U.S. Real Estate & Fed, Systemic Risk is Rising Quickly

Housing-Market / US Housing Apr 09, 2016 - 05:50 PM GMTBy: Chris_Vermeulen

The Federal Debt:

The Federal Debt:

The current amount The U.S. Government owes is over $19 trillion and therefore it is mathematically impossible to pay back. They will never be able to pay this back. Central bankers are in uncharted waters. They do not know how to create economic growth and fight deflation in some areas of the market. They do not know how to even return to a time of “normal” monetary policy. Their pretense of knowledge, of being able to effectively control currencies used by billions of people, is coming to an end.

The amount of debt only continues to grow and people think that somehow, governments are beyond the laws of mathematics. Things are fine until they are not. This is not an issue that will just go away or disappear, but rather continue to build until it reaches a breaking point.

Labor Force Participation:

We have close to 10’s of millions of Americans that are flat out not part of the labor force (not including children). The argument that this is only being made up of recent retirees is not true. First, many cannot retire because they need to work until they die. Another point is the rate is going up much faster than the number of people hitting old age.

Homeownership:

The homeownership rate has fully collapsed. Since the Great Recession hit, a large part of buying came from Wall Street and institutional investors. They bought homes to convert into rentals since this was how they used their bailout savior money. The money kept them afloat and what do they do? Buy up homes in a tight market and drive prices higher when working Americans already have declining incomes. The net result is that fewer people/families own their property and owning your home has always been traditionally viewed as the American dream. This has been the one vehicle where most Americans build wealth and equity and it’s not happening at nearly the same rate as it one was.

The problem is that people do not have $20,000 or $30,000 to make a down payment. I see a smaller number of Americans making their home the ultimate financial goal which is a good thing. It forces saving via having equity in their home. Let’s face it, you don’t hear all the retired and wealthy people saying they made their big money in a retirement account. In almost every case they earned their wealth through real estate investments in their own home and/or rental properties over time.

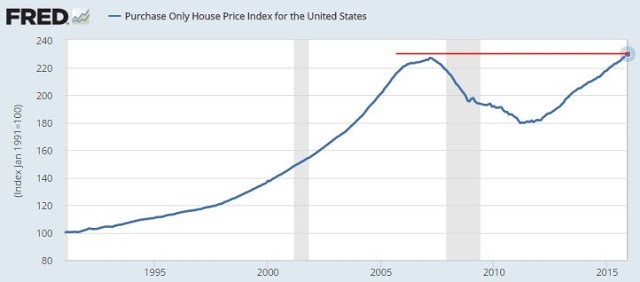

There are currently signs of another new housing bubble emerging. The current home price data shows that across the country we have now surpassed the last bubble peak. Incomes are not keeping up with wild movements in home prices. The end result is that the work force incomes are decreasing so creative financing is necessary to buy more expensive homes.

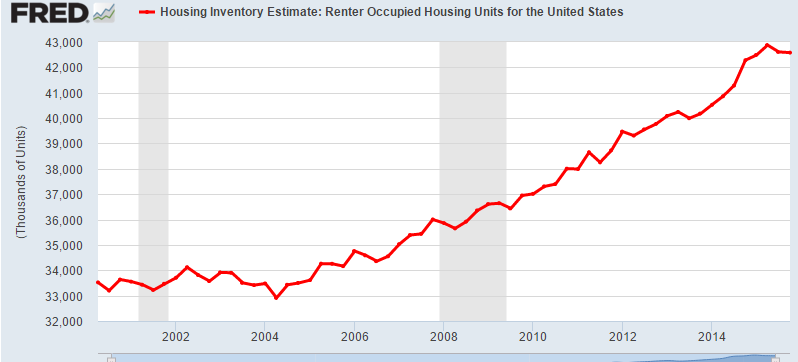

Homes homeownership rate has collapsed because of the higher priced housing market. How can prices go up with fewer families buying homes? Easy, since the bailout funds allowed banks, hedge funds, and investors to pick up foreclosed homes from families and then turned them into rental income properties. Today, we have many more people living in rental apartment and rental homes accumulating no equity and barely scraping by. Yet somehow housing prices soaring, college tuition at crazy levels, all while we have lower incomes. The current model of the American Dream involves no homeownership for the already shrinking middle class.

The upper-income, educated, married with children class are still not buying!

A strong middle class has been at the core of what has been promoted as the American Dream. How would America look like if the middle class simply vanished? We may not need to wait too long at the current rate since we are quickly siphoning people off the middle class and throwing them into lower Income brackets. The vast majority of Americans do not buy into the propaganda promoted on the mainstream media.

Housing prices have now reached an all-time peak. This is worth noting because the last peak was clearly at a point where we were massively overpriced, as seen in the chart below, and the entire world economy came close to experiencing the next Great Depression. There is nothing remotely “normal” about the current housing bubble’s rise and we can anticipate that its deflation could be equally abnormal and abrupt if the financial markets start to implode.

Homes were being bought by large investors to convert into rentals because money is almost FREE with rates so low, and the return on capital with rental properties is more than you will get anywhere else, plus you have a real asset, not paper money. This is where the bulk of the price increase occurred. This is why while net household’s information for owners is neutral, the country added 10,000,000 more reenter since 2004:

In short, real estate continues to provide the best return on investment. I recently purchased a large property, demolished the house, and am in the process of building a multi-family high-end retirement four-plex. I believe my area which is the www.CollingwoodRealEstate.net market will generate the best return on investment (cost of one property paying 4 rental income).

With low-interest rate it can make a business venture like this very profitable and is a solid long term strategy. The key with real estate though is to not get over extended with borrowed money. Own properties well within your financing capabilities factoring some worst case scenarios.

Eventually, certain areas of the financial system with crumble while others become favorable from stocks, bonds, currencies, to real estate. Each of these provide great opportunities to profit from through various investment vehicles like Exchange Traded Funds.

Follow my lead as I navigate the financial market and profit using ETF’s at TheGoldAndOilGuy newsletter.

Chris Vermeulen

Join my email list FREE and get my next article which I will show you about a major opportunity in bonds and a rate spike – www.GoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.