Goldman Sach's Dubious Advice 'Short Gold!'

Commodities / Gold and Silver 2016 Apr 08, 2016 - 10:58 AM GMTBy: Mike_Shedlock

Those betting against Goldman Sach's retail investment advice have generally been on the right side of things.

Those betting against Goldman Sach's retail investment advice have generally been on the right side of things.

The same thing is about to happen again.

"Short gold! Sell gold!" said Goldman's head commodity trader, Jeff Currie, during a CNBC "Power Lunch" interview.

Currie's advice was in response to the question "Is there any commodity you are recommending that can help our viewers make some money?"

Currie's provided several reasons for shorting gold, blatantly wrong.

MarketWatch explains, and I will rebut, Why Goldman's Commodity Chief Wants Investors to Bet Against Gold .

"Short gold! Sell gold!" That was Currie's unabashed advice during a CNBC interview Tuesday after discussing the outlook for crude-oil futures.

Currie's rationale is fairly straightforward: The closely followed Goldman strategist sees the Federal Reserve raising benchmark interest rates at some point in 2016 and believes the result of higher rates will be a drag on the dollar-denominated precious metal.

"The Fed has signaled two [rate hikes]. Data is signaling three and what do higher interest rates do to gold? Send it down," said Currie.

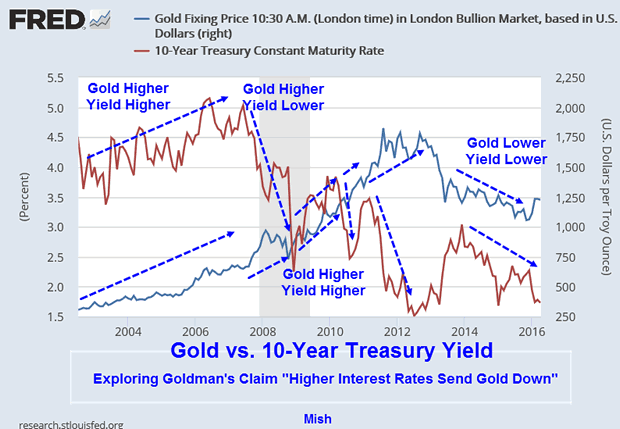

Exploring Currie's Claim "Higher Interest Rates Send Gold Down"

Recall that gold fell from $850 to $250 from 1980 to 2000 with interest rates generally declining all the way.

In more recent history (shown above), gold sometimes rises with rising yields and sometimes with falling yields.

In short, Currie's statement is easily disproved nonsense.

With that out of the way, let's turn our spotlight on his idea that data signals three hikes.

"Fed Signaling Two Hikes, Data Signaling Three"

What data is that?

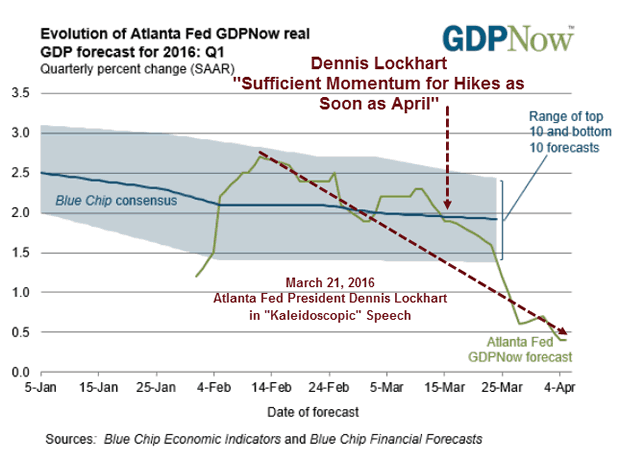

On April 5, I noted GDPNow Forecast Sinks to 0.4% Following More Weak Economic Report .

GDPNow History

Back on March 21, Atlanta Fed president Dennis Lockhart made a speech to the Rotary Club of Savannah on March 21.

