Gold Commitments of Traders

Commodities / Gold and Silver 2016 Apr 12, 2016 - 01:41 PM GMTBy: Dan_Norcini

There was little change in this week’s Commitments of Traders report when it came to the positioning of traders within the gold futures market.

There was little change in this week’s Commitments of Traders report when it came to the positioning of traders within the gold futures market.

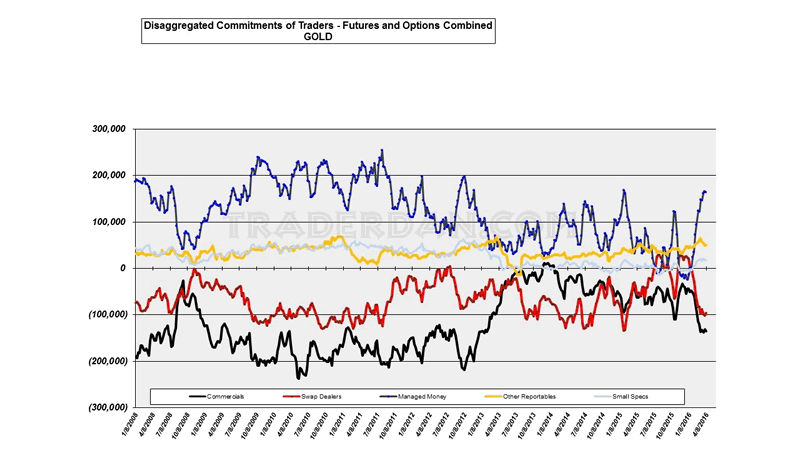

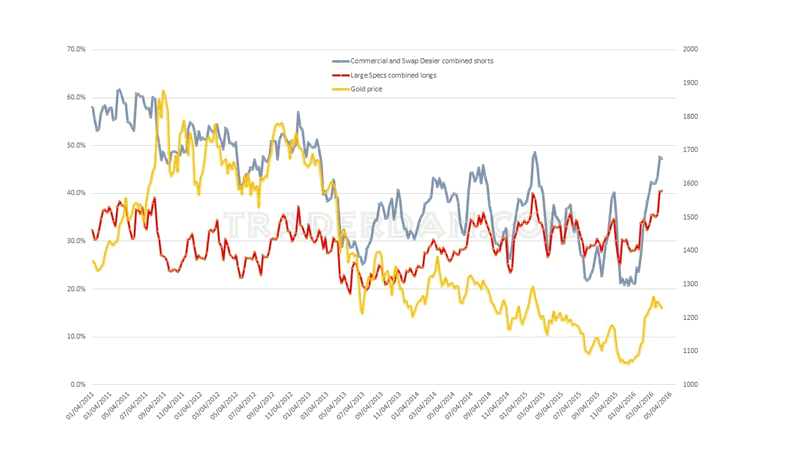

Here is an updated chart reflecting the current composition.

