One Chart Reveals Fed's True Intent; Wreck Havoc on The Middle Class

Interest-Rates / Quantitative Easing Apr 12, 2016 - 04:39 PM GMTBy: Sol_Palha

"Crises refine life. In them, you discover what you are." ~ Allan K. Chalmers

What strikes one immediately is that the Fed has been creating money hand over fist; one hand they create money, with the other hand they buy assets and put it on their books, all looks well until you realize this is something called monetization of debt. Paper buying more paper and in most nations this leads to hyperinflation and a currency collapse. However as the Dollar is the world reserve currency. The Fed can magically create money out of thin air and use this newly created money to pay bills and or prop up markets as is currently the case.

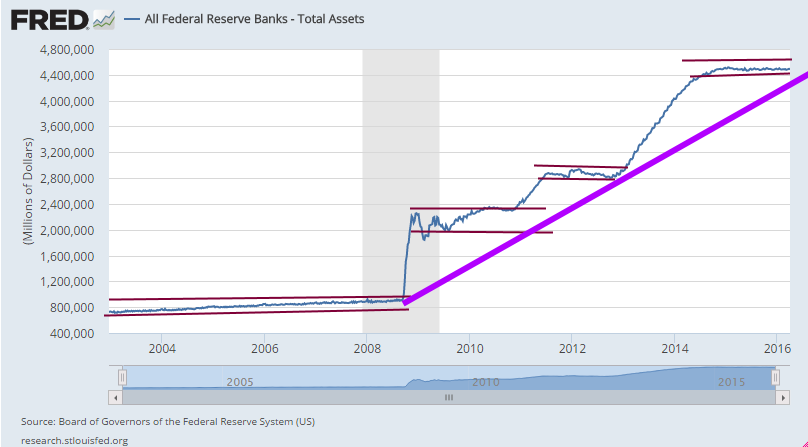

Look at how the total assets of the Fed have skyrocketed since 2004. You will also notice that we have nice channel formations where nothing happens for awhile and then suddenly the Fed's assets explode. One hand starts to print while the other hand uses this newly created money to buy treasuries, etc.; it's nothing but one big Ponzi scheme. It has not collapsed because the masses are still asleep and show no signs of waking up so it will go on for a significantly longer period. Translation, the markets will not be allowed to stay down for the count for too long. In other words, strong corrections should be viewed as buying opportunities.

Look how CNBC aired in 2009: in this video one of the members openly describes what is essentially a Ponzi scheme, but the CNBC host goes on to say, well we have a better term for that it's called "debt monetization" but that is just a nice word for outright robbery and theft.

Do you still think the Fed is dumb? If they were really that thick, they would not have managed to get away with murder for so many decades. Furthermore, they flooded the markets with volumes of money after 2008 and based on logic; Gold should have soared; the dollar should have crashed, and interest rates should have risen. Instead, the opposite occurred. The reason for this unexpected reaction was that Fed wisely brought the velocity of money to a standstill. Money was not changing hands frequently. If you remember, they froze the credit market. Suddenly it was no longer easy to get credit before you could buy a house by simply signing X on the signature line. Now we have another channel formation in the process, and it's a pretty long channel formation. Thus, be ready for the Feds to open the spigots again and flood the markets with hot money; quantitative easing for the people perhaps.

Game Plan

The market is going to trend higher in such an environment; sure it's going to be a volatile ride up, but the markets will be spending more time to the upside than to the downside. Hence, all strong corrections/pullbacks have to be viewed through a bullish lens. Lastly, it would be prudent to allocate some money to Gold bullion; look at it as a form of insurance against an unforeseen event.

"Man is not imprisoned by habit. Great changes in him can be wrought by crisis -- once that crisis can be recognized and understood." ~ Norman Cousins

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2016 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.