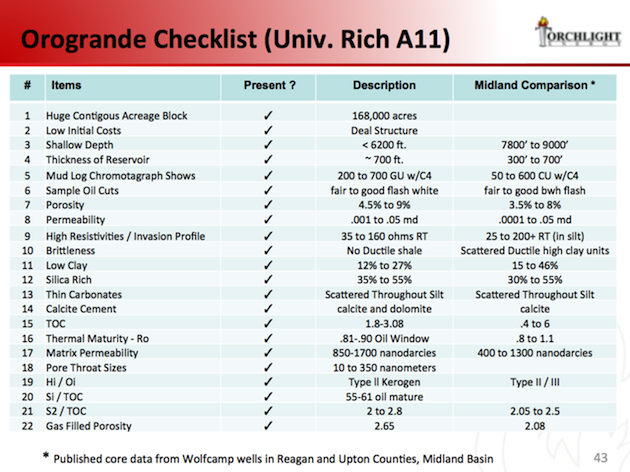

Torchlight Energy Resources Inc. (TRCH:NASDAQ) is out with an update that comes roughly 30 days after the company updated venture investors that it had decided to move on from the successful drilling and data capture of its Rich A-11 well, up to that point its primary valuation-driving well in the all-important Orogrande project. This new update is more comprehensive; Torchlight Energy updated investors as to progress being made regarding its Marcelina Creek and Orogrande projects, as well as provided a merger-and-acquisition update regarding its Hunton assets, which are currently being marketed.

Regarding the Marcelina Creek Project:

Progress is being made on all fronts in the Marcelina, with Torchlight updating the Johnson #1, #2 and #4 wells. It's important to keep in context Torchlight's overall lack of maturity and overall lack of scale when reviewing the following updates. Put simply, Torchlight is able to continue to drive production—even into this commodity environment—in that it substantially has no production; well, not really.

In that Torchlight is so immature and still very much in its "pre-leveraged/pre-negative capital productivity phase" (basically it doesn't yet have to balance out capex to debt capacity—a problem plaguing so many of its much more mature peers—because it's so young and has such a clean balance sheet), Torchlight is entirely focused on driving production volumes for the future. Torchlight, and more importantly at this point its farm-in partner, aren't focused on the commodity environment currently but the commodity environment of, say, 24 months from now. That's when Torchlight should have enough production development to be considered greater than "de minimus." At that point, when it has created something of scale (regarding oil production volumes), is when underlying economics will matter and will largely drive rate of growth decisions. Still, 1) we're a long ways away from 24 months from now, and 2) we believe that there is general consensus that oil prices will be meaningfully higher at that point in time.

Again, it's important to keep the maturation dynamic at Torchlight in context:

"The Johnson #1 continues to produce 40 to 50 barrels per day (40 to 50 bbl/d) and provide sustained production for the company."

"Torchlight also re-entered its Johnson #2 well and performed a seven stage acid procedure on the Buda formation, which had not been previously stimulated. Initial fluid entry is positive and the company is currently having a down hole pump installed to maximize production capability."

"The Johnson #4 well produced a total of 2,920 barrels for the month of February 2016, compared to 169 barrels for the month of February 2015, representing a 1,400% increase YOY. This production does not represent a full month of production and it also represents a reduction from potential recovery due to a 'best practice' of choking the well back to maintain pressures, as the well continues to clean up. Over the next ~30 days, Torchlight expects to optimize daily production thus maximizing sales and providing for increased well life."

Marcelina Creek Project Map

Regarding the Orogrande Project:

Progress continues as scheduled for the Orogrande project—again, regardless of underlying commodity prices. Torchlight Energy CEO John Brda was quick to note in the press release that the Orogrande project development, via a farm-in agreement with Founders Oil & Gas LLC (a D.R. Horton subsidiary), is fully funded for development over the next 24 months. Torchlight will continue to receive award payments in $500,000 increments per milestone achieved (via drilling initiations). The big takeaway here is Torchlight reiterating that this is the future of the company and that things are going as planned at least to this point:

"Preparatory work is currently underway for the next Orogrande project well, the Founders B19 #1. As previously announced and in line with timing expectations, the company anticipates drilling to commence within the next 60 days."

Regarding the currently marketed Hunton Assets:

While these assets have been openly marketed for quite some time now, it does appear that Torchlight is finally seeing interest in the assets. There's not much explanation needed here outside of reading the notes from the press release:

"With recent improvement to commodity prices and resulting acquisition activity, Torchlight has received an increase of inquiries and interest for the purchase of its Hunton assets. The company is in final negotiations with prospective buyers and anticipates a purchase and sale agreement to be finalized during the calendar Second or Third Quarter 2016. In addition to providing cash for Torchlight, at closing the company will retain assets in four additional AMIs to market for future sale."

Torchlight's Hunton Asset

All told we found the update meaningful in several ways:

- Torchlight updated each significant moving piece to its model.

- Torchlight is now keeping venture investors updated seemingly every 30 days or so and, more importantly, updated with meaningful information—that matters to us and provides another checkpoint of validation for management and for the story.

- Torchlight reiterated that it has an acute focus on production and commodity pricing several years down the road; in that Torchlight is currently funding itself via a partner-driven farm-in agreement we take this to mean that its partner is on board with this strategy.

- Torchlight's wells are seeing excellent and, equally important, on schedule development.

- Torchlight made brief note that it should soon be able to cover its overhead from operations and asset sales (assuming the Hunton divestiture goes as planned with a calendar Q2/Q3 sale being consummated); currently it is covering overhead via a blend of operations and its farm-in partnership.

Dallas Salazar is the chief analyst at CapGainr.com and currently owns and operates as CEO an Austin-based enterprise consulting firm that specializes in private company lifecycle management, up to and including taking companies public, and in helping consult publicly traded companies ranging in market cap from $100 million to $500 million.

Want to read more Energy Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

DISCLOSURE:

1) The following company mentioned in the article is a banner sponsor of Streetwise Reports: Torchlight Energy Resources Inc. The company mentioned in this article was not involved in any aspect of the article preparation. Streetwise Reports does not accept stock in exchange for its services.

2) Dallas Salazar: I own, or my family or company owns, shares of the following companies mentioned in this interview: Torchlight Energy Resources Inc. I was not paid by Streetwise Reports for this article. Comments and opinions expressed are my own comments and opinions. I am responsible for the content of the article.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

Streetwise – The Energy Report is Copyright © 2014 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC hereby grants an unrestricted license to use or disseminate this copyrighted material (i) only in whole (and always including this disclaimer), but (ii) never in part.

Streetwise Reports LLC does not guarantee the accuracy or thoroughness of the information reported.

Streetwise Reports LLC receives a fee from companies that are listed on the home page in the In This Issue section. Their sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

Participating companies provide the logos used in The Energy Report. These logos are trademarks and are the property of the individual companies.

101 Second St., Suite 110

Petaluma, CA 94952

Tel.: (707) 981-8204

Fax: (707) 981-8998

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.