Oor 'Lawnmower' Economy - Financiers Skim Profits While Main Street Stagnates

Economics / US Economy Apr 08, 2016 - 04:20 PM GMTBy: Gordon_T_Long

Charles Hugh Smith and Gordon T Long share their thinking on why the middle class in America has been experiencing a steady decline in their real standard of living over the last four decades and why the decline has recently accelerated. Their is a fundamental reason why productivity is falling while corporate profits soar and the employment participation rates falls.

Charles Hugh Smith and Gordon T Long share their thinking on why the middle class in America has been experiencing a steady decline in their real standard of living over the last four decades and why the decline has recently accelerated. Their is a fundamental reason why productivity is falling while corporate profits soar and the employment participation rates falls.

The "Crippled" Capitalist System

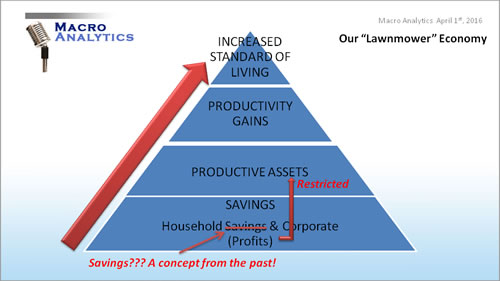

The Capitalist System is based on the construct that savings are invested into productive assets which increase productivity and in turn increase the standard of living of the whole society within which it operates. This mechanism has worked well for a century and and half. It no longer is working.

Savings come from two sources:

- Household Savings

- Corporate Profits

Today Household savings borders on being an extinct concept and what there is of it, is invested in financial securities. Therefore savings to be invested into productive assets comes primarily from corporate profits or "Wall Street" financing. We would argue that the capital is no longer flowing into productive assets but rather being directed to other venues which are unproductive and fail to increase the standard of living for society. Be assured how22$100M going to change in their lives?

In fact three approaches today are skimming billions of dollars of that "savings" from investment that will lead to rising standards of livings. This is one of the reasons that standards of living are falling for the vast majority of Americans.

Three of those major skimming mechanism are analyzed in this video:

- High Frequency Trading (HFT)

- Stock Buybacks

- The "Carry" Trade

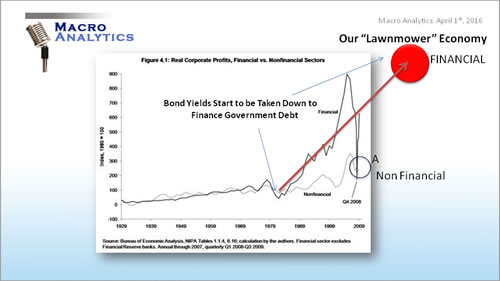

A Financialized Economy Flows profits to The Fiancial Sector

There is nothing wrong with making profits. However, there is something wrong in an economy when those profits don't flow into productive assets but rather "circularly" flow back into financial products.

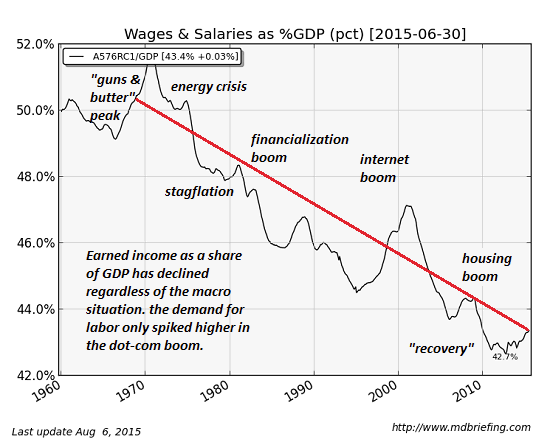

The Financialization "Skim" is Killing The Middle Class in America

This insidious and effectively "unsupervised" process has resulted in:

The Results

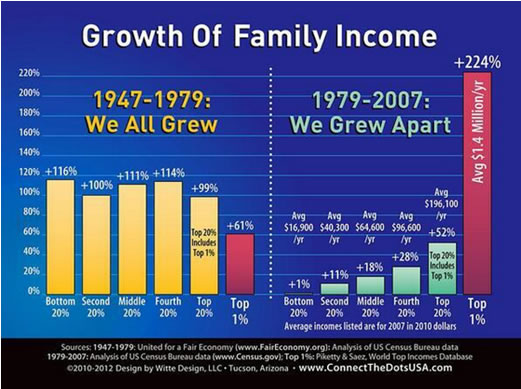

Falling Real Incomes

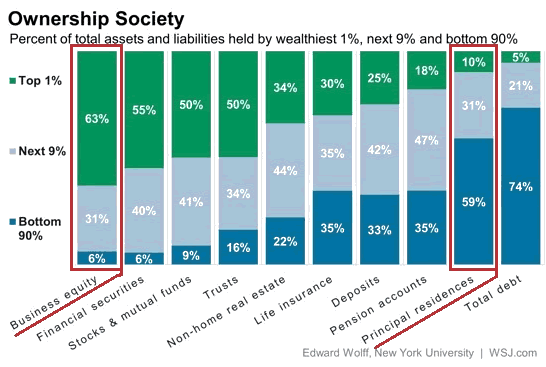

The Wealthiest Now Almost Eclusively ReapThe Benefits

The Middle Class Has Effectively Been "Gutted"

There is much, much more in this 27 Minute video discussion which is illustrated with 21 slides.

Gordon T. Long

Publisher - LONGWave

Signup for notification of the next MACRO INSIGHTS

Request your FREE TWO MONTH TRIAL subscription of the Market Analytics and Technical Analysis (MATA) Report. No Obligations. No Credit Card.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that you are encouraged to confirm the facts on your own before making important investment commitments. © Copyright 2013 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or suggestions you receive from him.

Copyright © 2010-2016 Gordon T. Long

Gordon T Long Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.