His speech was called Kaleidoscopic Context for Monetary Policy . In his speech, Lockhart stated there was sufficient momentum for a rate hike as soon as April.

I commented on his speech with my take called Kaleidoscope Eyes .

Here is the data since Lockhart's speech.

- On March 21, the same day as Lockhart's speech, I commented Existing Home Sales Plunge "Surprising" 7.1%, Price Concessions the Norm; What Happened? ... Data was so bad the National Association of Real Estate cheerleaders showed concern. "Know Before You Owe" kinks have been worked out. The "surprise" downtrend continues.

- On March 23, I commented New Home Sales Near Consensus on Muddle-Through Track ... It's easy to spot the lack of momentum in housing starting a year ago. This is a muddle-through track, and a weak one at that.

- On March 24, Durable Goods Orders Plunge 2.8%; Will a Falling Dollar Soon Help? ... The answer to my falling dollar question is "no". I used a chart to explain why.

- On March 28, we noted Consumer Spending Outlook Buckles with "Surprisingly Weak" Income Report

- On March 29, Fed Chair Janet Yellen reversed course and gave a Lovey-Dovey Speech Citing "Other Tools" and More QE

- On April 4, we noted Factory Orders Dive 1.7%, Core Capital Goods Dip 2.5%, Last Month Revised Lower

- On April 5, the Trade Deficit Unexpectedly Widens

Kaleidoscope Currie

Somehow Currie got a hold of Lockhart's kaleidoscope and is using it.

Did Lockhart throw that thing away?

That would make sense because clearly it's not functioning properly.

Stagflation Anyone?

Should the Fed actually manage to get in a couple hikes, the most likely reason would be inflation concerns, not an overheating economy from a GDP perspective.

Call that the stagflation scenario. Historically, that is an environment in which gold rates to do extremely well.

However, there is no sign of that just yet, at least from the bond market.

Instead, the bond market looks like it's begging for more QE.

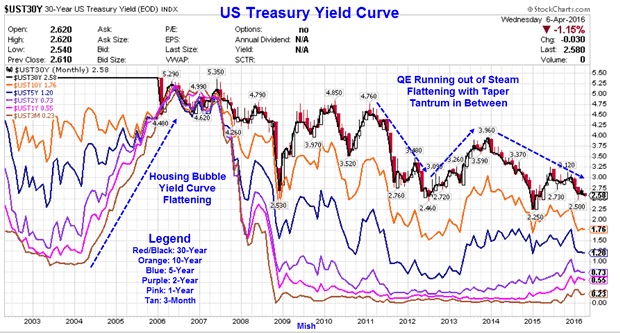

Yield Curve 2002 to Present

The above chart shows monthly closing yields for US treasuries from 3-month to 30-years in duration. Current data points are month-to-date.

There is nothing remotely strong about recent action in Treasuries. In contrast to the recession that started in 2007, the Fed does not have runaway housing prices to contend with.

Should consumer prices rise enough for the Fed to hike, there is every indication the yield curve has room to invert. This is at a time when the 30-year long bond yields a mere 2.58%.

The all-time low yield on the long bond is 2.25%.

Why the Persistent Hike Talk?

Why does the Fed seem desperate to hike (market willing of course)?

I offer three possibilities.

- The Fed wants room to cut when the next recession hits.

- The Fed is clueless about the next recession (which may already be here).

- The Fed is concerned about wage-push inflation from various minimum wage hikes.

Point #1 discussion: The idea of hiking to have room to cut is nonsensical, but that is the way these guys think.

Point #3 discussion: The Fed may very well be concerned about a series of minimum wage hikes due to escalate every year from now until 2022. (See my post Good Ole Days Return: Nixonian Wage and Price Controls for an explanation).

My preferred explanation is #2. The Fed is clueless in general, not just about recession odds.

I am not arguing for low rates. Rather, I propose the Fed has no idea whatsoever where rates should be.

Talk of negative rates as if they are normal is proof enough.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2016 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.