Bloomberg Article Sparks Some Stock Market VIX Observations

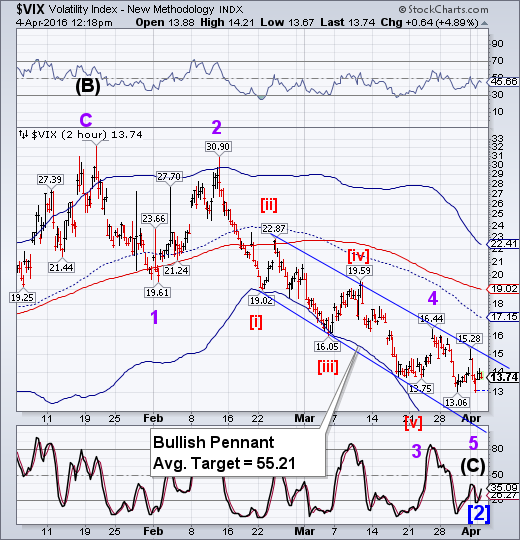

Stock-Markets / Stock Markets 2016 Apr 04, 2016 - 05:47 PM GMT VIX made a probable Master Cycle low on April 1 at 13.00. In the case of this chart, the price label “stuck” to an earlier low. This sometimes happens in StockCharts and other charting services.

VIX made a probable Master Cycle low on April 1 at 13.00. In the case of this chart, the price label “stuck” to an earlier low. This sometimes happens in StockCharts and other charting services.

If my observation is correct, we may finally see it rally above its prior high at 15.28 and give us a buy signal. Granted, the trendline is at 15.00, but a breakout does give additional confirmation.

Bloomberg just wrote a piece on the VIX and VIX ETFs that seems to point out the all the VIX trades are being unwound with losses. I don’t know whether this is deliberate misinformation, but we often see articles such as this at market tops and bottoms. The main contention that I get out of the article is that all the inflows in the VIX ETFs and ETNs came in since February 11.

That is not true, as you will recall from the ZeroHedge article that identifies the massive inflows only in the two weeks prior to their article being written on March 27.

You can see the rise in volume in the second half of March.

While the Bloomberg article has some elements of truth in it, I would say that, overall, it was misleading and poorly timed.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.