Bitcoin Price Volatility Deceptively Low

Currencies / Bitcoin Apr 08, 2016 - 10:10 PM GMTBy: Mike_McAra

In short: short speculative positions, target at $153, stop-loss at $515.

In short: short speculative positions, target at $153, stop-loss at $515.

A custom Bitcoin-based record-keeping system has been tested on credit default swaps (CDSs), we read on the Wall Street Journal website:

Banks including J.P. Morgan Chase & Co. and Citigroup Inc. have successfully tested the record-keeping technology behind bitcoin on credit-default swaps, a move that could help it gain a foothold in mainstream finance.

The swaps are essentially insurance contracts that pay off if a bond goes bad, and the process of keeping track of the over-the-counter products can be a burden. Banks match buyers and sellers, transmit the trades via a service run by data provider Markit Ltd. and send a record to Wall Street's central bookkeeper, Depository Trust & Clearing Corp.

The new test showed that a portion of that record-keeping task could be accomplished using "blockchain," a common ledger that each party can view in much the same way that multiple users can work on shared computer documents.

(...)

Analysts at Autonomous Research say using blockchain could cut trading settlement costs by a third, or $16 billion a year, and cut capital requirements by $120 billion. A recent report by Citigroup forecast that automation including blockchain could eliminate two million banking jobs, largely in processing, over the next decade.

This has been a long time coming. A Bitcoin-based solution has now been tested in what looks like one of the first experiments involving more than just one bank. So, it has taken the banks more than two years since the outburst of media coverage on Bitcoin to develop an initial version of a possible record-keeping system. This might seem a long time, particularly that the system that's been tested is nowhere near to real usability. On the other hand, it seems that Bitcoin is actually entering the financial landscape.

We're skeptical that traditional settlement systems will be eliminated in favor of Bitcoin-related systems. Actually, even if the banks decide to move on the CDS settlement system, it might still take years before the system is overhauled. There are a lot of legacy systems in the banking world, and unless there is some serious cost cutting, the banks might not be willing to take that gamble just now.

There's a flipside to this coin. The mentioned CDS system is only one of the possible applications of blockchain systems. It might just as well be the case that numerous other solutions will be explored in the wake of the initial successful of the CDS tests.

For now, let's focus on the charts.

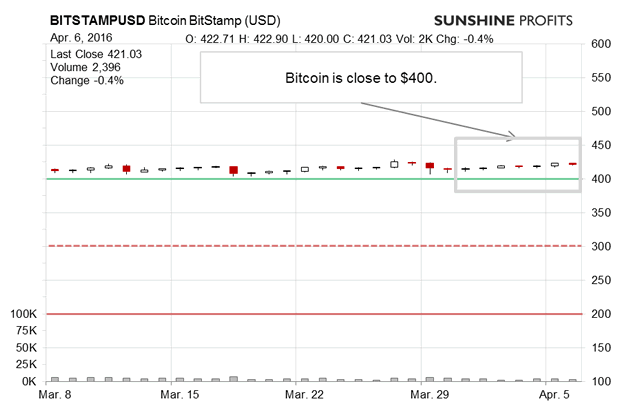

On BitStamp, we once again didn't see much action. Bitcoin remained flat and there was no significant price swings. The situation looks boring at first sight, but there's more to the current environment.

In our recent alert, we wrote:

(...) we haven't seen much action in the last couple of weeks. This makes Bitcoin "boring" in the eyes of some investors. But is it?

We don't think so. Actually, we do think that the fact that Bitcoin has become less interesting for the financial press might be an indication that this is precisely the time we should pay particular attention to the currency. Generally, Bitcoin gains publicity only after major moves have transpired, not before they do. This doesn't mean that Bitcoin has to move shortly, no one knows that for sure but the lack of motion is not an indication that Bitcoin won't move in the future. (...)

Bitcoin is at a possible long-term declining resistance line, not really above it. This means that the outlook for the currency hasn't really changed in a substantial way as far as becoming more bullish is concerned. Zooming in on the last couple of days, Bitcoin is slipping below the 50-day moving average. The move is not confirmed and it is not a very strong bearish indication at this time, but it is a bearish indication nonetheless. (...)

Generally, Bitcoin went up in the previous week and it shot up on Easter Sunday. This could've looked like a bullish hint but actually the currency paused the appreciation yesterday and it has erased all of the previous gains today (...). Is this the depreciation we've been waiting for? Unfortunately, this isn't clear at this time. The depreciation seems to be the hint that the trend remains down and the recent swing to the upside is nothing more than a countertrend correction. At the same time, we haven't really seen enough depreciation to consider the next major decline underway. It might be, but this is still not perfectly clear.

The situation is still very much unchanged. Bitcoin is still close to the possible long-term declining resistance line but not really above it. There have been no additional signs, so the outlook remains bearish.

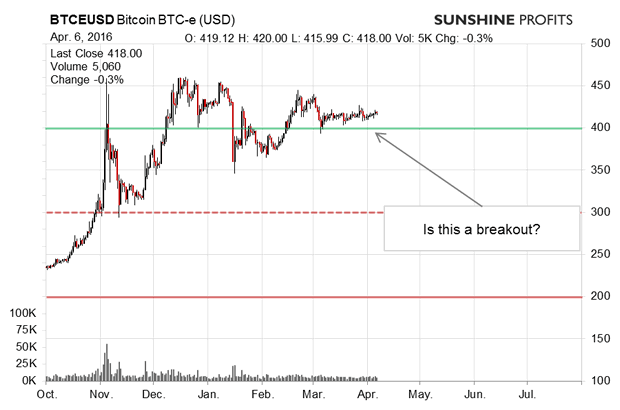

On the long-term BTC-e chart, we see Bitcoin flat above $400. This has been the case for a couple of weeks now. In our previous alert, among other things, we wrote about Bitcoin being a potential portfolio diversifier :

(...) a very small portion of one's portfolio in Bitcoin might improve the overall risk-reward characteristics (this is not investment advice - one has to consider their own individual portfolio and we don't know the composition of the portfolios of our readers).

Bitcoin is still above $400 and this might at first sight look like a bullish indication. In our opinion, it isn't. (...)

(...) we see Bitcoin edging toward $400 but there hasn't really been that much action. Bitcoin is well within the range of the downward trend, possibly establishing a series of lower highs. Also, the currency is at a possible rising resistance line based on the July 2015 low and the March 2016 slump. If Bitcoin moves visibly below this level, this would be yet another bearish indication.

The RSI is still at 50, not oversold and the last "extreme" reading was very close to the overbought area. This is also a bearish hint pointing to the possibility of more action to the downside. This is not sure, nothing in the market is, but the bearish indications are very much in place, in our opinion.

Right now, the situation is even slightly more bearish as we saw several daily closes below the 50-day moving average but the RSI didn't move much and is still in the 50 range. This is not a very important change but an indication nonetheless.

These remarks are still up to date. The one thing that we might add today is that for the last couple of weeks Bitcoin has been trading on thin volume, particularly the case in March and now in April, but we haven't really seen an important uptick in volume since January. This might have lulled investors and traders, but one should be on alert. We definitely wouldn't bet on the volatility staying low indefinitely. Quite the contrary, once a move transpires, it might be significant.

Summing up, in our opinion speculative short positions might be the way to go now.

Trading position (short-term, our opinion): short speculative positions, target at $153, stop-loss at $515.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.