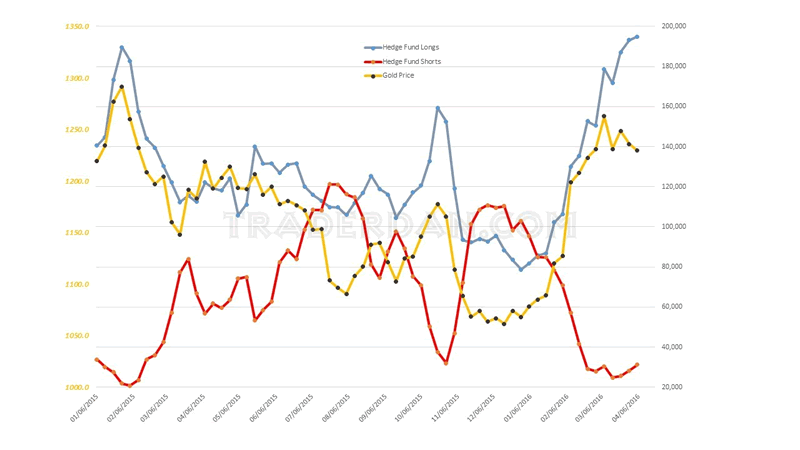

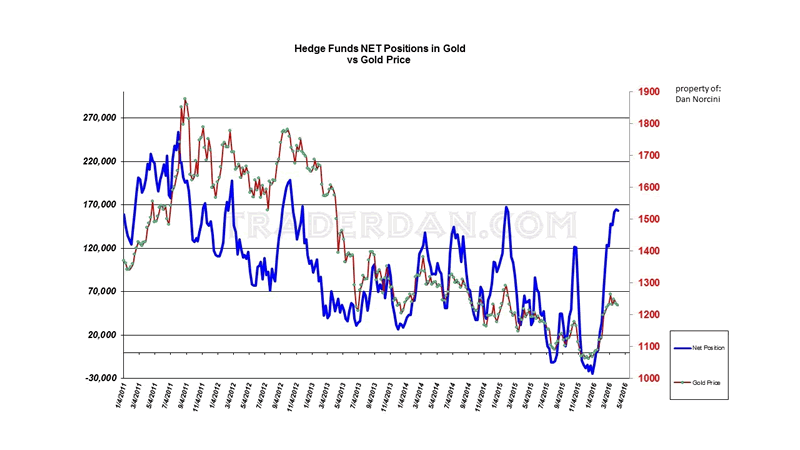

Hedge funds both slightly increased overall outright long positions and outstanding outright short positions with the result that their overall NET LONG position did slightly DECREASE as more new shorts were added than new longs.

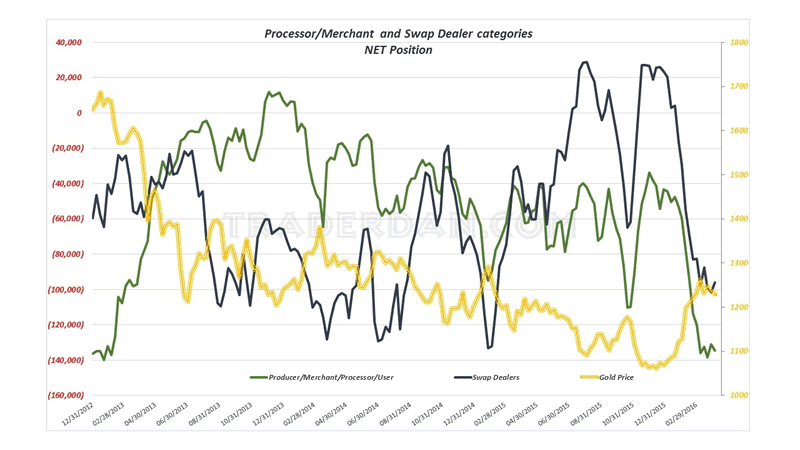

On the Commercials side, their overall NET SHORT position slightly increased while the Swap Dealer net short position slightly decreased. Together it was essentially a wash.

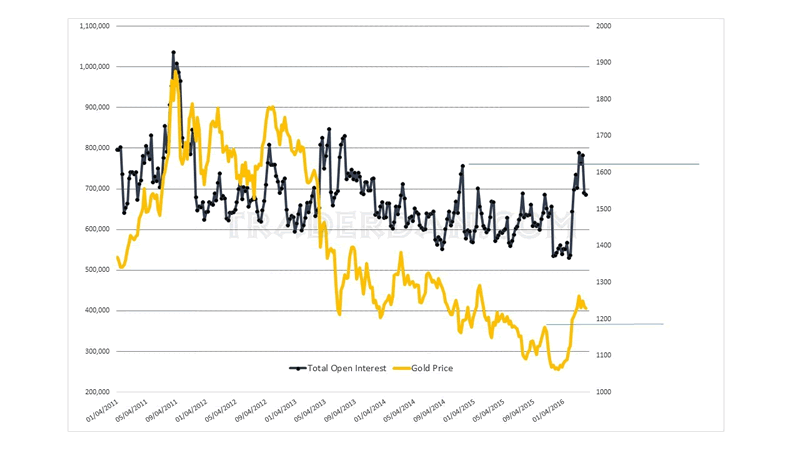

Total open interest ( futures and options combined) declined overall, something which the bulls will want to see reverse sooner rather than later.

On a percentage basis, the total number of outright longs held by LARGE SPECULATORS ticked up slightly while the total number of combined commercial and swap dealer outright short positions declined slightly. Both readings remain at relatively high levels.

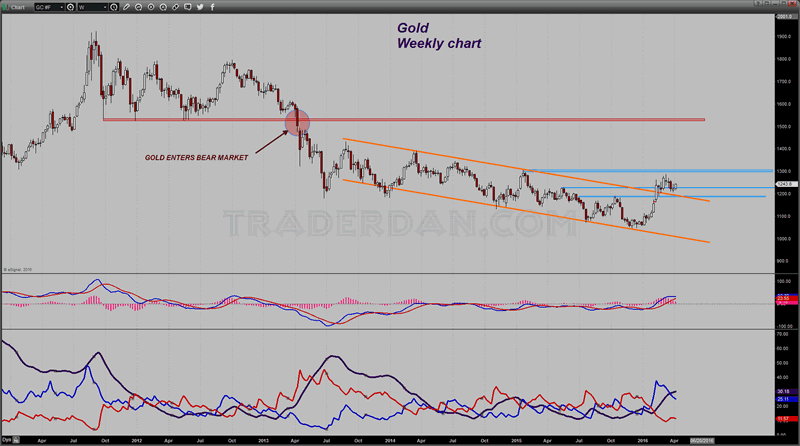

On the weekly chart, there was little change in price movement when viewed from a larger perspective. Gold remains ABOVE the former descending price channel with price having moved down to retest the upper trendline only to find buying support. The $1285-$1300 overhead resistance zone is the notable barrier to further upside potential at this juncture.

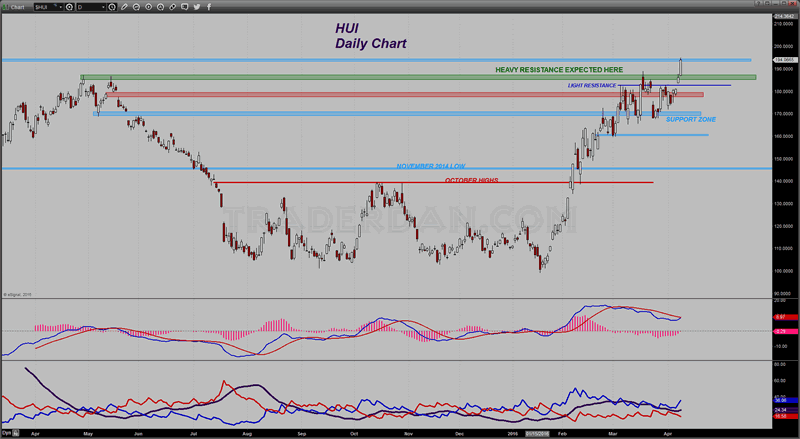

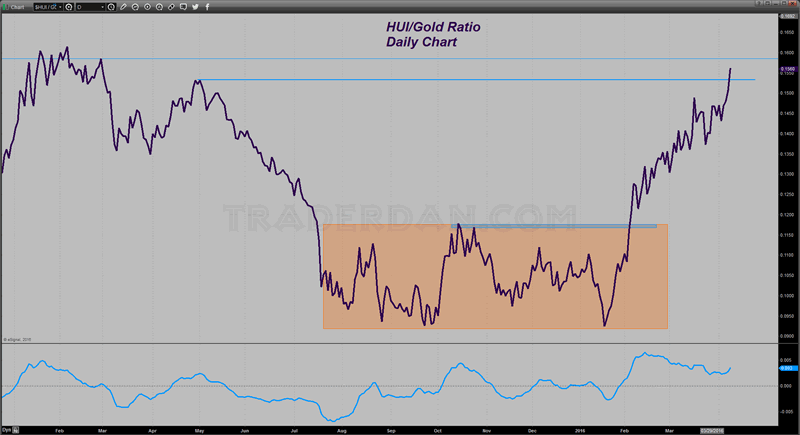

Near term, the gold mining stocks as represented by the HUI are suggesting that the upside is more probable than downside at the moment.

The reason I say this is not only on account of the strong performance by the miners recently, but the HUI/Gold ratio is surging.

This ratio has a history of being rather reliable as a LEADING INDICATOR of the gold price direction.

The slight reduction in GLD’s reported holdings is noteworthy but withdrawals/reductions thus far remain muted while the technicals such as the HUI’s strong showing and rising ratio would seem to be outweighing those reductions in my mind for the time being.

Ever since Yellen and company decided to sacrifice the US Dollar in order to prop up the Emerging Markets, gold has refused to back down. Barring some sort of yet another shift again in their attitude towards the Dollar, it would seem unlikely for a sharp breakdown in the gold price in spite of that imbalanced spec long position. Simply put, while the specs are overextended on the long side, from a fundamental perspective, there just does not seem to be enough of a catalyst to spook them enough to send them heading for the hills in a large way at this time. As long as the downside support levels continue to hold firm, they will stick around.

Dan Norcini

Dan Norcini is a professional off-the-floor commodities trader bringing more than 25 years experience in the markets to provide a trader's insight and commentary on the day's price action. His editorial contributions and supporting technical analysis charts cover a broad range of tradable entities including the precious metals and foreign exchange markets as well as the broader commodity world including the grain and livestock markets. He is a frequent contributor to both Reuters and Dow Jones as a market analyst for the livestock sector and can be on occasion be found as a source in the Wall Street Journal's commodities section. Trader Dan has also been a regular contributor in the past at Jim Sinclair's JS Mineset and King News World as well as may other Precious Metals oriented websites.

Copyright © 2016 Dan Norcini - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

Dan Norcini Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.